Penumbra (PEN) Posts Earnings in Q4, Revenues Top Estimates

Penumbra, Inc. PEN reported fourth-quarter 2017 earnings per share of 10 cents, comparing favorably with a loss of 9 cents in the year-ago quarter. The figure is also better than the Zacks Consensus Estimate of a loss of a penny.

The company reported full-year 2017 adjusted loss of a penny, narrower than the Zacks Consensus Estimate of a loss of 14 cents. The figure also compares favorably with the year-ago loss of 7 cents.

Revenues in the reported quarter rose 31.4% year over year (up 29.7% at constant exchange rate or CER) to $96.1 million, exceeding the Zacks Consensus Estimate of $87.7 million.

Net revenues in 2017 totaled $333.8 million, outpacing the Zacks Consensus Estimate of $325.4 million. The figure also improved 26.8% (up 26.4% at CER) from the year-ago level.

On a geographic basis, fourth-quarter revenues in the United States (representing 64.1% of total sales) grossed $61.6 million, up 26.7% from the year-ago quarter (same at CER). Meanwhile, international sales (35.9% of total sales) advanced 40.6% year over year (up 35.6% at CER) to $34.4 million.

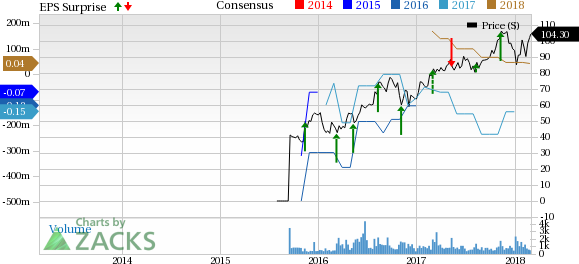

Penumbra, Inc. Price, Consensus and EPS Surprise

Penumbra, Inc. Price, Consensus and EPS Surprise | Penumbra, Inc. Quote

Going by product category, revenues from neuro products grew 31.1% (up 29.2% at CER) to $67.3 million in the quarter under review. Revenues from peripheral vascular product business rose to $28.7 million in the fourth quarter, reflecting an increase of 32.1% (up 30.9% at CER) year over year.

Operational Update

Penumbra’s fourth-quarter gross margin was 66.3%, reflecting a 260-basis point (bps) expansion year over year. Gross profit rose 36.7%.

Research and development expenses totaled $8.4 million, up 37.7%, while sales, general and administrative expenses amounted to $51.5 million, up 23.8% year over year. Operating profit in the reported quarter came in at $3.9 million, comparing favorably with the operating loss of $1.2 million in the prior-year quarter.

Financial Update

Penumbra exited 2017 with cash and cash equivalents of $50.6 million as compared with $13.2 million at the end of 2016.

Outlook

Penumbra has provided guidance for 2018 revenues. The company expects total revenues in the range of $400-$405 million. The Zacks Consensus Estimate of $389.8 million lags the guided range.

Our Take

Penumbra exited fourth-quarter 2017 with better-than-expected results. The year-over-year comparison of earnings was favorable. Moreover, the company witnessed strong growth across all geographies and product lines. The company is focusing on product innovation through research and development.

Penumbra is an active player in the fast-growing interventional therapies space. In fact, the company’s products primarily cater to the unmet clinical needs in two major markets — neuro and peripheral vascular.

Zacks Rank & Key Picks

Penumbra has a Zacks Rank #3 (Hold).

A few better-ranked stocks that reported solid results this earnings season are PetMed Express PETS, PerkinElmer PKI and Becton, Dickinson and Company BDX. While PetMed sports a Zacks Rank #1 (Strong Buy), PerkinElmer and Becton, Dickinson carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported third-quarter fiscal 2018 results. Adjusted earnings per share of 44 cents were up 88.3% from the prior-year quarter. Revenues rose 13.7% on a year-over-year basis to $60.1 million.

PerkinElmer reported fourth-quarter 2017 adjusted earnings per share of 97 cents. Adjusted revenues were approximately $641.6 million, up from $567 million in the year-ago quarter.

Becton, Dickinson reported first-quarter 2018 adjusted earnings per share of $2.48, up 3.9% at constant currency. Revenues totaled $3.08 billion, up 3.7% at constant currency.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PetMed Express, Inc. (PETS) : Free Stock Analysis Report

PerkinElmer, Inc. (PKI) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance