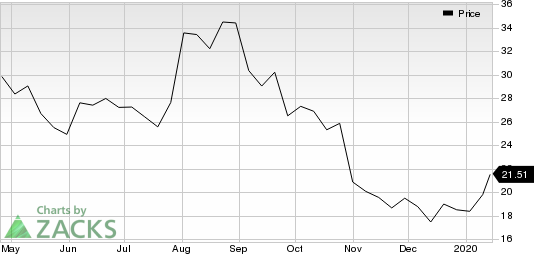

Pinterest (PINS) Catches Eye: Stock Jumps 9.6%

Pinterest, Inc. PINS was a big mover last session, as the company saw its shares rise nearly 10% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This continues the recent uptrend for the company —as the stock is now up 23.3% in the past one-month time frame.

The upmove came after the company’s user base reportedly surpassed that of Snapchat.

The company has seen no changes when it comes to estimate revision over the past few weeks, while the Zacks Consensus Estimate for the current quarter has also remained unchanged. The recent price action is encouraging though, so make sure to keep a close watch on this firm in the near future.

Pinterest currently has a Zacks Rank #3 (Hold) while its Earnings ESP is 0.00%.

Investors interested in the Internet - Software industry may consider a better-ranked stock like Chegg, Inc. CHGG, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Is PINS going up? Or down? Predict to see what others think:Up or Down

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Click to get this free report Chegg, Inc. (CHGG) : Free Stock Analysis Report Pinterest, Inc. (PINS) : Free Stock Analysis Report To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance