Polymer Parts Produced 2022: Polymer Additive Manufacturing Market to Produce Nearly $26B in Components Annually by 2030

Graph

Dublin, Sept. 30, 2022 (GLOBE NEWSWIRE) -- The "Polymer Parts Produced 2022: Global Market Data & Forecast" report has been added to ResearchAndMarkets.com's offering.

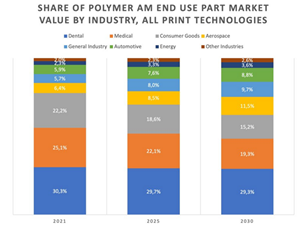

The Polymer Parts Produced 2022: Global Market Data & Forecast estimates the production volumes and resulting estimated market values of various polymer additively manufactured components. The study reconfirms the positive long-term outlook for leading polymer AM technologies moving into significant manufacturing roles across a multitude of industries over the coming decade, with print production activity eventually growing to nearly $26B annually.

This inaugural database publication is a companion to the analyst's already existing Metal Parts Produced data product, combining for singular and comprehensive AM parts market coverage.

This data report includes polymer AM market projections specifically around the production volumes and resulting market value of AM polymer parts spanning prototypes, tools and tooling, and end-use production parts across eight major industries and dozens of part categorizations, from aircraft interiors and UAV components in the aerospace sector, to dental surgical guides and personalized surgical guides in healthcare markets.

The "Polymer Parts Produced" database will be updated on annual basis and is available as a one-time or subscription purchase. The database is fully customizable, allowing for the purchase of individual data segments and subsets.

Report Scope:

Polymer AM technologies, comprising a series of several commercially relevant sub-processes, continue to make inroads into manufacturing through many applications, while also remaining a critical technology for product development and prototyping. Polymer additive technologies have made similar strides to metal AM processes in terms of production readiness, increasingly competing with injection molding and other processes. This has catalyzed activity of production of end use parts, functional tooling to assist existing manufacturing operations, and of course prototypes to speed time-to-market for products regardless of end production process.

Key Highlights:

At times in the recent past, filament based additive manufacturing processes produced nearly as many parts in a professional context as powder based processes, but it is expected that beginning in 2023 the gap in terms of volumes of all parts produced using these processes worldwide will begin to widen, with proliferation of powder bed based systems from HP, EOS, 3D Systems, Stratasys, and many others pushing the powder based part volumes into 100+ million parts per year annually as soon as 2025.

Unsurprisingly, end use part categories across numerous industries dominate the list of 'top 5 fastest compound annual growth' opportunities in each major polymer AM print technology segment through 2030. The aerospace sector averaged the highest end use part CAGR rate across all technologies, closely followed by consumer goods. Though medical applications (including dental) have much more widespread use, their growth rates are more modest based on their more relatively mature position today compared to industrial applications.

For more information about this report visit https://www.researchandmarkets.com/r/qp0agk

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance