Pinnacle West (PNW) Q1 Earnings Lag Estimates, Revenues Rise Y/Y

Pinnacle West Capital Corporation PNW reported a first-quarter 2023 operating loss of 3 cents per share, which missed the Zacks Consensus Estimate of earnings of 3 cents by 200%. In the year-ago quarter, the company reported earnings of 15 cents per share.

Total Revenues

Sales for the quarter totaled $945 million, which surpassed the Zacks Consensus Estimate of $792 million by 19.3%. The top line also increased 20.7% from $783.5 million in the prior-year quarter.

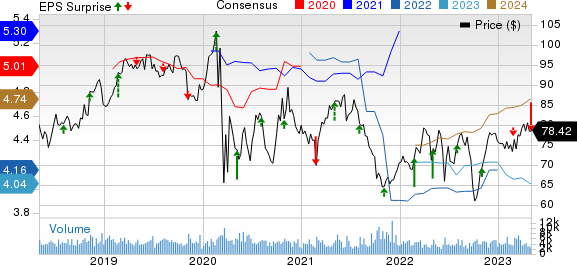

Pinnacle West Capital Corporation Price, Consensus and EPS Surprise

Pinnacle West Capital Corporation price-consensus-eps-surprise-chart | Pinnacle West Capital Corporation Quote

Operational Highlights

Total operating expenses amounted to $894.2 million, up 22.6% from the year-ago quarter. This was due to an increase in fuel and power purchase costs, along with higher operational and maintenance expenses.

Operating income totaled $50.7 million, down 7% from the year-ago quarter’s $54.5 million.

Net interest expenses were $75.4 million, up 23.8% from $60.9 million in the prior-year period.

Financial Highlights

Cash and cash equivalents were $6.9 million as of Mar 31, 2023, compared with $4.8 million as of Dec 31, 2022.

Long-term debt less current maturities was $7,916.5 million as of Mar 31, 2023, higher than $7,741.3 million as of Dec 31, 2022.

Net cash flow provided by operating activities in the first quarter was $211.6 million compared with $340.6 million in the year-ago period.

Guidance

PNW reaffirmed its 2023 earnings per share (EPS) guidance at $3.95-$4.15, assuming 113.6 million shares outstanding. The Zacks Consensus Estimate for the same is $4.04, lower than the mid-point of the company’s guided range.

PNW expects its adjusted operating and maintenance expenses for 2023 to be $885-$905 million.

Zacks Rank

Pinnacle West currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

Edison International EIX reported first-quarter 2023 adjusted earnings of $1.09 per share, which beat the Zacks Consensus Estimate by 4.8%.

EIX’s long-term (three to five years) earnings growth rate is pinned at 2.92%. The consensus estimate for 2023 EPS stands at $4.74, indicating a year-over-year increase of 2.6%.

Eversource Energy ES recorded first-quarter 2023 earnings of $1.41 per share, which beat the Zacks Consensus Estimate by 3.7%.

ES’ long-term earnings growth rate is pinned at 6.34%. The consensus estimate for 2023 EPS stands at $4.36, indicating a year-over-year improvement of 6.6%.

NiSource Inc. NI reported first-quarter 2023 EPS of 77 cents, in line with the Zacks Consensus Estimate.

NI’s long-term earnings growth rate is pegged at 6.9%. The consensus mark for 2023 EPS stands at $1.57, implying a year-over-year increase of 6.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

Edison International (EIX) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance