Pure Storage (PSTG) Q1 Earnings Beat, Revenues Fall Y/Y

Pure Storage PSTG reported non-GAAP earnings of 8 cents per share in first-quarter fiscal 2023, which beat the Zacks Consensus Estimate by 100%. The company reported non-GAAP earnings of 25 cents per share in the prior-year quarter.

Total revenues decreased 5% from the year-ago reported quarter to $589.3 million, which surpassed the Zacks Consensus Estimate by 5.1%. Global macroeconomic weakness and cautious IT spending remain concerns.

However, revenues increased 5% year over year after excluding the impact of $60 million in the first quarter of fiscal 2023 product revenues, which was expected for the second half of last year.

Pure Storage, Inc. Price, Consensus and EPS Surprise

Pure Storage, Inc. price-consensus-eps-surprise-chart | Pure Storage, Inc. Quote

Pure Storage rolled out FlashBlade//E, an unstructured data repository solution for large-capacity data stores. Customers can also deploy the new FlashBlade solution through a new service tier of Pure's Evergreen//One Storage as-a-Service subscription.

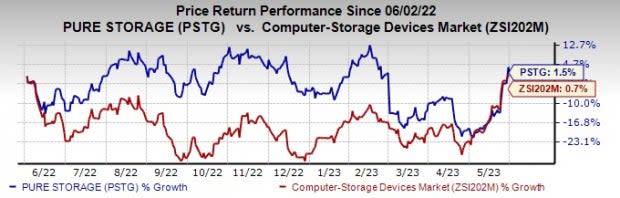

Following the announcement, shares are up 6.1% in the pre-market trading on Jun 1. The stock has gained 1.5% of its value in the past year compared with the sub-industry’s growth of 0.7%.

Image Source: Zacks Investment Research

Quarter in Detail

Product revenues (contributing 52.4% to total revenues) amounted to $308.9 million, down 23% on a year-over-year basis.

Subscription services revenues (47.6% of total revenues) of $280.3 million rose 27.9% on a year-over-year basis.

Subscription annual recurring revenues (ARR) amounted to more than $1.2 billion, up 29% on a year-over-year basis. Subscription ARR includes the annualized value of all active subscription contracts as of the last day of the quarter, along with annualized on-demand revenues.

Total revenues in the United States and International were $427 and $162 million, respectively.

PSTG added more than 276 customers in the reported quarter. The company’s customer base has more than 11,500 customers and represents 58% of Fortune 500 companies.

Margin Highlights

The non-GAAP gross margin expanded 160 basis points (bps) from the year-ago reported quarter to 72.2%.

The non-GAAP Product gross margin expanded 80 bps from the year-ago reported quarter to 70.8%. The non-GAAP Subscription gross margin was 73.7%, which expanded 220 bps on a year-over-year basis.

Non-GAAP operating expenses, as a percentage of total revenues, were 68.9% compared with 56.8% reported in the prior-year quarter.

Pure Storage reported a non-GAAP operating income of $19.6 million compared with $85.4 million reported in the year-ago quarter. The non-GAAP operating margin was 3.3% compared with 13.8% reported in the prior-year quarter.

Balance Sheet & Cash Flow

Pure Storage exited the fiscal year ended May 7, with cash and cash equivalents and marketable securities of $1.2 billion compared with $1.6 billion as of Feb 6.

Cash flow from operations amounted to $173.2 million in the fiscal first quarter compared with $220.1 million reported in the prior-year quarter. Free cash flow was $121.8 million compared with $187.3 million reported in the previous-year quarter.

In the fiscal first quarter, the company returned $70 million to shareholders by repurchasing 2.9 million shares. The company has $211 million left from its previously announced $250 million share-repurchase plan.

Deferred revenues increased 25.5% to $1.396 billion in the quarter under review.

The remaining performance obligations at the end of the fiscal fourth quarter totaled $1.8 billion, up 26% year over year. The metric represents total committed non-cancelable future revenues.

Guidance

The company has reiterated its revenue guidance for fiscal 2024. Amid current macroeconomic weakness, Pure Storage expects revenues to grow in the range of mid-to-high single digits on a year-over-year basis. The non-GAAP operating margin is expected to be 15%.

Pure Storage expects revenues to be $680 million for second-quarter fiscal 2024, representing a rise of 5% from the year-ago reported figure.

The non-GAAP operating income for the fiscal first quarter is expected to be $90 million. The non-GAAP operating margin is expected to be 13%.

Zacks Rank and Stocks to Consider

Pure Storage currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Dropbox DBX, Badger Meter BMI and Blackbaud BLKB. Dropbox and Badger Meter presently sport a Zacks Rank #1 (Strong Buy), whereas Blackbaud currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dropbox’s 2023 earnings has increased 10.1% in the past 60 days to $1.85 per share. The long-term earnings growth rate is anticipated to be 12.3%.

Dropbox’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.4%. Shares of DBX have gained 7.5% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 earnings has increased 4.7% in the past 60 days to $2.69 per share.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have surged 75% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 earnings has increased 9.3% in the past 60 days to $3.75 per share.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 10.4%. Shares of the company have jumped 13.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance