Q1 Earnings Outperformers: Warner Music Group (NASDAQ:WMG) And The Rest Of The Media Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the media stocks, including Warner Music Group (NASDAQ:WMG) and its peers.

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

The 9 media stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 0.8%. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the media stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.8% on average since the previous earnings results.

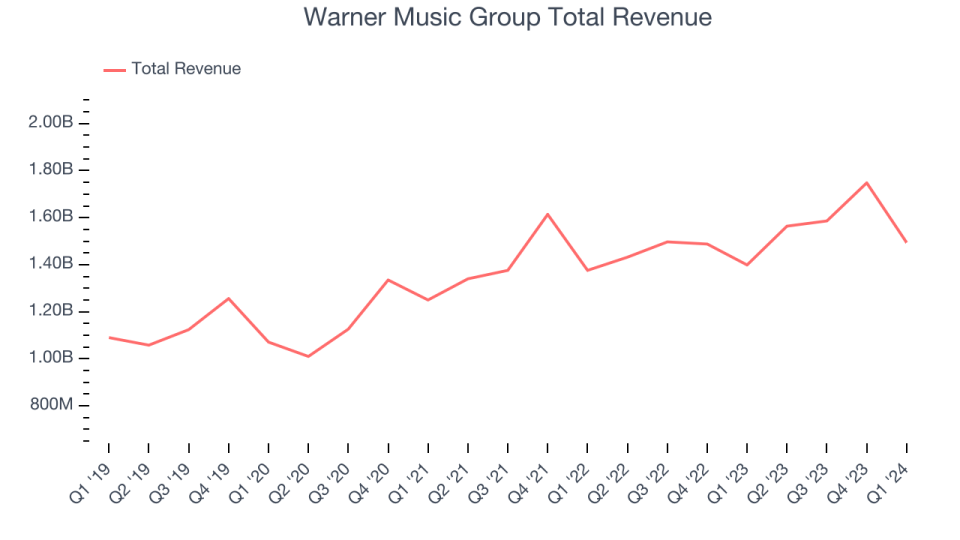

Warner Music Group (NASDAQ:WMG)

Launching the careers of legendary artists like Frank Sinatra, Warner Music Group (NASDAQ:WMG) is a music company managing a diverse portfolio of artists, recordings, and music publishing services worldwide.

Warner Music Group reported revenues of $1.49 billion, up 6.8% year on year, in line with analysts' expectations. It was a weak quarter for the company: Warner Music Group narrowly beat analysts' revenue and EPS expectations this quarter, driven by outperformance in its Music Publishing segment. On the other hand, its operating margin missed and it burned cash-Wall Street was anticipating positive free cash flow.

The stock is down 14.2% since the results and currently trades at $30.61.

Read our full report on Warner Music Group here, it's free.

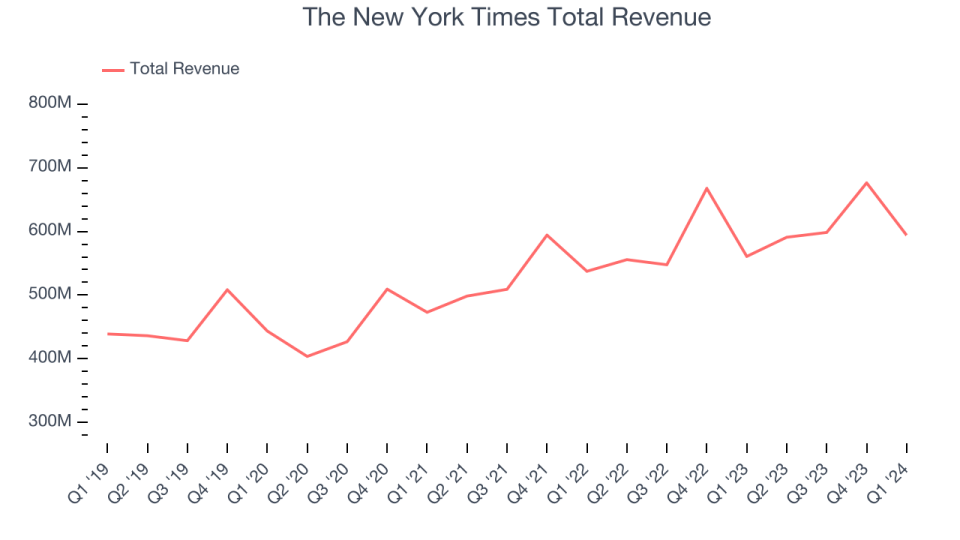

Best Q1: The New York Times (NYSE:NYT)

Founded in 1851, The New York Times (NYSE:NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

The New York Times reported revenues of $594 million, up 5.9% year on year, in line with analysts' expectations. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 11.2% since the results and currently trades at $51.44.

Is now the time to buy The New York Times? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Warner Bros. Discovery (NASDAQ:WBD)

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ:WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Warner Bros. Discovery reported revenues of $9.96 billion, down 6.9% year on year, falling short of analysts' expectations by 2.6%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Warner Bros. Discovery had the weakest performance against analyst estimates in the group. The stock is down 8.5% since the results and currently trades at $7.12.

Read our full analysis of Warner Bros. Discovery's results here.

News Corp (NASDAQ:NWSA)

Established in 2013 after a restructuring, News Corp (NASDAQ:NWSA) is a multinational conglomerate known for its news publishing, broadcasting, digital media, and book publishing.

News Corp reported revenues of $2.42 billion, down 1% year on year, falling short of analysts' expectations by 1%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 14.5% since the results and currently trades at $27.63.

Read our full, actionable report on News Corp here, it's free.

Endeavor (NYSE:EDR)

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE:EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Endeavor reported revenues of $1.85 billion, up 15.9% year on year, falling short of analysts' expectations by 1.1%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

The stock is up 1.2% since the results and currently trades at $26.81.

Read our full, actionable report on Endeavor here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance