Procter & Gamble (PG) Professional Brings New Laundry Items

The Procter & Gamble Company PG has been gaining from robust pricing and a favorable mix, along with strength across segments. The company has been focused on productivity and cost-saving plans to boost margins. We note that P&G Professional has been expanding its laundry care lineup with Tide Professional Commercial Laundry Detergent and Downy Professional Fabric Softener.

The Tide Professional Commercial Laundry Detergent has been made to clean greasy commercial stains in a single wash. The detergent is convenient for commercial and residential washing machines and can be used by numerous industries including salons, spas, restaurants, hospitality, healthcare and others.

The Tide Professional Detergent comes in liquid, powder and Power PODS, hence offering three cleaning options to suit diverse needs and preferences. While the liquid detergent is available in 105 oz. and 170 oz., the powder version is available in 197 oz. and the PODS are available in a 63 ct pack.

The Downy Professional Fabric Softener is available in 140 oz. The Softener aids in softening fibers in a single wash and freshens uniforms, towels, linens and more. The Downy Professional can also be used for commercial and residential washing machines. Such additions help business owners optimize the laundry processes and focus on the other essential tasks in running the business.

What Else?

Procter & Gamble’s products play a key role in meeting the daily health, hygiene and cleaning needs of consumers around the world. The company witnessed continued strong momentum in the fiscal third quarter, as reflected by underlying strength in brands and appropriate strategies, which aided organic sales growth.

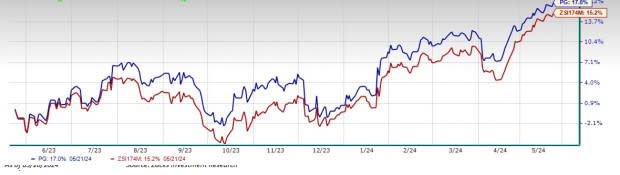

Image Source: Zacks Investment Research

The company’s productivity and cost-saving plans appear encouraging. Procter & Gamble’s continued investment in the business and efforts to offset macro cost headwinds and balance top and bottom-line growth underscore its productivity efforts. The company is witnessing cost savings and efficiency improvements across all facets of the business.

With the introduction of the supply chain 3.0 program in fiscal 2023, the company is driving improved capacity, greater agility, flexibility, scalability, transparency and resilience, along with greater productivity. PG anticipates benefiting from tailwinds of $900 million after tax in fiscal 2024, attributed to favorable commodity costs.

Shares of this Zacks Rank #3 (Hold) company have increased 17% in a year compared with the industry’s 15.2% growth.

Key Picks

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal year sales and earnings suggests growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank of 2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The consensus estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.6% and 35.6%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse portfolio of salty snacks, currently carries a Zacks Rank of 2. UTZ has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 15.8% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance