Pension tax relief – how it works and how it can boost your retirement

The taxman may not be known for his generosity, but HM Revenue and Customs (HMRC) is quite good at putting its hand in its pocket when it comes to pension saving.

Tax relief on pension contributions is an important element of retirement saving, as it boosts the amount of money in your pot that can be put to work in the stock market.

Basic-rate taxpayers get their pension tax relief automatically, but higher earners need to claim to get the full benefit of the perk – otherwise you risk missing out on significant sums.

Hundreds of thousands of higher earners fail to do this. In fact, research by pension provider PensionBee last year found £1.3bn of pension tax relief went unclaimed between 2016 and 2021.

Here, Telegraph Money explains how to make the most of “free money” to boost your pension.

What is pension tax relief?

HMRC rewards people who are saving towards their retirement through pension tax relief.

The perk boosts the contributions that you make into your retirement savings by essentially putting the money you would have been taxed when you earned it back into the pension.

For example, every £100 a basic-rate taxpayer puts into a pension from their salary only costs them £80, as HMRC “gives back” the 20pc or £20 you would have been charged in income tax.

Higher and additional-rate taxpayers can also benefit from pension tax relief at their marginal rate, so a £100 contribution would cost each only £60 or £55 respectively.

Pension tax relief is paid on contributions until age 75.

How does pension tax relief work?

There are two ways that you can receive pension tax relief – through net pay or a relief at source.

If you are employed by a business, then you are most likely auto-enrolled into a workplace pension scheme, which will typically work on a net pay basis.

In this situation, your contributions may be paid before you are taxed (this may be part of a salary sacrifice scheme). This effectively gives you the tax relief by lowering your earnings, so there is less salary to be taxed on.

An alternative is a relief at source pension, where your income is taxed and then goes into your pension, but the provider – typically a personal pension or self-invested personal pension (Sipp) – claims the basic-rate relief on your behalf and adds it to your pot.

This is particularly beneficial for those whose earnings fall below the personal tax allowance threshold, meaning they don’t pay tax. A low-income earner who doesn’t pay tax can still receive the basic-rate of pension relief on the first £2,880 paid into a pension each year.

For others contributing through this method, if you are a basic-rate taxpayer and contribute £80 to your pension, your provider would automatically claim back £20 in tax relief, boosting your contribution to £100.

If you’re in Scotland and the starter rate of income tax at 19pc, or the basic rate at 20pc, you’ll still get the standard 20pc tax relief on your pension contributions. Those who pay 19pc tax won’t have to make up the difference.

The pension tax relief example from MoneyHelper in the table below shows how the two methods give you the same tax relief for a basic-rate taxpayer.

It gets a bit trickier if you are a higher or additional-rate taxpayer though, as you should technically get 40pc and 45pc pension higher rate relief respectively.

You will automatically get the higher reliefs if the contributions are made on a net pay basis, but if it is deducted at source you would need to claim back the extra 20pc or 25pc yourself.

This has to be done through a self-assessment tax return.

It is important to do this, otherwise you are missing out on extra money that could be going into your pension and ultimately boost your retirement.

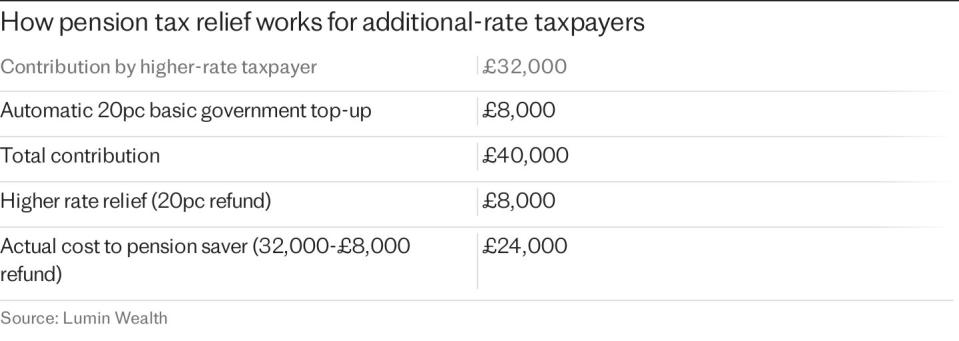

For example, if a higher rate taxpayer contributes £32,000 in a year, they would automatically get £8,000 of pension tax relief at the basic marginal rate, boosting their contribution to £40,000 that can then be put to work in the stock market.

But as they are a higher earner, they are still owed an extra 20pc in tax relief, giving them an £8,000 refund from HMRC. This means the actual cost of the £40,000 contribution for the saver was only £24,000.

“Neglecting to make a claim can mean you’re missing out on thousands of pounds annually,” said James Corcoran, senior chartered financial planner at Lumin Wealth.

Is there a limit on the amount of tax relief I can receive?

Pension tax relief is a “valuable benefit”, said Becky O’Connor, director of public affairs at PensionBee – but she highlights that it’s crucial to stay within annual contribution limits to avoid potential penalties or taxes.

Pension tax relief is paid on contributions worth up to the annual pension allowance each year, which is currently £60,000 or 100pc of your salary – whichever is lower.

If you contribute more then you won’t get any relief, plus you will be charged tax at your marginal rate on the excess.

A higher earner can also “carry forward” unused allowances for the previous three tax years.

How to claim tax relief on pension contributions

If you’re a higher-rate or additional-rate taxpayer, you’ll need to claim the extra tax relief you’re owed either via a tax return, or if you don’t file a return then you could call or write to HMRC.

In the “tax reliefs” section of the tax return, go to “Payments to registered pension schemes where basic-rate tax relief will be claimed by your pension provider”. Here, you should include the total gross value of your pension contributions, and the tax relief will then be calculated.

This money will either be returned to you as a rebate, a reduction in your tax bill or a change in your tax code.

Pension tax relief FAQs

Still have questions about pension tax relief? Here, we answer some of the most common questions about how it works.

How far back can I claim tax relief on pension contributions?

Pension savers can claim tax relief on contributions from the previous three tax years using carry forward rules.

This lets you make use of any unused allowance and to get tax relief on pension contributions.

The allowance for the previous three tax years was £40,000 per year, meaning you could be able to pay up to £180,000 into a pension before April 6 2024.

However, there is another limit to be aware of.

You cannot pay in more than your “pensionable earnings” for the year, so to pay in £180,000 you would need to be earning at least £180,000 from your salary.

Mr Corcoran added that it can be easy for people who are busy with work and family to keep on top of these rules, so it may be worth consulting a financial planner to help ensure you are getting all the perks towards saving for your retirement.

How to calculate tax relief on pension contributions

There is an option when completing a self-assessment tax return to include your pension contributions.

You can see how much you put into your pension on your payslips, so you will need to calculate the amount you contributed throughout the tax year. It is important to include the basic-rate of tax relief you received in the total amount.

HMRC will then calculate the extra higher rate pension relief owed based on whether you are a higher or additional rate taxpayer and are owed a 20pc or 25pc refund.

Another option, if you don’t regularly complete a tax return, is to contact HMRC directly. But this could mean waiting a long time on hold due to its understaffed phone lines, plus if you claim the money back every year then it may be more effective and less time-consuming to just complete a self-assessment form.

“Maintaining accurate records of contributions and relief claimed is essential for tax compliance and future financial planning, particularly given the impact of contribution limits on tax relief eligibility,” added Ms O’Connor.

Yahoo Finance

Yahoo Finance