Persol HoldingsLtd And 2 Other High-Yield Dividend Stocks In Japan

Amidst a backdrop of heightened uncertainty about the Bank of Japan's future monetary policy moves, Japan's stock markets experienced a slight downturn last week. In such an environment, high-yield dividend stocks like Persol Holdings Ltd may attract investors looking for potential stability and income in their portfolios.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.87% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.47% | ★★★★★★ |

Globeride (TSE:7990) | 3.66% | ★★★★★★ |

Yahagi ConstructionLtd (TSE:1870) | 3.57% | ★★★★★★ |

Koei Tecmo Holdings (TSE:3635) | 3.51% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.49% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.04% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

Innotech (TSE:9880) | 3.91% | ★★★★★★ |

Click here to see the full list of 374 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Persol HoldingsLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Persol Holdings Ltd. (TSE:2181) operates globally, offering human resource services under the PERSOL brand, with a market capitalization of approximately ¥516.09 billion.

Operations: Persol Holdings Ltd. specializes in providing diverse human resource services on a global scale.

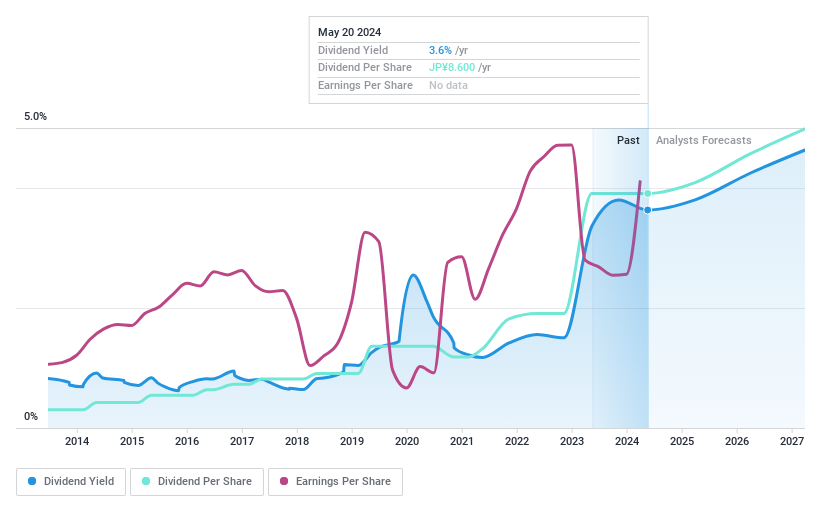

Dividend Yield: 4%

Persol Holdings Ltd. has announced a significant share repurchase program, planning to buy back up to 5.41% of its shares for ¥20 billion, aiming to enhance shareholder returns by March 2025. Despite a reasonable payout ratio of 65.1%, indicating earnings coverage, the company's dividend history over the past decade has been marked by volatility and inconsistency in growth. Trading at a notable discount to estimated fair value and with earnings expected to grow annually by 11.56%, the stock offers potential upside but with caution due to its unstable dividend track record.

Unlock comprehensive insights into our analysis of Persol HoldingsLtd stock in this dividend report.

France Bed HoldingsLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: France Bed Holdings Co., Ltd. operates in Japan, focusing on medical services and home furnishing and health sectors, with a market capitalization of approximately ¥43.79 billion.

Operations: France Bed Holdings Co., Ltd. generates ¥38.87 billion from its Medical Services segment and ¥20.01 billion from its Interior Health segment.

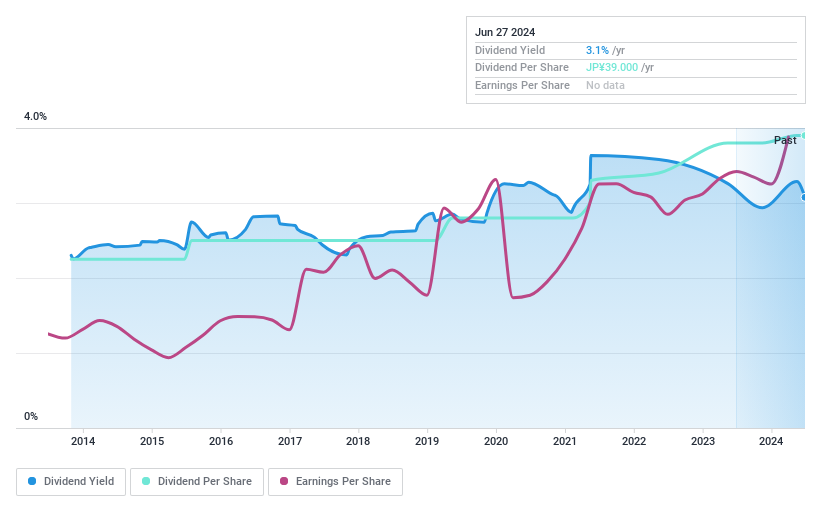

Dividend Yield: 3.1%

France Bed Holdings Ltd. maintains a stable dividend history, with a recent increase to ¥22.00 per share for FY 2024 from ¥20.00 the previous year, signaling consistent shareholder returns. With earnings and cash flows adequately covering dividends (payout ratios of 44.7% and 43.9%, respectively), the financial structure supports ongoing payments despite a modest yield of 3.08%. The company's recent performance includes an earnings rise to JPY 3,134 million and sales growth, projecting continued operational strength into FY 2025 with expected net sales of JPY 61 billion and an operating profit of JPY 4,800 million.

Nice

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nice Corporation, with a market cap of ¥23.53 billion, specializes in importing, distributing, and selling building materials for housing both in Japan and internationally.

Operations: Nice Corporation generates revenue primarily through its Building Materials segment, which brought in ¥172.76 billion, and its Housing segment, which contributed ¥45.84 billion.

Dividend Yield: 3.3%

Nice Corporation offers a dividend yield of 3.26%, lower than the top quartile in Japan's market. Despite this, dividends are well-supported by earnings and cash flows, with payout ratios of 16.8% and 11.1% respectively, indicating financial health for continued payments. However, the dividend history has been marked by volatility over the last decade, reflecting inconsistency in payouts which may concern investors looking for stable returns. Trading at a significant discount to fair value suggests potential undervaluation or underlying issues impacting investor confidence.

Where To Now?

Embark on your investment journey to our 374 Top Dividend Stocks selection here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2181 TSE:8089 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance