UK house prices predicted to not rise in 2021

As the coronavirus crisis hammered almost every sector and plunged the UK economy into its deepest recession, the housing market, which came to a complete halt during the lockdown, managed to bloom after reopening in May, according to Hamptons International Housing Market Forecasts (HIHMF).

The latest data for September indicates that the property market has remained buoyant, with the average home selling for a record high of 99% of its initial asking price.

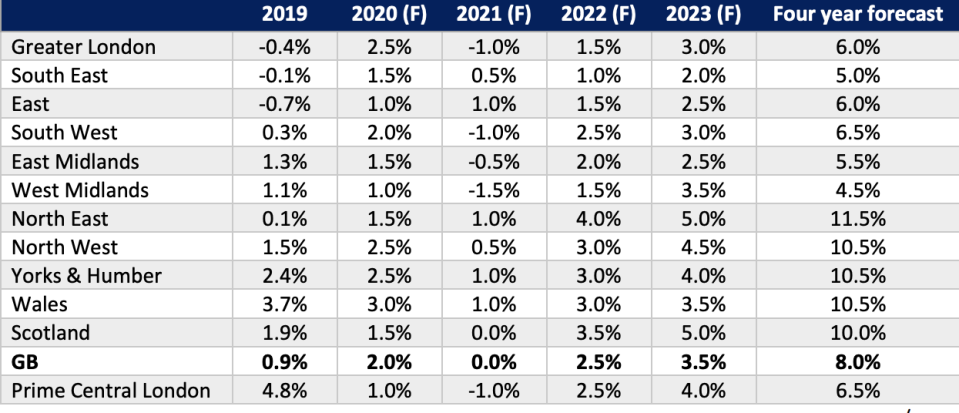

Hamptons expect house prices in the UK to rise 2.0% in 2020, up from 0.9% in 2019. It predicts a 3% rise in Wales followed by a 2.5% increase in London, home prices in Yorkshire and the Humber and the North West are also expected to rise by 2.5%, with the latter expected to see the strongest house price growth in 2020.

But, there is less optimism going into the new year as many economic deadlines, such as Britain’s departure from Europe on 31 December loom. COVID-19 fallout is also likely to disrupt the housing market’s upward trajectory.

Meanwhile, the research suggests that the second quarter of 2021 could see a fall in house prices, assuming that the stamp duty holiday ends in March.

It forecasts the UK housing market and economy to make some gains and stabilise by the end of 2021. With prices expected to remain flat if the availability of mortgage finance returns to near pre-COVID levels.

READ MORE: Coronavirus: 'Unprecedented' surge in property sales as English market reopens

The regions with the most job losses where affordability barriers are already tight will see a small price fall. The West Midlands — the area with the highest furlough take-up rate at the peak — is set to see a -1.5% fall in 2021 — the biggest price decline. London is expected to see a -1.0% falls, while the East Midlands could see a -0.5% drop. Meanwhile the remaining six regions will see prices rise between 0.0% and 1.0%.

For 2022 and 2023 Hamptons predicts the housing market to go back to its “longer-term growth path” with property prices expected to increase across all regions by 2.5% and 3.5% respectively. The rise is predicted to be in line with household incomes and is supported by low interest rates.

With the greatest price growth expected to come from areas where affordability barriers are not a big issue, Hamptons says these are “typically from the regions where prices have lagged behind.”

Prices in the North East are expected to rise by 4% in 2022, with those in Scotland by 3.5%.

Southern regions, where many people can’t afford to buy a home, will see the weakest price growth in 2022.

Over the four-year period, the West Midlands is expected to record the weakest house price growth, due to the impact of the coronavirus crisis on the local economy, with prices expected to rise 4.5%.

While it forecasts the North East to see the biggest price rises over the next four years (11.5%). London is expected to underperform the average growth rate in the UK, with prices forecast to rise 6% by 2023.

Meanwhile, sales will rise gradually, “surpassing the average of the last five-years by 2022,” after sales completions were halted following the advice from the government to only move home “if necessary.”

Data from HM Revenue and Customs showed that completions in April — the height of the COVID-19 pandemic — were down 57% year-on-year. While most buyers who agreed a sale before the lockdown continued with the purchase once the housing market reopened in May, transactions were still down 25% in the first six months of 2020 compared with the same period in 2019. However, July and August saw more sales agreed compared with the same period last year.

READ MORE: Government spends £12.2bn on up to 180,000 affordable homes in England.

Head of Research at Hamptons International, Aneisha Beveridge, said: “The housing market’s strong start to 2020 soon came to a halt with the rise of COVID-19. But after seven weeks of lockdown the market began to recover quickly.

“The market was buoyed by pent-up demand going back to 2016 as well as a rise in the number of households making lockdown-induced lifestyle changes, all topped off by a stamp duty holiday. We believe house prices are set to rise across Great Britain and will end 2020 having picked up from where they started at the beginning of the year.

“But the real challenges won’t be felt until 2021. The economic consequences from the COVID-19- induced recession will pull the housing market from its long-term growth trajectory. While some economic recovery should have taken place to cushion the withdrawal of government support, we still expect the housing market to slow next year.

“In line with a gradual economic recovery, we forecast house prices to rise again in 2022 and 2023. The housing market will fall back in line with its historical cycle, with northern regions expected to see the greatest price growth, further closing the gap with those in the south.”

READ MORE: Rishi Sunak admits unemployment will rise despite ‘radical’ job support scheme

Fear of more job losses is also mounting as the government’s furlough scheme is due to end in October, although chancellor Rishi Sunak unveiled a “job support scheme” starting from November as tougher coronavirus measures were introduced nationwide, earlier in the week.

The six-month “job support scheme” will see wage subsidies for workers in “viable” jobs, as long as they work and are paid as normal for at least a third of their usual hours. For hours not worked, workers face a pay cut of a third, with the government and employer covering another third each.

In June, Zoopla said there was an “unprecedented rebound” in sales in England’s property market since coronavirus lockdown rules were eased.

According to the property listing site, new sales in the UK in May were close to pre-lockdown levels in early March, prices were up 6% on June last year on average, while demand, a measure based on analysis of Zoopla site visits, was up 54% on the start of March.

The late summer sales, completed in the fourth quarter will be used to forecast house prices.

In the last couple of years, the UK housing market has been beset by Brexit as well as existing affordability barriers.

Yahoo Finance

Yahoo Finance