Can the UK housing and construction boom ride out a tough winter?

Britain’s economic recovery was already losing momentum even before strict coronavirus restrictions came into force in Northern Ireland, Wales, and then England in recent weeks.

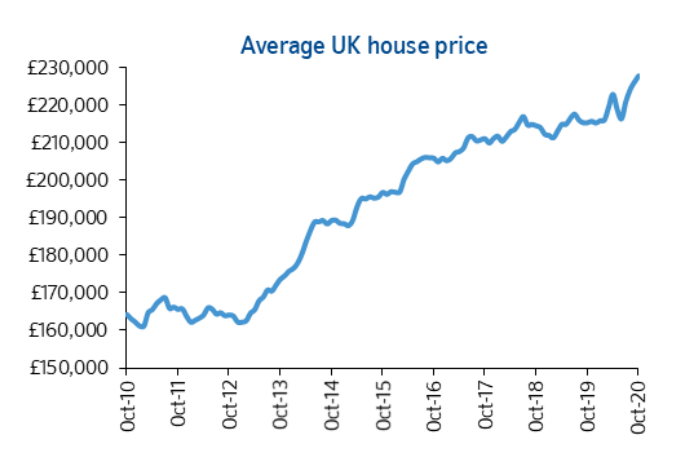

But the boom in home sales that exploded in the summer has continued at pace, in a striking contrast to the wider health and economic crisis and predictions of a slump. The scale of demand has not merely revived but overwhelmed the property and construction industries, with prices soaring for homes and building materials alike.

A major question facing both sectors is—will the resurgent pandemic and a fresh economic downturn finally bring the boom to a halt this winter?

Construction firms hope to survive winter ‘unscathed’

Politicians, business group chiefs and union leaders alike have warned of a bleak winter. England is currently in lockdown with the virus spreading rapidly, curbs on social contact and many firms forced to close. Economists warn of a double-dip recession and mass job cuts by well-known firms have dominated the headlines.

But the construction and property sectors have avoided an enforced shutdown in England, suggesting most activity will continue as now, in a decision naturally welcomed by industry leaders.

The government has allowed builders to continue to work on sites, estate agents to open and tradespeople and potential buyers to enter homes, with renters and homeowners still allowed to move.

READ MORE: UK house prices top £250,000 for first time in history

A leading industry report this week suggests construction bosses are far more “cheerful” than their peers in other industries, with exemption from the shutdown not the only thing lifting spirits.

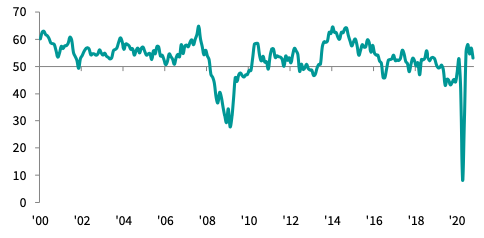

Some 45% of managers polled in a purchasing managers’ index (PMI) survey—albeit one carried out before England’s lockdown announcement—expected output to rise in the year ahead, while just 14% predicted declines. Most firms saw work increase in October.

WATCH: Why are house prices rising when the economy is struggling?

“The strength of the pipeline of new work especially from a robust housing market means the sector is moving in the right direction and hopeful of getting through the winter unscathed," said Duncan Brock, group director of the Chartered Institute of Procurement and Supply, which co-authors the report. Commercial work has also remained healthy, though civil engineering is struggling, according to the survey.

Firms may be hoping existing orders can tide them over even if new orders do take a hit as the wider economy struggles. Shares in housebuilder Redrow (RDW.L) leapt on Friday as it announced its forward order book was “close to record levels” at £1.5bn ($1.9bn), up 10% on a year earlier.

“Given the bonanza that housebuilders are currently experiencing from the stamp duty reduction, it's no surprise that they are the best-performing sector of the construction industry,” said Ben Dyer, CEO of Powered Now, a software app specialised in the trades.

READ MORE: Redrow shares leap on record order book

Alex Rose, director of new homes at Zoopla, told Yahoo Finance UK that housebuilding continued to be “turbocharged” by pent-up demand from the first lockdown as well as the England and Northern Ireland stamp duty holiday.

Experts have warned repeatedly of a looming slump since the pandemic hit, but the most recent data shows housing sales still buoyant in October even as infection rates grew and much of the country faced tighter restrictions.

On Friday, the latest data from lender Halifax showed homes selling for an average of 7.5% more than a year earlier.

