Q1 Earnings Highlights: Caterpillar (NYSE:CAT) Vs The Rest Of The Heavy Machinery Stocks

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the heavy machinery industry, including Caterpillar (NYSE:CAT) and its peers.

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new demand for heavy machinery and equipment companies. The gradual transition to clean energy also allows companies to innovate around emissions, potentially spurring replacement cycles that can accelerate revenue growth. On the other hand, heavy machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

The 16 heavy machinery stocks we track reported a decent Q1; on average, revenues were in line with analyst consensus estimates. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and heavy machinery stocks have had a rough stretch, with share prices down 6.3% on average since the previous earnings results.

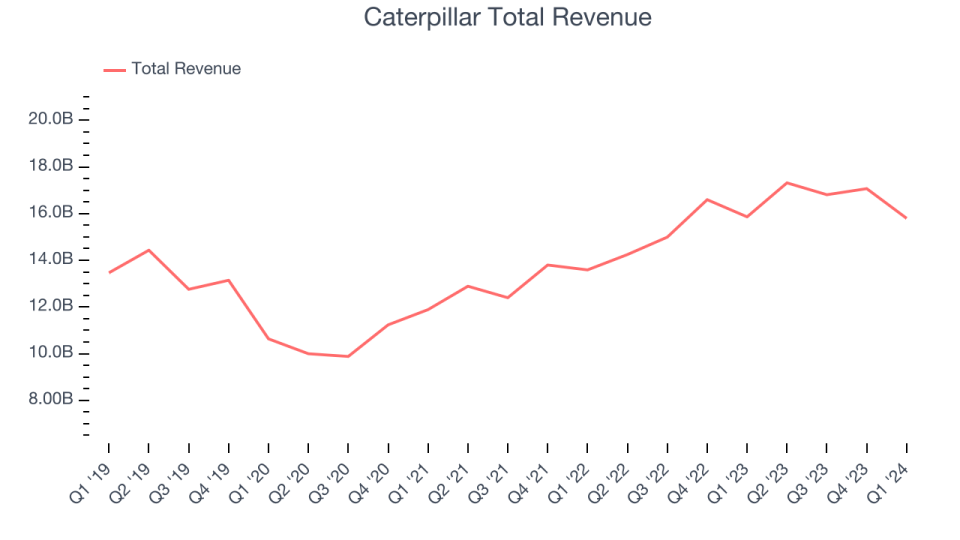

Caterpillar (NYSE:CAT)

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE:CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

Caterpillar reported revenues of $15.8 billion, flat year on year, falling short of analysts' expectations by 1.2%. It was a slower quarter for the company with a miss of analysts' organic revenue estimates.

"I'm pleased with our team's performance that resulted in higher adjusted operating profit margin, record adjusted profit per share and strong ME&T free cash flow. Our strong balance sheet and ME&T free cash flow allowed us to deploy a record $5.1 billion of cash for share repurchases and dividends in the first quarter," said Chairman and CEO Jim Umpleby.

The stock is down 10.2% since reporting and currently trades at $326.65.

Is now the time to buy Caterpillar? Access our full analysis of the earnings results here, it's free.

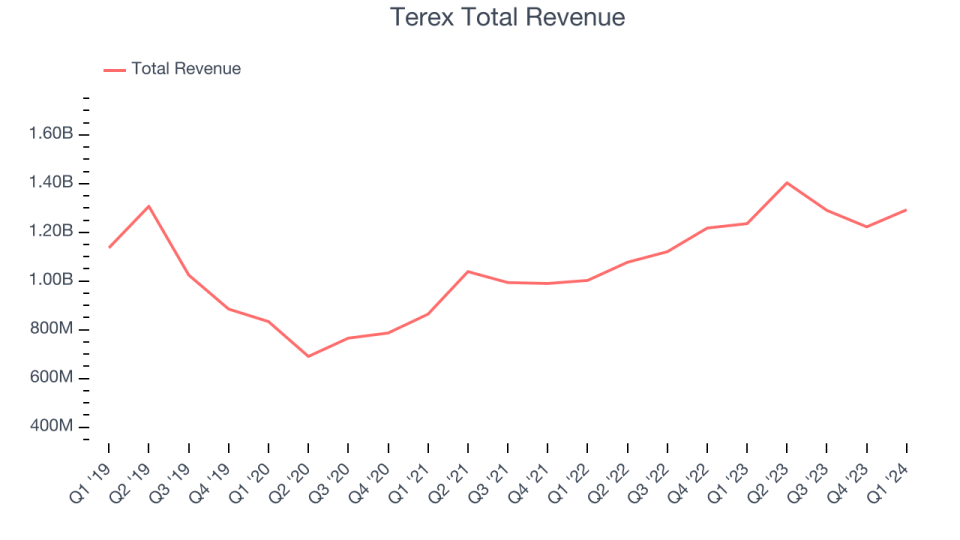

Best Q1: Terex (NYSE:TEX)

With humble beginnings as a dump truck company, Terex (NYSE:TEX) today manufactures lifting and material handling equipment designed to move and hoist heavy goods and materials.

Terex reported revenues of $1.29 billion, up 4.6% year on year, outperforming analysts' expectations by 5%. It was a stunning quarter for the company with an impressive beat of analysts' organic revenue estimates and a solid beat of analysts' earnings estimates.

Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 11.1% since reporting. It currently trades at $53.19.

Is now the time to buy Terex? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Wabash (NYSE:WNC)

Headquartered in Indiana, Wabash National (NYSE:WNC) is a diversified industrial company, mainly producing semi-trailers and liquid transportation systems.

Wabash reported revenues of $515.3 million, down 17% year on year, in line with analysts' expectations. It was a weak quarter for the company with a miss of analysts' earnings and backlog sales estimates.

As expected, the stock is down 17.8% since the results and currently trades at $21.16.

Read our full analysis of Wabash's results here.

Cummins (NYSE:CMI)

Having produced the first commercially available diesel engine in 1933, Cummins (NYSE:CMI) designs and manufactures engines used in cars, trucks, heavy machinery, and other types of vehicles.

Cummins reported revenues of $8.40 billion, flat year on year, in line with analysts' expectations. Looking more broadly, it was a weaker quarter for the company with a miss of analysts' Engine revenue estimates.

The stock is down 5% since reporting and currently trades at $269.5.

Read our full, actionable report on Cummins here, it's free.

Greenbrier (NYSE:GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE:GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $820.2 million, down 21% year on year, falling short of analysts' expectations by 10.9%. Looking more broadly, it was a slower quarter for the company with a miss of analysts' earnings estimates and full-year revenue guidance missing analysts' expectations.

Greenbrier had the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update among its peers. The stock is down 9.4% since reporting and currently trades at $44.

Read our full, actionable report on Greenbrier here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance