Spanish stocks plunge and bonds yields soar as Catalonia crisis intensifies

IBEX 35, Spain's blue-chip stock index, sheds 2.5pc as Catalonia prepares to declare independence from Spain

Pound claws back lost ground as services sector data beats expectations; IHS Markit's closely watched PMI survey nudged up to 53.6 in September (any reading above 50 indicates expansion)

Sterling snaps losing streak; trading 0.3pc higher at $1.3283 against the dollar

FTSE 100 edges down; British Gas owner Centrica and SSE sink as Theresa May announces energy price cap

Mrs May defends the free market and attacks "rip-off" energy prices; the prime minister also warns housebuilders to do their duty and build houses

Tesco restores dividend as profits rise; chief executive Dave Lewis said that the results were "strong progress"

IBEX 35 plunges 2.9pc; 'investors shunning Spanish stocks for German shares'

Mercifully for Spanish stocks, markets in Europe have now closed and the IBEX 35 has finished 2.9pc lower, its worst day of trading in just over 15 months. The banking sector has suffered most this afternoon with TSB owner Banco de Sabadell nosediving 5.7pc and Santander shedding just under 4pc of its value.

IG chief market analyst Chris Beauchamp said on the markets' reaction to the crisis in Spain:

"Today’s focus has been relentlessly on the situation in Spain, where Catalonia is seemingly headed for a declaration of independence. As a result, the Ibex remains under heavy pressure, with the index now down 11% from its highs.

"Geopolitical risk is back on the agenda, with investors shunning Spanish stocks in favour of their German counterparts, as the Dax returns to all-time highs."

Bank of England Governor Mark Carney is talking up the pound to cut inflation, says S&P

The Bank of England is talking up the chance of an interest rate hike to push the pound higher and so reduce inflation, analysts at Standard and Poor’s have argued.

However this would only lead to one rate hike this year and none in 2018, the credit ratings agency estimates, as the economy would suffer with rates rising beyond 0.5pc.

Mark Carney and several colleagues on the Monetary Policy Committee have made it clear that they expect to raise interest rates in next month’s meeting, if the economy continues on its current path.

The proposal took markets by surprise and sent the pound sharply upwards. Although the currency has fallen back a little in recent weeks, sterling is still around 4.5pc stronger now than it was in late August.

Read Tim Wallace's full report here

Spanish stocks sell-off intensifies; government bond yields soar

#Spain's Ibex extends its underperformance vs Germany's Dax as fallout from the Catalonian referendum continued to rattle markets. pic.twitter.com/ae1KDIy4Qp

— Holger Zschaepitz (@Schuldensuehner) October 4, 2017

Catalonia's president Carles Puigdemont brushing aside King Felipe VI's televised warning to announce that the region will declare independence in a matter of days has jolted the markets into life.

Spanish stocks shook off the general strike gripping Barcelona yesterday but Mr Puigdemont's defiant message to Madrid has spooked investors with the IBEX 35 shedding 2.5pc of its value today to drop below 10,000 for the first time since March.

Catalonian pro-independence parties will hold a special session in its parliament on Monday to decide the next steps in the region's secession plans.

Spanish government bond yields have soared with the benchmark 10-year yield jumping 5 basis points to 1.75pc.

Party conference season has been a 'big let-down' for business, says Institute of Directors

With Help to Buy's £10bn extension a big win for housebuilders and the energy price cap a huge blow for utility firms, was the Conservative Party conference good for business?

What was particularly jarring about today's keynote speech by Theresa May was her fierce defence of the free market followed by the prospect of strong government intervention in the energy sector with the promise of price caps.

Stephen Martin, director general of the Institute of Directors, believes conference season has been "one big let-down for business".

He explained:

"On the one hand you have a Labour Party which has decided that business is the bad guy, on the other you have a Conservative Party which talks about the importance of markets, but then tinkers around with help to buy and energy price caps.

"What are business leaders meant to make of it all? “At this pivotal moment in this country’s history, far too little time has been spent explaining the plan for how we leave the European Union, or debating how we tackle the long-term challenges that face our economy."

Number of homebuyers aged 18-35 drops 21pc as Millennials continue to be squeezed out of property market

The so-called silver economy appears to be the driving force behind growth in the UK housing market, with those aged 66 and over the only age group to see an increase in the number of property exchanges over the past quarter.

Although the period between April and June has seen 17,000 (6.2pc) fewer home moves overall, there were 1pc more homemovers aged 66 and over compared to the previous quarter, and 55pc more than during the same period last year.

By comparison, the number of homemovers in all other age brackets has fallen over the past three months, with those in the 18-25 and 26-35 age groups seeing the biggest drops.

Read Sophie Christie's full report here

Catalonia crisis sell-off intensifies; Barcelona-based banks plunge

The IBEX 35, Spain's blue-chip stock index, has plunged over 2pc today as the Catalonia crisis sell-off intensifies in Madrid.

After eking into positive territory yesterday, the index has sunk after Catalonia said that it will declare independence within a matter of days. Spanish banking stocks are taking the biggest knock with Barcelona-based CaixaBank and Banco de Sabadell (which owns UK bank TSB) shedding over 5pc of their value.

The euro, however, has brushed aside the crisis, remaining in flat territory against the dollar and edging down against the pound.

Housebuilders' cash returns could be boosted if May delivers on her rhetoric

Theresa May's pledge to help the next generation own their own home will mean housebuilders will be able to"shorten their landbanks", which would boost cash returns, according to Jefferies analyst Anthony Codling.

He said on the speech:

"This bodes well for continued support for Help to Buy. The PM also said she would make sure land was available, but the housebuilders must build houses.

"Our take is that if land is more readily available, housebuilders will shorten their landbanks, and we would therefore expect enhanced cash returns in the medium term."

Rare earth miner aims to catch a ride on electric vehicle boom

A rare earth miner in Burundi says it is on track to begin producing concentrate by the end of the year, having listed on Aim in January.

Martin Eales, chief executive of Rainbow Rare Earths, said the company was close to completing its processing plant and making its first sale by the end of the December.

RRE is counting on the rise of electric vehicles to fuel demand for its minerals, which include neodymium and praseodymium. These elements are used in rare earth magnets, which Mr Eales said would be vital for the motors in new electric cars, as well as in wind turbines.

Read Jon Yeomans' full report here

Energy price cap reaction: Running the risk that people will end up paying more in the long run

Only a "draft bill" for the energy price cap. That implies no room in this Brexit-heavy Queen's Speech session which will last to next June.

— Alan Travis (@alantravis40) October 4, 2017

Capping energy prices is not the answer to cheaper bills for households, according to editor in chief at money.co.uk Hannah Maundrell.

She said:

"By ignoring the competition watchdog’s recommendations and taking matters into their own hands the Conservatives actually run the risk that people will end up paying more in the long run.

"An energy cap could lull people into a false sense of security and actually reduce switching; not to mention knock out incentives for energy companies to compete with cheaper prices.

Theresa May tells housebuilders to do their duty and build houses

PM takes on housebuilders: says government will make land available - do your duty and build homes our country needs...

— Faisal Islam (@faisalislam) October 4, 2017

The prime minister also revealed that an extra £2bn will be used for affordable housing, bring the total budget for the scheme to almost £9bn.

She told housebuilders that they must do their duty to Britain and build the homes the country needs. Housebuilding shares are largely unmoved by the announcement with the overall sector remaining in the red for the day.

Theresa May announces energy price cap bill

Energy cap back on, draft bill next week

— Laura Kuenssberg (@bbclaurak) October 4, 2017

So theres to be energy price cap.let's hope itll be properly implemented. I await detail next week. Done wrong itll do more harm than good

— Martin Lewis (@MartinSLewis) October 4, 2017

Theresa May has announced that her Government will put a cap on "rip-off" energy prices with a bill to be drafted next week.

The energy market punishes loyalty with higher prices and hits the poorest most, she said. Centrica shares have sunk a little lower following the announcement but most of the impact was already priced in before the speech. Centrica is now 6.4pc down while rival SSE has dived 3.7pc.

Here's what she said on the free market:

"We must come together to fight for this mainstream Conservative agenda.

"To win the battle of ideas in a new generation all over again. For those ideas are being tested. And at stake are the very things we value.

"Don’t try and tell me that free markets are no longer fit for purpose - that somehow they’re holding people back."

Theresa May defends the free market

Theresa May has used her speech at the Conservative Party conference to defend the free market, echoing her appearance last week at the Bank of England's independence anniversary conference to say that it is the "greatest agent of collective human progress ever created".

With that in mind, will she now announce a price cap for energy firms?

Housebuilding is another sector to keep an eye on. We're expecting something a bit more on them in addition to the Help to Buy extension announced earlier this week.

Diageo seeks partner to redevelop part of the historic St James's Gate Guinness brewery

Diageo is to turn part of its flagship St James's Gate Guinness brewery in Dublin into offices, shops and homes.

The drinks firm has kicked off the search for a development partner to redevelop 12.6 acres of the 50-acre site into what it describes as a “new urban quarter” for Ireland’s capital, appointing Deloitte to broker a deal.

Diageo announced in early 2012 that it would be investing heavily in its brewing facilities in order to ensure the sustainability of its Irish business, having moved the entirety of its UK and Ireland operations to the site in 2008.

It now says that because of technological advances, it can brew more beer in less space and can therefore use the surplus land for redevelopment.

Read Rhiannon Bury's full report here

Lunchtime update: Centrica and SSE sink in anticipation of energy price cap

The UK's crucial services sector accelerated in September, according to IHS Markit's PMI survey this morning, picking up from an 11-month low to lift the pound off its lowest level since the Bank of England dropped that very strong hint of an interest rate hike before the end of the year.

The reading beating expectations has pushed the pound up 0.3pc against the dollar to $1.3282 but IHS Markit warned that subdued domestic demand was dragging on growth and that the rise in new work had been the slowest for 13 months.

The FTSE 100 looks set to snap a five-day winning streak after nudging down into the red this morning with British Gas owner Centrica and SSE sinking on fears that Theresa May will use her speech to announce an energy price cap.

We'll provide an update on what Theresa May's speech will mean for the economy and UK businesses a little later.

UK’s powerful services firms pick up pace but inflation puts clouds on the horizon

Britain’s dominant services firms’ growth accelerated in September, indicating that the economy is still expanding at a moderate pace.

Business activity picked up pace, hiring kept on growing though at a slightly slower pace, and expectations of future business also climbed.

The purchasing managers’ index (PMI) from IHS Markit, an influential survey, climbed to 53.6, up from 53.2 in August.

Any score of above 50 indicates growth, so this figure shows a steady expansion.

However, economists are concerned that the new business component of the index slipped to 53.3, its lowest level since summer 2016 in the aftermath of the Brexit referendum.

Read Tim Wallace's full report here

Energy price cap fears sink Centrica and SSE

Let's have a quick round-up on what's moving and why in London this morning.

British Gas owner Centrica has plunged to a 20-month low after business secretary Greg Clark confirmed that Theresa May will use her keynote speech at the Conservative Party conference to speak about energy price caps. Following just behind the firm's 5.5pc dive is peer SSE, which has retreated 2.7pc as investors brace themselves for the announcement.

On the mid-cap index, gambling firm 888 has fallen 4.3pc after a founding shareholder sold its stake for $150m while Royal Mail has dipped 2.8pc after CWU members voted overwhelmingly in favour of industrial action.

EU orders Amazon to pay £220m in unpaid taxes

Luxembourg gave illegal tax benefits to Amazon worth around €250 million. Now Amazon must pay back these benefits. https://t.co/WlTkQicQ2spic.twitter.com/NEuhTcq2E6

— European Commission (@EU_Commission) October 4, 2017

The European Union has said Amazon should pay €250m (£220m) to Luxembourg for receiving years of illegal tax treatment.

EU Competition Commissioner said that around three quarters of the online retail giant's profits were not taxed by Luxembourg after a deal agreed between the company and the Duchy in 2003.

It ordered Luxembourg to recoup the money, plus interest, after saying it provided state aid to the company, which bases much of its European operations there.

Amazon said it would appeal. "We believe that Amazon did not receive any special treatment from Luxembourg and that we paid tax in full accordance with both Luxembourg and international tax law," the company said.