Signs of momentum fraying and the stamp duty cliff-edge

Halifax’s data contained some signs of the property market starting to fray at the edges, however.

While year-on-year price inflation remains eye-watering, the pace of monthly price gains has slowed sharply over the past two months. Prices were up 0.3% between September and October, compared to 1.5% gains a month earlier and 1.7% the previous two months.

There are some question marks over how representative of the market transaction figures are, with sales increasingly dominated by better-off buyers purchasing more expensive homes.

Lenders have slashed the number of low-deposit mortgages and raised interest rates on such products, as well as increasing scrutiny of buyers’ finances. Their caution may only increase as England’s economic crisis deepens with another lockdown.

READ MORE: Calls for stamp duty extension as 375,000 buyers ‘set to miss deadline’

Analysts say such changes are cutting certain would-be buyers out of the market, while rising job cuts and renewed furloughing could hit buyer numbers further. Yet the extended furlough scheme, low interest rates and continued offer of mortgage holidays could also keep buttressing the market, limiting forced sales.

Meanwhile in construction, while most builders are still reporting rising activity in PMI surveys, growth last month was at the weakest pace since June.

Jeremy Leaf, a north London estate agent and a former RICS residential chairman, told Yahoo Finance UK that Britain’s bleak economic outlook could hit new home construction, despite work being allowed to continue.

“Generally, builders require longer-term confidence, not just in the property market but in the economy generally before making broader commitments,” he said.

Dyer added: “The reduction in the rate of growth could be the first signs of a drop in demand from lockdown-related macro-economic damage.”

READ MORE: UK house prices at five-year high despite economy losing steam

He also noted homeowners considering booking in building work “may become more anxious over time, particularly if the virus continues spreading rapidly.”

One of the biggest concerns on the horizon for firms is the time-limited stamp duty holiday. It is due to expire at the end of March, but may take a significant hit much sooner once buyers stop expecting to be able to complete by the deadline. Transactions typically take several months, and soaring demand has already caused bottlenecks processing sales.

“Short-term at least, those in the construction sector will be a little bit circumspect about their prospects going forward unless they can see the stamp duty holiday perhaps extended,” said Leaf.

“Looking forward to after its removal from the end of March, or in the run-up to then when it will be impossible to buy and take advantage of the holiday, developers will be concerned as to how things will pan out.”

Materials are a more immediate concern for many in the trades, however. The first UK lockdown resulted in shortages that hamstrung activity even among firms that kept trading or had hoped to do so.

WATCH: What are the new lockdown rules?

Firms reported in the PMI survey that demand for materials outstripped supply last month, pushing up prices at the highest rate since April 2019. “It's disappointing that the supply of building materials remains a constraint and it could be argued that suppliers over-reacted to the first lockdown, creating this situation,” said Dyer.

Meanwhile higher activity provides little consolation for workers losing their jobs. Despite the recent boom in parts of the sector, PMI surveys show employment levels in the industry falling month after month.

A boom in housing also provides little help for other parts of the industry. A spokesperson at the Unite union said job losses in the commercial building sector were likely to be significant, with firms buckling under the weight of both the pandemic and Brexit.

"The pandemic is also set to worsen longstanding skills shortages, with existing apprentices face being laid off and employers reluctant to recruit new trainees due to the ongoing uncertainty,” said the spokesperson.

READ MORE: Fears over construction workers’ safety as building sites reopen

The construction industry’s exemption from lockdown in England also poses more fundamental questions about the government’s and firms’ priorities in seeking to preserve not just livelihoods but lives.

Many workers were furloughed during the last UK lockdown, but not all were eligible and large numbers continued to work. Official figures earlier this year showed construction workers, already in one of the most dangerous industries in Britain, had some of the highest death rates from COVID-19.

Understanding of the virus has improved and leading housebuilders and other firms have introduced rigorous safety policies since the first wave of the pandemic. But maintaining social distancing can be difficult on sites, and there are concerns many firms have not done enough to keep staff safe.

The Unite spokesperson added: "It should also be remembered that while social distancing and safety measures are often strong on large sites, the smaller the site the weaker such measures are likely to be, which threatens the health of construction workers."

Meanwhile in the property sector, many viewings are virtual already—but many tenants are unlikely to feel comfortable with potential new tenants or buyers visiting their homes in the middle of a pandemic.

Yahoo Finance

Yahoo Finance