UK house prices fall despite strong demand driven by second lockdown

UK house prices fell by 0.5% this month, despite aspects of renewed coronavirus restrictions driving strong demand and as sellers rush to beat the Stamp Duty deadline.

Property website, Rightmove (RMV.L) said that the average price of a property coming to market this month was down by £1,505 ($1,980) compared to last month.

The fact that, despite new coronavirus restrictions, activity in the housing market has been allowed to continue, has alleviated some uncertainty, which, in turn has slightly buoyed demand.

Rightmove said the price pressure “could be a result of some new sellers pricing more realistically to have a better chance of agreeing a sale in time to benefit from the stamp duty savings.”

Despite the dip, asking prices are still 6.3% higher than a year ago. Across Britain, the average asking price for a home coming to market in November is £322,025.

The first six days of England’s lockdown saw demand bounce back, up 49% on 2019, according to Rightmove.

Properties in the higher bands between £100,000 and £500,000 — in areas where buyers are set to make the biggest stamp duty savings as the March deadline approaches — saw strong demand and increased activity compared to October last year.

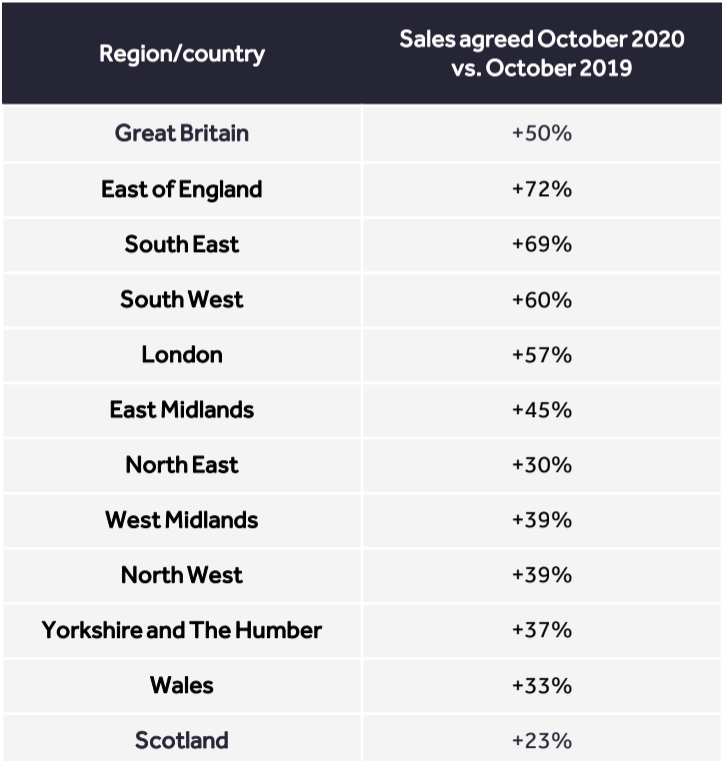

National sales agreed are up 50% on October 2019, a softening from the 70% year-on-year jump recorded in last month’s report.

Regionally, the south is performing best relative to 2019 for the number of sales agreed, up by 72% in the East of England, with sales rising by 69% in the South East and 60% in the South West. The capital, London, saw an increase of 57%.

Rightmove estimates that 650,000 sales are currently going through the buying and selling process, 67% higher than during the same time period in 2019.

Around a third of transactions in the pipeline would still be exempt from stamp duty after the holiday ends on 31 March 2021, due to being below thresholds or qualifying for first-time buyer exemptions.

READ MORE: Major UK housebuilder reveals COVID-19 is not slowing down demand

The number of sales agreed for homes priced between £100,000 and £200,000 was up 16% on this time in 2019. Sales agreed in the £400,000 to £500,000 price band more than doubled with a 106% rise.

Additionally, according to data from the property website, there was a decrease in the number of days it takes from when a property is listed on Rightmove until it’s marked as under offer or sold subject to contract by an agent.

Overall, the time to secure a buyer is at a new record low of 49 days, with the £400,000 to £500,000 price band seeing a drop of 23 days, compared an eight days drop in the £100,000 to £200,000 band.

Rightmove’s director of property data, Tim Bannister, said: “Given the ongoing mini-boom, prices might have been expected to rise again this month, but instead we have a slight dip which could be a result of some new sellers pricing more realistically to have a better chance of agreeing a sale in time to benefit from the stamp duty savings on their onward purchase.

“We know from a recent Rightmove study that sellers are twice as likely to sell if they agree a sale based on the first price at which their property goes on the market, something that’s even more important now as we move towards the end of March and the end of the stamp duty holiday.

“If your initial asking price is too high then you’re less likely to get an offer even after you’ve cut your price back to a more realistic level. Our revised prediction of a 7% annual increase in prices in 2020 looks to be on track, since the annual rate has jumped to 6.3% with a month to go.”

The latest UK house price data from Halifax showed average prices breach the £250,000 mark for the first time in history, up 7.5% year-on-year in the highest annual growth since 2016.

Watch: What do stamp duty cuts mean for buyers and house prices?

READ MORE: London property prices expected to fall over next three months

Bruce King, director of Cheffins in Saffron Walden, said: “Political uncertainty, Brexit and the first lockdown period caused many who were considering moving to sit on the fence, however the announcement of the stamp duty holiday was the trigger for many of these to bite the bullet and get on with moving house.

“This, coupled with the change in lifestyle which has been caused by the coronavirus outbreak, has created a pressure cooker in the market which has resulted in activity which couldn’t have been foreseen around a year ago,” he added.

A temporary stamp duty holiday in England and Northern Ireland was also introduced, in a bid to revive the property, construction and related sectors during the pandemic downturn. The changes mean that buyers pay no stamp duty on the first £500,000 of a property’s value until 31 March 2021

Yahoo Finance

Yahoo Finance