Property markets have soared, but a tough few months is yet to come

Covid-19 has upended the world. The New Normal is a 10-part series, published daily at 6am, looking at the dramatic ramifications for the world of economics and business. Part eight reviews shifting trends in the property market.

Confined at home but freed from the daily commute, lockdown had a huge impact on how millions of families live. No longer tied to where they work, homeowners have realised it may be possible to have more space and a garden. Property websites Rightmove and Zoopla reported record traffic as wannabe buyers sought to make that a reality.

It remains to be seen if this represents a fundamental shift in behaviour, away from cities and towards a work-from-home culture. Much depends on the future of the office – and the race for a vaccine.

But for the property market, at least in the short term, lockdown and its aftermath had an instant effect. As soon as restrictions were loosened, estate agents reported a huge spike in demand for homes in the countryside and cities’ outer commuter belts.

Combined with a stamp duty holiday and pent-up demand left over from the ‘Boris Bounce’ after last year’s general election, this psychological boost has created a mini-boom.

Soaring against the odds

To begin with, anecdotal evidence suggested the surge was being driven by just a few wealthy buyers ready to pay far over the asking price for a place in the country.

A few months have now passed since market restrictions were lifted, and it’s clear that changes are far more widespread. Across the whole country, buyers are bringing forward long-planned moves.

Rightmove has recorded a 4.6pc surge in asking prices since last August as vendors seek to benefit from a jump in demand.

Estate agents’ body NAEA Propertymark said that the number of properties sold per branch is at its highest level for 13 years. Zoopla has said that properties are selling 31pc faster than last year, with the average time taken to sell falling from 39 days to just 27.

Part of the reason for this broader rise in demand has been the stamp duty holiday, introduced by Chancellor Rishi Sunak to stimulate activity in the market. This added fuel to the pent-up demand that emerged over lockdown. House prices are rising as a result - even though the country has been through one of the most brutal recessions in its history.

This can partly be explained by an imbalance in the market as well as the tax cut. Demand is up 34pc so far this year compared to 2019 but new supply is still 12pc according to Zoopla.

Since the pandemic started, house price forecasts have ranged from falls of 3pc to a drop of 15pc or more. But Zoopla now says that the stamp duty cut has created such demand that falls have been delayed until next year. It expects house prices to rise by between 2pc and 3pc in 2020.

Lucian Cook, of estate agency Savills, says: “The momentum we have seen over the summer will continue into the autumn, but in the fourth quarter it will be more difficult to sustain.”

The creation of micro markets

Those moving now are taking a gamble. It is not clear if a vaccine will spark a return to office life. Will they still be able to work from their home in the countryside if things go back to ‘the old normal’? The specific demand created by lockdown has led to the creation of super-powered micro markets, with interest strongest in leafy commuter belt towns in the South East. Homes priced between £400,000 and £500,000 are particularly popular, as this is the price band ‘sweet spot’ for the stamp duty cut in which you can make the biggest savings as a proportion of your house price.

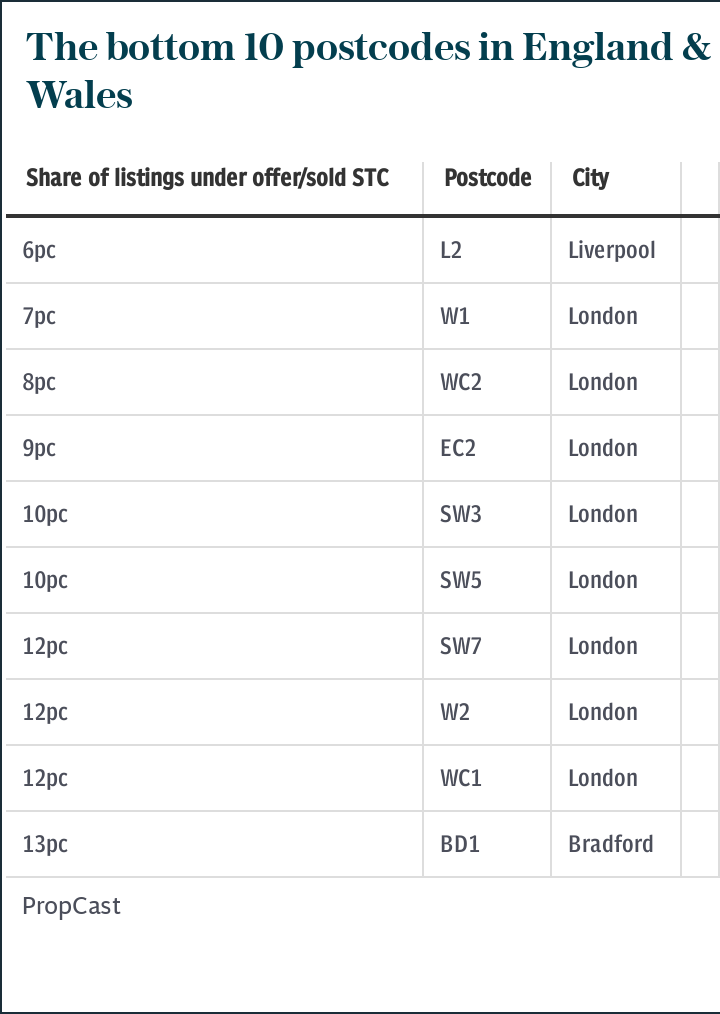

Rightmove reports that the number of listed properties has increased the most in Harlow and Wickford in Essex, and Hertford in Hertfordshire. While demand is currently soaring in the countryside, towns, villages and suburbs, it is more modest in cities as an urban exodus takes place. London is a particular laggard.

Idealism meets reality

The soaring demand reported by Zoopla and Rightmove is based on buyer inquiries and should be treated with some caution. People want to move, but can they? Many banks have shut up shop to first-time buyers with low deposits, forcing them to use the government-backed Help to Buy programme before it is tapered next April with regional price caps.

Research published by analyst Defaqto showed that there just 28 deals are available to buyers with a 5pc or 10pc deposit, after banks have withdrew loans over fears customers could fall into negative equity. But with record low interest rates, some lenders are very keen to offer mortgages – as long as you have enough of a deposit.

This has triggered a big impact on the type of people buying. Analysis by Savills of industry data from trade body UK Finance suggests that existing homeowners and cash buyers are the ones moving, not first-time buyers or buy-to-let investors. This will only be amplified in coming months as job losses mount and lenders seek out the lowest-risk customers.

The dreams of a post-lockdown escape are meeting the reality of the mortgage market, and the pandemic has served to widen the divide between the haves and have nots.

The pain begins in autumn

Tax-payer funded furlough, mortgage holidays and a ban on evictions have so far masked the looming economic reality. But all three are due to be unwound in autumn, bringing varying degrees of disaster for the market.

Simon Rubinsohn, of the Royal Institution of Chartered Surveyors trade body, said: “The bigger risk next year...is rather than big price drops, activity flatlines.”

The real pain will instead be felt by renters and landlords. While the Government has urged banks to continue support for struggling homeowners when Covid mortgage holiday periods end and unemployment rises, tenants will face eviction if they rack up arrears and get no help paying their rent. Homeowners will be able to take advantage of low interest rates to remortgage, and stricter regulation since the financial crisis will save many from forced sales.

A fundamental shift?

The property market is currently detached from the economic reality. The new normal is this sense of uncertainty, an expectation that house prices will fall at some point this year or next, when the recession catches up once the stamp duty holiday ends and unemployment rises.

It also represents a new attitude for many buyers, in which the psychological effects of lockdown and the pandemic outweigh economic concerns. And it serves to further entrench the divide between those who can get finance – largely people who already have a stake in the market – and those who can’t.

Yahoo Finance

Yahoo Finance