Read James Titcomb's full report here

Rollercoaster day for Tesco shares

Tesco shares are on a bit of a rollercoaster this morning following its first-half figures, in which the grocery giant reinstated its dividend and boosted operating profit by 72pc. After initially jumping to the top of the FTSE 100 leaderboard, its shares soon retreated into the red, falling as low as 3.5pc, before rebounding back to flat territory again.

City Index analyst Kathleen Brooks explains why some doubts might be creeping into investors' minds:

"Tesco did see some of its profit gain come from sales of commercial property; this is a one off gain, so if sales can’t keep pace in the second half of this year, profit growth may only be illusory.

"Unfortunately for Tesco, Aldi and Lidl are still in business, and even if Amazon’s foray into food sales has so far failed to take off, analysts are always going to fret about Tesco’s sales potential with these two formidable competitors."

Tesco restores dividend for first time since accounting scandal

Tesco boss Dave Lewis has reasserted his “confidence” in the retailer’s turnaround plan by unveiling the first shareholder payout since the supermarket cut its dividend three years ago in the wake of its accounting scandal.

Britain's biggest retailer said it would pay a 1p dividend alongside announcing a 71.8pc jump in half year profits to £885m. Mr Lewis denied that the ongoing fraud trial of a trio of former Tesco directors had cast a shadow over his attempt to draw a line under the saga.

“Today's announcement that we are resuming the dividend reflects our confidence that we can build on our strong performance to date and in doing so, create long-term sustainable value for all our stakeholders,” said Mr Lewis.

Read Ashley Armstrong's full report here

Services PMI reaction: 'Increase is encouraging given a backdrop of mixed economic signals'

Worth remembering that while useful, the PMIs are imperfect indicators of the official UK growth statistics. ONS presenting a weaker picture pic.twitter.com/QgeoMYMWM5

— Rupert Seggins (@Rupert_Seggins) October 4, 2017

Today's services PMI reading is getting very mixed reviews from economists. Let's get a slightly less bearish slant on today's figure from Capital Economics.

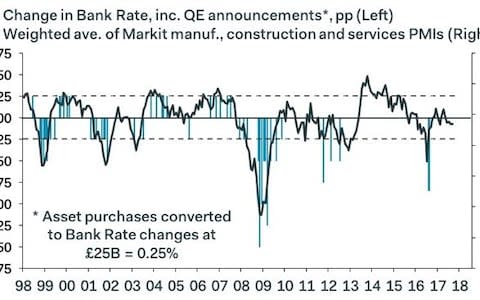

Its UK economist Paul Hollingsworth said that the composite PMI reading from the services, manufacturing and construction sectors is consistent with growth of around 0.3pc and "given that this is in line with the Bank of England’s projections, it shouldn’t prevent the MPC from pressing ahead and raising interest rates in November".

He added:

"The breakdown was not especially encouraging, with the future activity, new orders and employment balances all falling on the month.

"Nonetheless, on the basis of past form, the quarterly average headline balance still points to quarterly growth in services sector output of about 0.4%, the same as was recorded in Q2."

Chris Sood-Nicholls, managing director and head of global services at Lloyds Bank Commercial Banking, also takes the silver lining from the figures, commenting that the "slight increase in the index is encouraging, particularly given a backdrop of mixed economic signals".

Services PMI reaction: Reading will 'cast doubt' over whether the Bank of England will raise interest rates

Despite rising above economists' expectations, today's services PMI "indicates that the sector is still stuck in a rut" and could sow a seed of doubt in the minds of policymakers at the Bank of England over raising interest rates before the end of the year, argued Pantheon Macro UK economist Samuel Tombs.

He added that the reading will cast "doubt over whether the MPC will press ahead with a rate rise 'over the coming months'", explaining that the three PMI figures this week have been closer to the levels when the BoE's policymakers have cut rates rather than raised them.

Headline services PMI nudges up to 53.6; subdued domestic demand dragging on growth

UK Services PMI posted 53.6 in September, up from an 11-month low of 53.2 in August #PMI#BOE#GBPpic.twitter.com/b58USgr1Nr

— Sigma Squawk (@SigmaSquawk) October 4, 2017

Although the services sector rebounded from an 11-month low in September to lift the pound off the lows it hit yesterday following the woeful construction sector reading, IHS Markit's report on the sector paints a gloomier picture of the sector

IHS Markit said that subdued domestic demand acted as a drag on activity growth with the latest rise in new work being the slowest for 13 months despite business activity rising in the headline reading to 53.6.

Chris Williamson, chief business economist at IHS Markit, said that the sector "saw another month of modest growth" and added that “the rise in price pressures will pour further fuel on expectations that the Bank of England will soon follow-up on its increasingly hawkish rhetoric and hike interest rates".

Duncan Brock, director of customer relationships at the Chartered Institute of Procurement & Supply, commented:

"Strong signals indicate a stagnation trend is developing in the sector. With a subdued rate of expansion in September, UK services maintained a lower than long-term average performance this month.

"Where consumers recovered a little from their spending hesitation last month, it was the turn of businesses to be spooked into inactivity, exerting greater scrutiny over new projects and long-term spending plans. The pressure of Brexit and resulting uncertainty were at the heart of this indecision."

Services sector beats expectations in latest PMI reading

The pound has rebounded back into positive territory in the last few moments after IHS Markit's UK services PMI showed that business activity across the sector nudged up in September, beating economists' expectations. More to follow...

Eurozone services sector accelerates

Eurozone final Services PMI for September revised slightly to 55.8 from 55.6 #PMI#EURpic.twitter.com/J0ChJNw6lh

— Sigma Squawk (@SigmaSquawk) October 4, 2017

Just before the UK's services PMI, the eurozone's own reading has just dropped and indicated that their sector accelerated a touch in September, the figure nudging up to 55.8 from 55.6.

Pantheon Macro European economist Claus Vistesen said that the composite figures show that the eurozone private sector finished the third quarter on "a strong note, lifted by strength on both services and manufacturing".

Services sector PMI preview

Sterling is stuck at its lowest level against the dollar since the Bank of England dropped that very strong hint on interest rates a few weeks ago and this week's poor PMI readings from the construction and manufacturing sector have done little to dampen concerns that the UK economy might be too brittle to handle a hike.

Economists expect the services sector to continue expanding in the closely watched survey with the reading forecast to remain steady at 53.2. That being said, economists also expected yesterday's construction figure to hold firm but the sector sunk into contraction territory for the first time in over a year, according to IHS Markit's survey.

Could a worse-than-expected services sector PMI reading weaken the case for an interest rate rise before the end of the year?

Here's CMC Markets analyst Michael Hewson's take:

"With the Bank of England preparing the ground for a rate rise by the end of the year a similarly weak services numbers could make the case for that a little more uncertain as we come to the end of Q3.

"On the retail side activity does appear to be holding up but away from that we have seen some softness from the numbers we saw at the beginning of the summer.

Agenda: Pound stuck at lows ahead of services sector PMI

Two dismal PMI readings from the manufacturing and construction sectors this week have cranked up the pressure on the services sector PMI this morning with the reading expected to hold steady and dispel doubts over the UK economy.

Ahead of the reading this morning, the pound is stuck at the lows it hit yesterday following the poor construction figure, which showed that the sector contracted in September for the first time in over a year. That figure confounded economists’ expectations but they expect today’s services PMI reading to remain steady at 53.2.

Markets remain in jittery Risk-On mood as investors awaited Trump’s decision on the leadership of Fed & gauged prospects for US tax cuts. pic.twitter.com/U540ZqiTOH

— Holger Zschaepitz (@Schuldensuehner) October 4, 2017

The FTSE 100's five-day winning streak looks in danger after edging down into the red early on with the two oil majors, BP and Shell, weighing heaviest as crude prices continue to come off last week's highs.

Recently demoted Royal Mail has slipped 3pc this morning after Communication Workers Union members voted overwhelmingly in favour of the first industrial action since it was privatised while the UK's biggest supermarket Tesco has jumped 1.7pc after paying its first dividend since the company's accounting scandal.

Interim results: Walker Greenbank, Tesco

Full-year results: Avacta Group, Ceres Power Holdings

Trading statement: Topps Tiles, Avacta Group

AGM: AdEPT Telecom, Amedeo Air Four Plus Limited

Economics: BRC Shop Price Index (UK), Services PMI (UK), ADP Employment Change (US), Services PMI (US), Services PMI (EU), Retail Sales (EU)

Yahoo Finance

Yahoo Finance