Is Playgon Games Inc. (CVE:DEAL) Popular Amongst Insiders?

Every investor in Playgon Games Inc. (CVE:DEAL) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

Playgon Games is a smaller company with a market capitalization of CA$130m, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Playgon Games.

Check out our latest analysis for Playgon Games

What Does The Lack Of Institutional Ownership Tell Us About Playgon Games?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

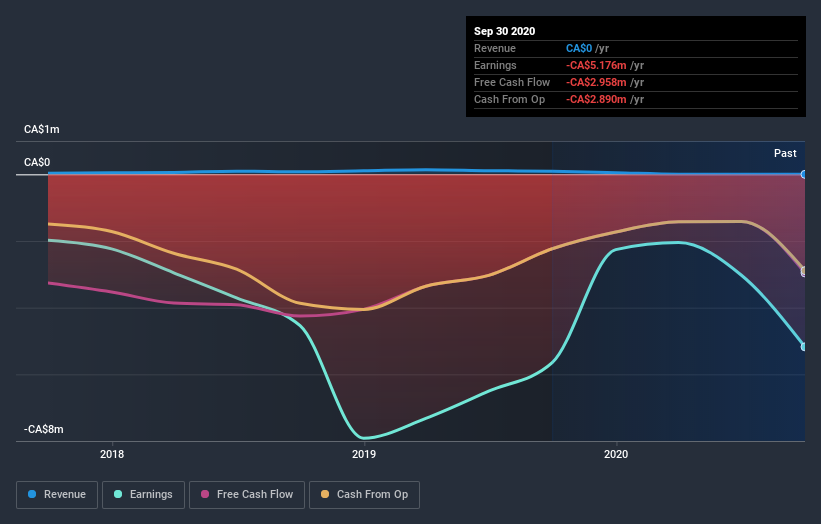

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Playgon Games, for yourself, below.

Playgon Games is not owned by hedge funds. From our data, we infer that the largest shareholder is Guido Ganschow (who also holds the title of President) with 15% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. In comparison, the second and third largest shareholders hold about 15% and 3.4% of the stock. Interestingly, the third-largest shareholder, Darcy Krogh is also a Member of the Board of Directors, again, indicating strong insider ownership amongst the company's top shareholders.

Our studies suggest that the top 11 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Playgon Games

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders maintain a significant holding in Playgon Games Inc.. Insiders have a CA$41m stake in this CA$130m business. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 57% of Playgon Games shares. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that Playgon Games is showing 6 warning signs in our investment analysis , and 4 of those can't be ignored...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance