London property prices expected to fall over next three months

Most surveyors and estate agents expect London property prices to fall over the next three months, according to a leading survey.

The outlook for the capital marks a contrast to the UK as a whole, where a majority of industry figures expect sales and prices to continue to rise.

A poll released by the Royal Institute of Chartered Surveyors (RICS) on Thursday suggests Britain’s property boom is largely holding up, despite increased coronavirus restrictions, record high redundancies and rising mortgage interest rates.

Many estate agents and surveyors said a boom in interest in moving since the first nationwide lockdown continued to fuel the market, on top of stamp duty cuts in England and Northern Ireland. Some reported demand so high it was causing delays processing transactions.

The number of people looking for new homes and of homeowners putting properties on the market both rose for a fifth month in October, according to RICS. Agreed sales continued to rise, and several estate agents and surveyors said they had seen a record month of business.

READ MORE: Can the UK construction and housing boom ride out a tough winter?

“The housing market remains very busy and despite the second national lockdown, the sense is that this will persist over the coming months and into the new year,” said Simon Rubinsohn, RICS chief economist.

Predictions of an imminent slump since the pandemic hit have proved wide of the mark so far, but the market is still widely expected to see a slowdown longer-term as Britain’s economic crisis eventually spills over into the housing market.

The property market secured an exemption from England’s new lockdown, but there are some signs of the boom already starting to fray. “Purchasers have been spooked,” said

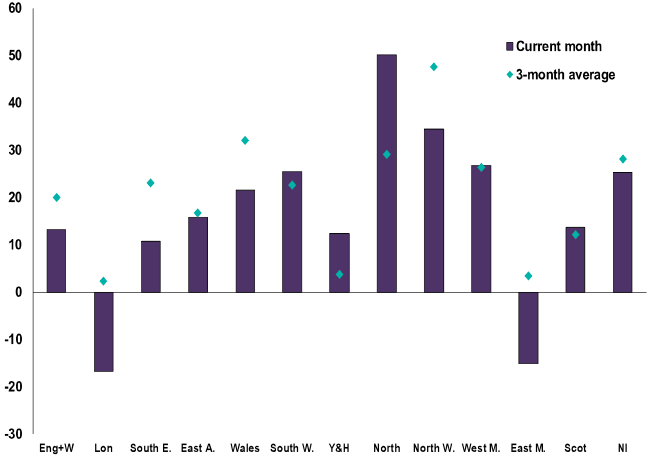

RICS analysts assess the market by subtracting the number of members giving negative responses from the number reporting positive ones, providing a ‘net balance’ figure on various questions.

The headline figure on near-term price expectations among London members was positive in August (+15) and September (+9), but turned negative in October (-17). It was the only English region other than the East Midlands where most members expect declines, with gains also expected in Scotland, Wales, and Northern Ireland.

READ MORE: Housebuilder confirms dividend with new lockdowns’ impact ‘limited’

“Whether mortgage valuations or lockdown contributed is the question but purchasers have been spooked,” said John King, a chartered surveyor at Andrew Scott Robertson estate agents in south-west London.

“What appeared to be an active start to the month has slowed while the market assesses the immediate future. Reductions are being sought throughout resulting in a delicate balance with most vendors resisting leading to a slowdown in sales.”

Mac Lal, managing director of another London property firm, Macneel & Partners, noted: “Terrible market - too many flats that are empty and not selling in central London.”

Several RICS members commented on the gap between weaker city centre demand and stronger interest in suburban areas in London, Birmingham and Manchester.

Many nationally were cautious about the longer-term future, and noted growing uncertainty in the market. John Reeves of the Helmsley Group property investment company said: “Who knows what is going to happen, everything is a mess. Lockdowns are a nightmare.”

It comes after analysis by Moneyfacts on Monday suggested average interest rates on two- and five-year mortgage deals rose for a fourth month in October. Many lenders have hiked rates and curbed availability, in a sign they fear more borrowers could struggle to pay in a bleak economic environment.

WATCH: UK property prices rising at fastest pace since 2015

READ MORE: Average UK house sale price tops £250,000 for first time ever

Yahoo Finance

Yahoo Finance