Plexus Corp (PLXS) Fiscal Q2 Earnings: Aligns with Analyst Projections on Revenue, Misses on EPS

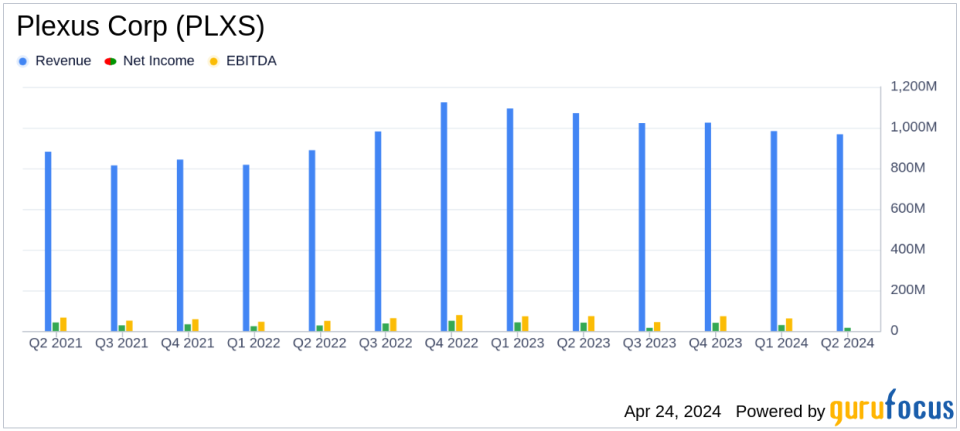

Revenue: Reported $967 million, surpassing the high end of the guidance range of $930 million to $970 million and exceeding the estimated $950.83 million.

Net Income: Achieved $16.24 million, significantly below the estimated $24.73 million.

Earnings Per Share (EPS): GAAP diluted EPS was $0.58, non-GAAP diluted EPS reached $0.94, surpassing the estimated $0.87.

Operating Margin: GAAP operating margin was 3.0%, non-GAAP operating margin improved to 4.2%.

Free Cash Flow: Generated a strong $65 million, indicating robust financial health and operational efficiency.

Return on Invested Capital (ROIC): Recorded at 9.9%, reflecting a solid return above the weighted average cost of capital of 8.2%.

Share Repurchase: Purchased $17.6 million of shares under the repurchase program, demonstrating confidence in the company's value.

Plexus Corp (NASDAQ:PLXS) disclosed its financial results for the fiscal second quarter ended March 30, 2024, in its recent 8-K filing. The company reported a revenue of $967 million, which aligns closely with analyst expectations ranging from $930 to $970 million. However, the GAAP diluted EPS stood at $0.58, notably lower than the non-GAAP EPS of $0.94, which includes adjustments for stock-based compensation and restructuring charges. This performance demonstrates a nuanced financial landscape, where non-GAAP adjustments play a significant role in the company's earnings portrayal.

Plexus Corp, headquartered in Neenah, Wisconsin, operates as a prominent player in the Electronic Manufacturing Services industry. The company offers comprehensive services spanning from design and development to manufacturing and after-market support, focusing on complex products and demanding regulatory environments. Its market segmentation includes the Americas, Asia-Pacific, and Europe, Middle East, and Africa, catering to diverse sectors such as Healthcare/Life Sciences, Industrial, and Aerospace/Defense.

Quarterly Financial Highlights

The company's fiscal second quarter saw a slight decline in revenue compared to the previous quarter's $982.6 million and a more significant drop from $1.07 billion year-over-year. The GAAP operating margin was reported at 3.0%, with restructuring and other charges impacting the bottom line. Notably, the non-GAAP operating margin was healthier at 4.2%, reflecting the company's ongoing adjustments to streamline operations and manage costs effectively.

Strategic Initiatives and Market Performance

During the quarter, Plexus won 32 new manufacturing programs, projected to generate $255 million in annualized revenue once fully operational. This achievement underscores Plexus's robust market position and its ability to attract significant new business. Furthermore, the company repurchased $17.6 million of its shares, signaling confidence in its financial health and future prospects.

CEO Todd Kelsey highlighted the strong free cash flow of $65 million, which significantly exceeded net income and bolstered the company's financial stability. This performance is attributed to effective capital management and ongoing working capital initiatives, which have also contributed to an improved cash conversion cycle.

Outlook and Forward Guidance

Looking ahead to the fiscal third quarter of 2024, Plexus anticipates revenue between $960 million and $1 billion. The projected non-GAAP EPS ranges from $1.22 to $1.37, reflecting expected improvements in operational efficiency and market conditions. The company's guidance suggests a positive trajectory, with strategic realignments and market expansions poised to drive future growth.

Investor and Analyst Perspectives

From an investment standpoint, Plexus's alignment with revenue projections and strategic acquisitions of new programs are positive indicators. However, the discrepancy between GAAP and non-GAAP earnings highlights the significant impact of restructuring costs and stock-based compensation on the company's profitability. Investors and analysts will likely monitor these adjustments closely, assessing their long-term implications on financial health and operational efficiency.

In conclusion, Plexus Corp's fiscal second quarter results present a mixed financial picture, marked by robust revenue performance aligned with market expectations but tempered by earnings adjustments. As the company continues to navigate its strategic initiatives amidst dynamic market conditions, its ability to maintain financial discipline while capitalizing on growth opportunities will be crucial for sustained success.

For detailed insights and continued coverage on Plexus Corp (NASDAQ:PLXS) and other investment opportunities, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Plexus Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance