The Points International (TSE:PTS) Share Price Has Gained 47% And Shareholders Are Hoping For More

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Points International Ltd. (TSE:PTS) share price is up 47% in the last three years, clearly besting the market return of around 0.8% (not including dividends).

View our latest analysis for Points International

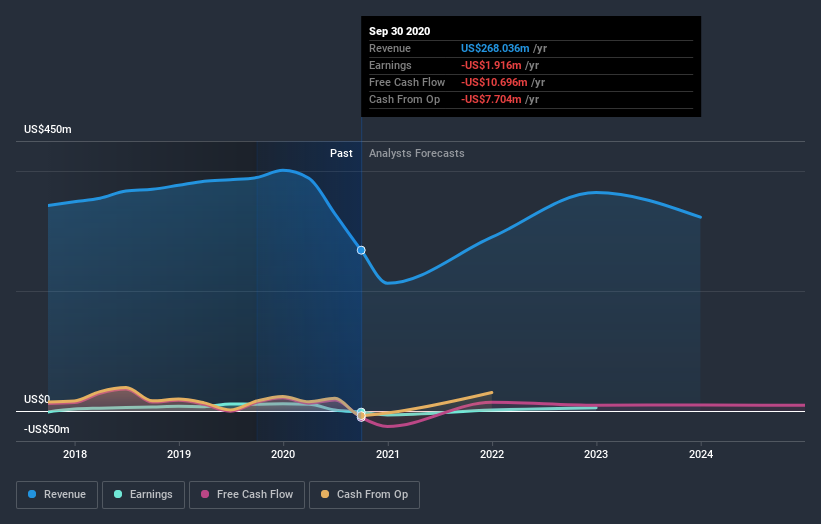

Points International isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Points International saw its revenue shrink by 1.6% per year. Despite the lack of revenue growth, the stock has returned 14%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Points International's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 4.6% in the last year, Points International shareholders lost 4.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Points International is showing 2 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance