UK Markets Advance After Labour’s Election Night Sweep

(Bloomberg) -- Investors responded to Labour’s historic election victory by buying up UK stocks and pushing the pound to its longest winning streak in four years.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Stocks Up as Jobs Spur Calls for September Fed Cut: Markets Wrap

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

The FTSE 100 Index gained 0.4%, with homebuilders leading the advance. The pound climbed for a seventh straight day, edging up 0.1% to around $1.277. Ten-year UK bond yields dropped two basis points to 4.17%.

The hope is that Keir Starmer’s center-left platform ushers in a new era of calmer and more moderate British politics, and that the new government is unlikely to see a return to the fiscal turmoil that upended bond markets in 2022. With Labour securing a decisive majority in the House of Commons, Rishi Sunak conceded defeat and Starmer is set to become prime minister.

“After the political whipsawing of recent years, this result should provide investors with the certainty and stability they have been craving,” said Adam Montanaro, a fund manager at Montanaro Asset Management.

With British stocks near a record high and bond volatility having disappeared, the country’s financial markets are starting to look like a bastion of tranquility, particularly at a time when the US and France are going through their own intense leadership battles that threaten policy upheaval.

“With political turmoil hitting other developed economies at the same time, this huge majority may present the UK to investors as somewhat of a political safe haven,” said Lindsay James, a strategist at Quilter Investors.

Relentless messaging on fiscal discipline in the UK has left investors confident that Starmer and his pick for Chancellor Rachel Reeves won’t do anything radical on spending or borrowing. Before the vote, Labour placed economic stability at the top of its manifesto and pledged to stick to tough spending rules.

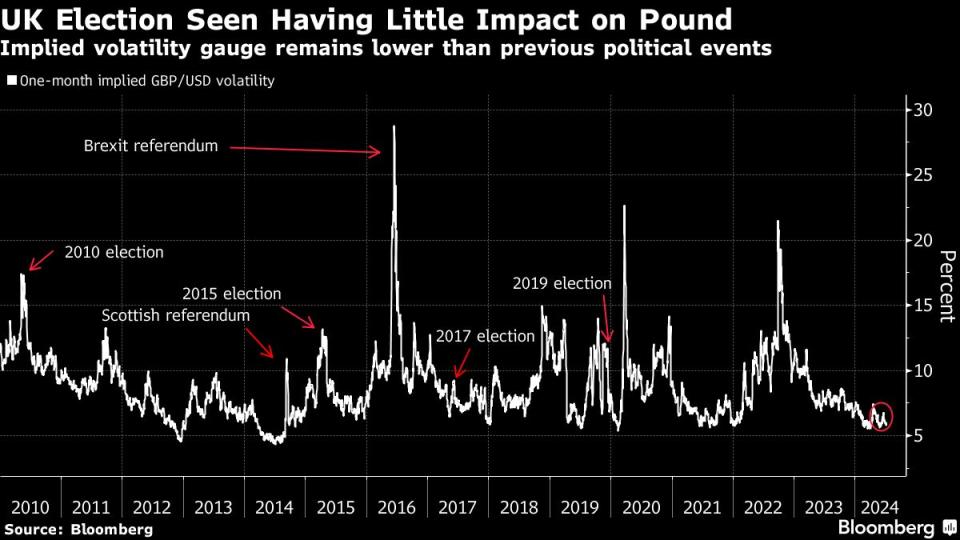

The UK’s transformation in the mind of investors can be most clearly seen in the pound. The currency has been the best performer across the Group-of-10 this year, bolstered by higher interest rates and the prospect of a slow and shallow easing cycle from the Bank of England. A gauge of expected price swings on sterling over the coming month fell to 5.76% this week, its lowest since May.

With “the UK’s macro balances and flow backdrop looking healthier and now a likely quiet period for politics, we remain constructive on sterling crosses,” Deutsche Bank AG strategists including Sanjay Raja wrote in a note to clients.

Rachel Reeves, an ex-Bank of England staffer who’s set to become the UK’s finance minister, has said that the administration would not raise three of the UK’s key taxes on wages and goods. Other promises included building more houses, creating a publicly-owned energy company and moving to “reset the relationship” with the EU — though Labour’s manifesto also ruled out a return to the single market or customs union.

Still, the incoming government is inheriting a sluggish and fragile economy. While inflation has fallen back to the Bank of England’s 2% target, prices for services remain sticky. And a rebound from last year’s technical recession appears to be losing momentum, according to the most recent growth data. But expected interest-rate cuts by the BOE in the next few months give bond investors another reason to favor gilts.

What Bloomberg’s Strategists Say...

“If the ultimate results are in line with the exit poll prediction the pound is likely to be well-supported in the days to come.”

— Ven Ram, cross-asset strategist.

Click here for more

The calm in financial markets puts the UK in contrast with neighboring France, where President Emmanuel Macron’s decision to call a snap vote in early June ignited a selloff. The yield premium on French bonds over safer German debt at one point rose to levels last seen in the depths of the euro-area debt crisis. The move pared this week as polls show the far-right National Rally is unlikely to achieve an absolute majority in a vote Sunday.

It’s also a far cry from years where UK markets danced to the tune of political drama. Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that followed caused gyrations in the pound and stocks. At the last general election in 2019, meanwhile, investors fretted over former Labour leader Jeremy Corbyn’s left-wing policies including nationalization and worker stakes in companies.

More recently, former Prime Minister Liz Truss’s package of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered forced selling from leveraged pension fund strategies. Gilts plunged, forcing an extraordinary Bank of England intervention.

That event has loomed large over politicians since, and both Labour and the Conservatives preached economic caution during the election campaign. Former Labour shadow chancellor Ed Balls said the party had put itself into a fiscal “straitjacket” by ruling out both austerity and tax rises. And Starmer’s target for annual growth of at least 2.5%, which might help fund additional spending, has been criticized by economists as unrealistic.

Markets, meanwhile, are watching closely for any signs of additional bond issuance to generate funds. The UK national debt is at the highest levels since the 1960s as a percentage of gross domestic product, and Britain is already committed to one of its biggest annual borrowing sprees on record. Further increases could hurt appetite for gilts among investors.

“For now, the markets will just be happy to get an election over and done with, and that should benefit market sentiment,” said Kyle Rodda, senior market analyst at Capital.Com.

--With assistance from John Cheng, Abhishek Vishnoi and Joel Leon.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance