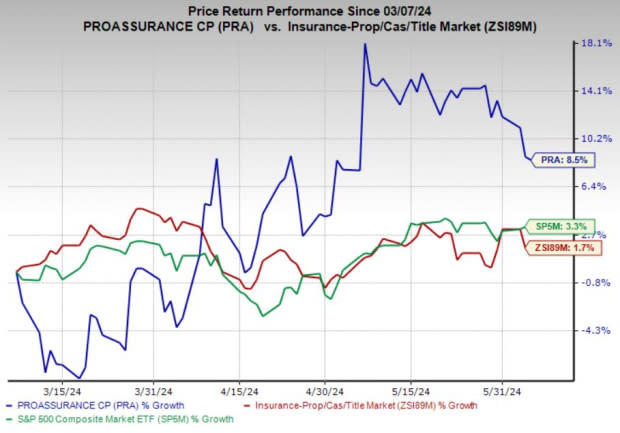

ProAssurance (PRA) Rises 8.5% in 3 Months: More Growth Ahead?

Shares of ProAssurance Corporation PRA have gained 8.5% in the past three months, outperforming the 3.3% growth of the S&P 500 Index and the 1.7% increase of the industry it belongs to. Factors such as improving pricing decisions, new business growth and strong customer retention in the Specialty P&C segment, as well as robust growth in investment income, have been well-received by investors.

ProAssurance, with a market capitalization of $727.4 million, is a leading property and casualty insurance and reinsurance product provider in the United States. The company benefits from prudent cost-control measures. These factors are collectively contributing to this Zacks Rank #1 (Strong Buy) company's notable price appreciation.

Image Source: Zacks Investment Research

Can it Retain Momentum?

The ingredients are there, and now let’s get into the details and show you how its estimates for the coming days stand.

The Zacks Consensus Estimate for PRA’s 2024 earnings is pegged at 38 per share, which witnessed five upward estimate revisions and no downward movement in the past month. The estimate indicates a 371.4% year-over-year improvement. ProAssurance beat on earnings in two of the last four quarters and missed on the other occasions.

Thanks to its cost controlling efforts, PRA’s expenses are expected to decline in the coming quarters, improving margins. In the first quarter of 2024, its total expenses fell only 0.6%. Nevertheless, we expect due to lower net losses and loss adjustment expenses, 2024 total expenses will likely fall 8% year over year in full-year 2024. Our model estimate for the net loss ratio indicates 182 basis points improvement in 2024.

The consensus mark for full-year 2024 revenues stands at nearly $1.1 billion. The growing investment income, which is benefiting from a high-interest rate environment, is likely to support the top line. In 2022 and 2023, PRA’s net investment income grew 36.1% and 33.8%, respectively. We expect the metric to rise further by 8.5% in 2024.

Its significant inorganic growth via successful acquisitions and integrations of companies enables it to diversify its revenue stream, boost its portfolio and expand its footprint. Its NORCAL acquisition still remains a substantial contributor to PRA’s overall gross premiums written.

The stock is currently trading at 0.64X trailing 12-month tangible book value, lower than the industry average of 1.52X, marking ProAssurance's shares are priced more affordably compared to its peers, indicating potential for further growth.

These positive factors are likely to help the company maintain its share growth trajectory and continue outperforming the industry.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on.

Its total debt-to-total capital of 27.8% remains well above the industry’s average of 17.8%. PRA exited the first quarter with cash and cash equivalents of $65.4 million, while debt-less unamortized debt issuance costs came in at $427.8 million. Also, ProAssurance’s return on equity of 0.6% is significantly lower than the industry average of 7.8%, reflecting a comparatively inefficient utilization of its capital. Nevertheless, we believe that a systematic and strategic plan of action will drive PRA’s growth in the long term.

Other Key Picks

Investors interested in the broader Finance space may look at some other top-ranked players like Ambac Financial Group, Inc. AMBC, Brown & Brown, Inc. BRO and Root, Inc. ROOT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ambac Financial’s current-year earnings is pegged at $1.45 per share, which witnessed one upward estimate revision in the past month against no movement in the opposite direction. AMBC beat earnings estimates in all the past four quarters, with an average surprise of 893.5%.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $3.61 per share, which indicates 28.5% year-over-year growth. It has witnessed one upward estimate revision against none in the opposite direction during the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.9%.

The consensus mark for ROOT’s current-year earnings indicates a 35.6% year-over-year improvement. It beat earnings estimates in all the past four quarters, with an average surprise of 34.1%. Furthermore, the consensus estimate for Root’s 2024 revenues suggests 125.3% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ambac Financial Group, Inc. (AMBC) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance