Positive Sentiment Still Eludes Ideanomics, Inc. (NASDAQ:IDEX) Following 38% Share Price Slump

The Ideanomics, Inc. (NASDAQ:IDEX) share price has softened a substantial 38% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 92% loss during that time.

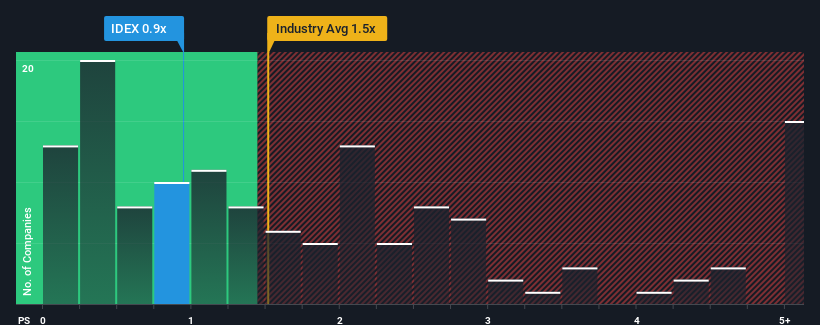

After such a large drop in price, considering around half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider Ideanomics as an solid investment opportunity with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Ideanomics

What Does Ideanomics' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Ideanomics over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Ideanomics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Any Revenue Growth Forecasted For Ideanomics?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ideanomics' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that to the industry, which is only predicted to deliver 6.4% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Ideanomics' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Ideanomics' P/S

Ideanomics' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ideanomics revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Ideanomics (of which 3 don't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Ideanomics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance