UK construction growth at weakest since June as job cuts continue

UK construction growth has slowed to its weakest since June over the past month, and firms have continued to slash jobs.

A new survey shows momentum waning in the industry, even ahead of England’s new lockdown coming into force. Employment in the industry continued to fall last month amid heightened economic uncertainty, according to consultancy IHS Markit and the Chartered Institute of Procurement & Supply (CIPS).

But most firms continue to report growth in work, albeit at a slower pace than in September. Demand for materials was so high it outsripped supply, pushing up costs.

Firms have been buoyed by pent-up demand over the summer in the wake of the first nationwide lockdown. The impact of England’s new lockdown remains to be seen, with construction work and the property sector allowed to remain open but curbs likely to have a heavy toll on the wider economy that risks dampening demand.

READ MORE: UK services firms close to stalling even before lockdown

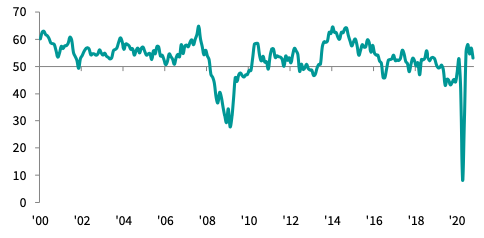

The purchasing managers’ index (PMI) data is based on a poll of construction firms, and is closely followed by investors and economists. Survey results are turned into a headline figure between 0 and 100. Readings above 50 show most firms are expanding, while readings below 50 show decline.

October’s reading came in at 53.1, compared to the 56.8 reading in September, when firms had seen the biggest rise in new work since before the first nationwide lockdown.

The home-building sector has seen some of the strongest recent growth within construction, fuelled by stamp duty cuts and soaring demand for moves since the pandemic hit.

The latest figures suggest UK house price growth is at a five-year high despite the crisis, with low interest rates, mortgage holidays and furlough limiting much of the fallout from the economy’s troubles. Mortgage interest rates and unemployment are rising, however.

The speed of recovery only eased slightly in housebuilding last month, while commercial activity continued to rise. Yet work in civil engineering declined for a third month in a row, with more firms reporting shrinking work than at any time since May.

"Activity growth in the construction sector dipped a little in October as supply chain challenges impacted on productivity, and some of the momentum from the last few months leaked away,” said Duncan Brock, group director at the CIPS.

“The largest blot on the landscape was the number of redundancies and job shedding reported by construction firms, though builders remained relatively cheerful about the next 12 months.”

READ MORE: UK factories losing steam as restrictions tighten

Data released for eurozone construction firms on Thursday showed a far worse reading of 44.9, indicating steep declines in work.

Meanwhile PMI figures for Britain’s dominant services sector earlier this week also showed recovery fading as national and regional restrictions have hit hospitality, leisure, retail and other services firms. Companies were almost evenly split between those reporting growth and decline, with a reading of 51.4 sharply down from the 56.4 reading seen a month earlier.

Manufacturing growth has also slowed, though it remained more firmly in positive territory on 53.7 with export demand in China, the US and Europe helping firms. Makers of consumer goods saw output decline last month however, blaming local lockdowns and falling demand among households as the virus has flared up once more.

WATCH: Mortgage approvals hit highest levels since 2007 in September

Yahoo Finance

Yahoo Finance