UK factory slowdown and job cuts worsen even before England lockdown

UK manufacturers have begun “losing momentum” and job losses have accelerated even before new coronavirus restrictions come into force in England.

A leading survey shows makers of consumer goods saw output decline last month, blaming local lockdowns and falling demand among households as coronavirus infection rates have risen.

Consumer goods firms also saw the most widespread job cuts within manufacturing, but the rate of lay-offs accelerated across the sector. Manufacturing employment levels have fallen for a ninth month in a row, and spare capacity has increased as output and new orders have slowed.

New figures IHS Markit and the Chartered Institute of Procurement & Supply (CIPS) highlight the challenges facing firms, though most still reported growth in October and it was higher than expected by analysts.

Intermediate and investment goods firms saw “marked expansions” of production and orders, as US and Chinese demand helped new export orders grow at the fastest rate in two-and-a-half years. One in four exporters said EU clients were stockpiling for the end of the Brexit transition, however.

READ MORE: UK chancellor says government will ‘seek’ to return to local lockdowns in a month

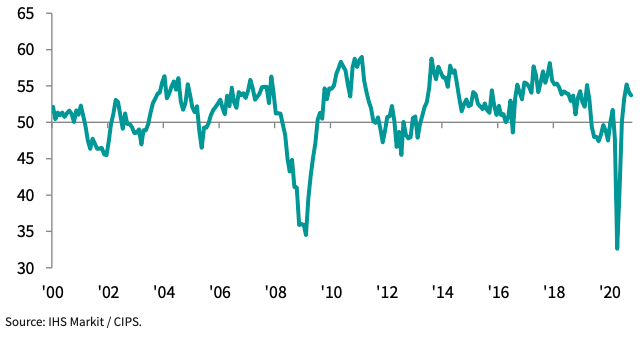

The data published on Monday is from a purchasing managers’ index (PMI) for manufacturing, a survey closely followed by investors and economists as a sign of the health of the UK economy.

The seasonally adjusted index sees survey results turned into a headline figure between 0 and 100. Figures above 50 show the majority of respondents are reporting positive growth, while readings below 50 suggest declining activity.

The headline reading last month came in at 53.7, down from 54.1 in September but 0.4 percentage points higher than flash estimates had suggested last week.

It comes as firms in England brace for the impact of a second blanket lockdown later this week as the country struggles to contain soaring infection rates. Wales and Northern Ireland have already imposed temporary new lockdowns, while Scotland has introduced a new five-tier local system from Monday.

Many analysts now expect a double-dip recession, with the recovery seen since the summer, already stalling amid tighter restrictions and higher infection rates, likely to go into sharp reverse.

Deutsche Bank analysts said on Monday that national output would likely plummet between 6% and 10% in November on already depressed October levels. GDP in the final quarter of the year is expected to slide between 2.5% and 3.5% on the previous quarter.

WATCH: What is a recession?

Manufacturing chiefs warned some hard-hit sub-sectors may require tailored support after prime minister Boris Johnson announced the new measures at the weekend.

James Brougham, an economist at industry group Make UK, said: “While the data remains in positive territory, it’s at the lowest level since the easing of the first national lockdown.

“While the recently announced month-long extension to the Job Retention Scheme will put the brakes on the rate of job losses, manufacturers will experience a forboding déjà vu as they face the exceptional operational challenges induced by another national lockdown.

“It’s clear that this crisis has many months to run at the very least. As such, government must now work with industry and look at longer term measures to support businesses and protect jobs. If that means thinking the unthinkable then that’s what we must do with nothing off the table.”

READ MORE: One in five young people jobless as unemployment ‘already at 2.5 million’

In the survey, carried out throughout October, 60% of manufacturers polled expected output to rise in the year ahead. “Positive sentiment reflected hopes of economic recovery and a reduction in COVID-19 disruption. However, some firms also raised concerns about the potential impact of both the ongoing pandemic and Brexit uncertainty,” said the IHS Markit and CIPS report.

But Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said: “Looking ahead, the industrial sector should not be disrupted significantly by the four-week lockdown that begins on Thursday, as manufacturing employees are permitted to attend their usual place of work, and schools will remain open, enabling parents to continue working.”

He said EU stockpiling demand would pick up over the next two months, and consumer goods demand would remain high until a vaccine is found as households have less ability to spend more on services. “We think that manufacturing output will be close to its pre-Covid peak in December.”

Yahoo Finance

Yahoo Finance