PeptiDream And Two More Japanese Exchange Growth Companies With High Insider Ownership

Amid a backdrop of fluctuating market conditions, Japan's stock markets experienced negative returns last week, with uncertainties around the Bank of Japan’s monetary policy affecting investor sentiment. In such an environment, companies like PeptiDream that boast high insider ownership may offer investors a sense of stability and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

freee K.K (TSE:4478) | 24% | 81% |

Below we spotlight a couple of our favorites from our exclusive screener.

PeptiDream

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥321.43 billion.

Operations: The company primarily generates revenue through its biopharmaceutical development activities, focusing on novel peptides and molecular therapeutics.

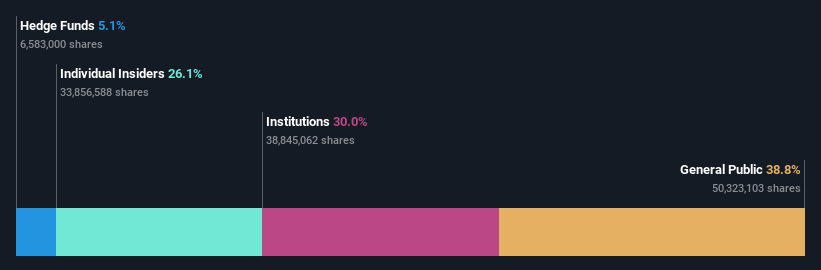

Insider Ownership: 26.1%

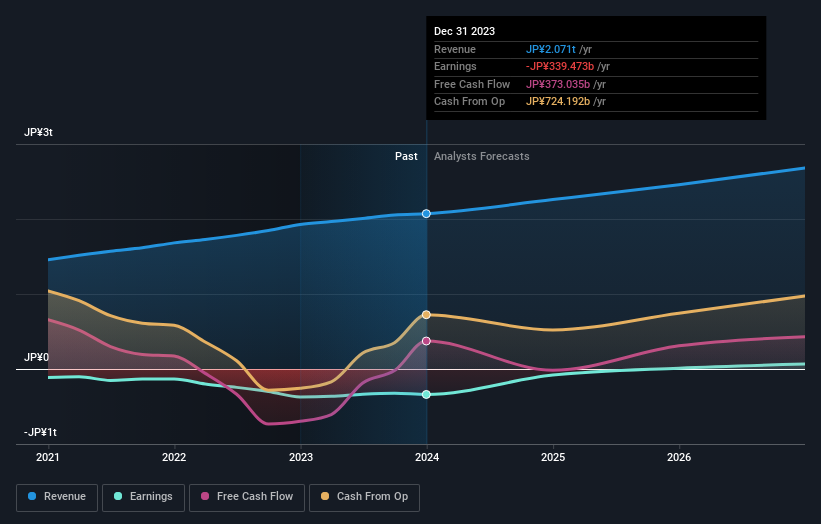

PeptiDream, a Japanese biotech firm, recently enhanced its financial outlook for 2024, doubling its operating profit forecast to JPY 20.10 billion and nearly doubling expected net profit to JPY 14.00 billion following strategic expansions with Novartis. This includes an upfront payment of US$180 million and potential milestones up to US$2.71 billion, emphasizing PeptiDream's robust growth trajectory in peptide-based therapeutics. Despite high market volatility and lower current profit margins compared to last year, the company's innovative edge in drug development is clear with promising clinical studies underway for renal cell carcinoma diagnostics using its proprietary technology.

Take a closer look at PeptiDream's potential here in our earnings growth report.

The valuation report we've compiled suggests that PeptiDream's current price could be inflated.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving a diverse global clientele with a market capitalization of approximately ¥1.83 trillion.

Operations: The company generates revenue through its operations in e-commerce, fintech, digital content, and communications.

Insider Ownership: 17.3%

Rakuten Group is positioned for notable growth with forecasted revenue increases outpacing the Japanese market. Despite trading significantly below its perceived fair value, Rakuten anticipates becoming profitable within three years, aligning with a strategy of robust operational expansion as evidenced by a recent $1.99 billion bond issuance. Challenges remain, including modest projected return on equity and abandoning plans to list its securities unit, reflecting a cautious approach amid broader financial strategies.

BayCurrent Consulting

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc., a company based in Japan, offers consulting services and has a market capitalization of approximately ¥495.07 billion.

Operations: The firm generates its revenue primarily through consulting services in Japan.

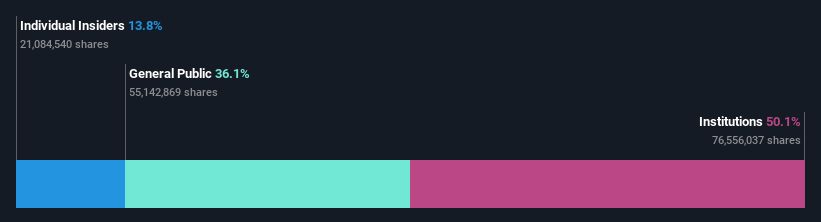

Insider Ownership: 13.9%

BayCurrent Consulting, with its substantial insider ownership, is trading at 59.1% below its estimated fair value, indicating potential undervaluation. The company's earnings and revenue are expected to grow at 18.41% and 18.3% per year respectively, outpacing the Japanese market averages of 8.9% for earnings and 4.2% for revenue growth. Despite this promising outlook, the share price has shown high volatility recently. Additionally, a recent share buyback program for ¥3.60 billion suggests a focus on shareholder value and capital efficiency.

Turning Ideas Into Actions

Dive into all 99 of the Fast Growing Japanese Companies With High Insider Ownership we have identified here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4587 TSE:4755TSE:6532 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance