Q1 Earnings Roundup: ABM Industries (NYSE:ABM) And The Rest Of The Environmental and Facilities Services Segment

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at ABM Industries (NYSE:ABM) and the best and worst performers in the environmental and facilities services industry.

Many environmental and facility services are non-discretionary (sports stadiums need to be cleaned after events), recurring, and performed through longer-term contracts. This makes for more predictable and stickier revenue streams. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. Despite these tailwinds, environmental and facility services companies are still at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these services.

The 8 environmental and facilities services stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 0.6%. while next quarter's revenue guidance was 0.6% above consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but environmental and facilities services stocks have shown resilience, with share prices up 8.8% on average since the previous earnings results.

ABM Industries (NYSE:ABM)

Operating through its subsidiaries, ABM Industries (NYSE:ABM) provides janitorial, electrical, HVAC (heating, ventilation, air conditioning), and landscaping services.

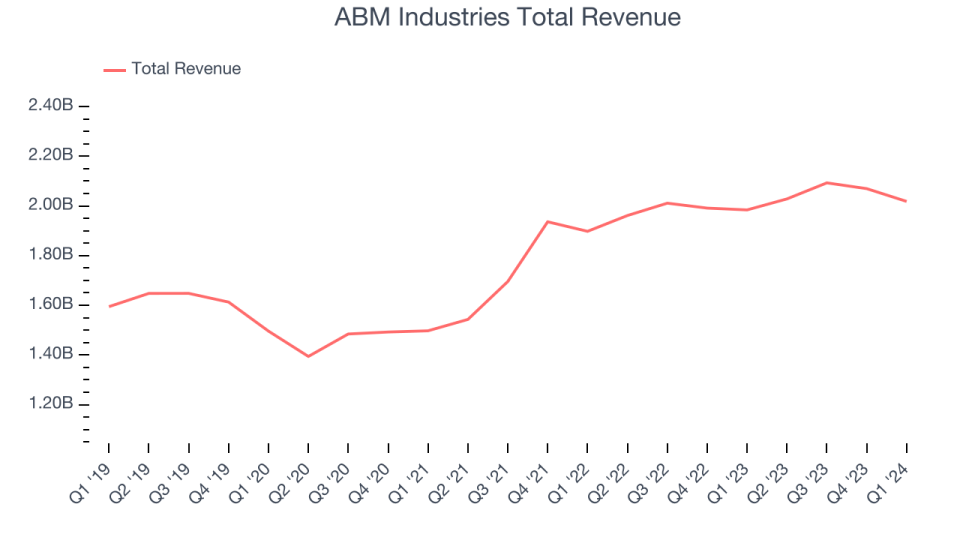

ABM Industries reported revenues of $2.02 billion, up 1.7% year on year, in line with analysts' expectations. It was a mixed quarter for the company, with a solid beat of analysts' organic revenue estimates but a miss of analysts' operating margin estimates.

“We are pleased with our second quarter results, which were driven by our team’s outstanding execution and highlighted by strong cash flow, as well as mid-single digit organic revenue growth in our Aviation, Technical Solutions, Manufacturing & Distribution and Education segments. Additionally, our Business & Industry segment again displayed its resiliency, benefiting from a diverse client and service mix, including a focus on higher performing Class A properties” said Scott Salmirs, President & Chief Executive Officer.

The stock is up 5.9% since the results and currently trades at $50.57.

Is now the time to buy ABM Industries? Access our full analysis of the earnings results here, it's free.

Best Q1: Clean Harbors (NYSE:CLH)

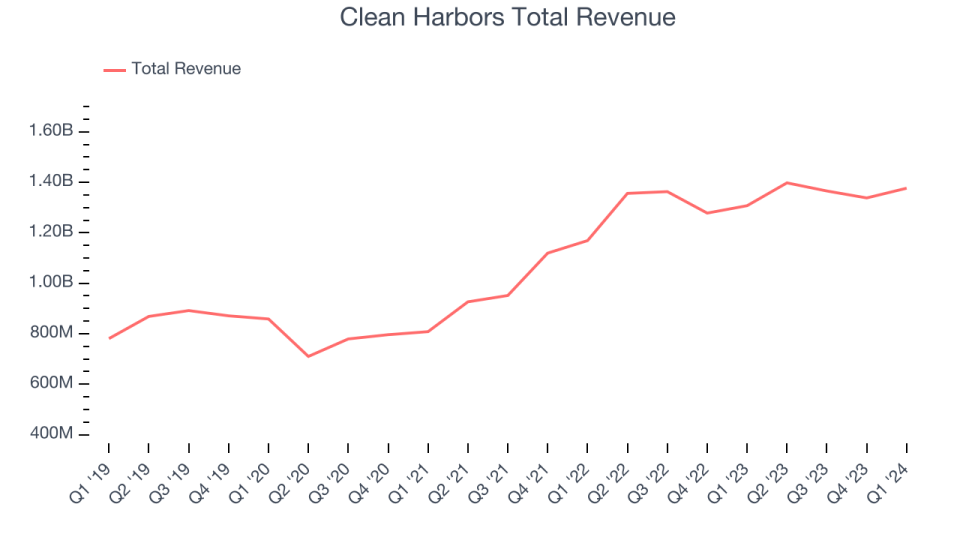

Having played a role in the cleanup of many historical oil spills, Clean Harbors (NYSE:CLH) provides environmental services like hazardous and non-hazardous waste disposal.

Clean Harbors reported revenues of $1.38 billion, up 5.3% year on year, outperforming analysts' expectations by 3%. It was a very strong quarter for the company, with an impressive beat of analysts' operating margin estimates and a solid beat of analysts' organic revenue estimates.

Clean Harbors pulled off the biggest analyst estimates beat among its peers. The stock is up 19.3% since the results and currently trades at $226.15.

Is now the time to buy Clean Harbors? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Stericycle (NASDAQ:SRCL)

Having completed 500 acquisitions since its inception, Stericycle (NASDAQ:SRCL) provides waste disposal and sensitive information destruction services.

Stericycle reported revenues of $664.9 million, down 2.8% year on year, falling short of analysts' expectations by 1.7%. It was a weak quarter for the company, with a miss of analysts' operating margin and organic revenue estimates.

Stericycle had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is up 16.5% since the results and currently trades at $58.1.

Read our full analysis of Stericycle's results here.

Republic Services (NYSE:RSG)

Using a purely natural gas-power truck fleet, Republic Services (NYSE:RSG) provides waste collection and related services across the United States and Canada.

Republic Services reported revenues of $3.86 billion, up 7.8% year on year, falling short of analysts' expectations by 0.7%. It was a mixed quarter for the company, with a miss of analysts' volume estimates.

The stock is up 1.8% since the results and currently trades at $195.22.

Read our full, actionable report on Republic Services here, it's free.

Casella Waste Systems (NASDAQ:CWST)

Started with a single garbage truck back in 1975, Casella Waste (NASDAQ:CWST) is a waste services company that provides waste collection, disposal, and recycling.

Casella Waste Systems reported revenues of $341 million, up 29.9% year on year, in line with analysts' expectations. It was a weak quarter for the company, with a miss of analysts' operating margin and earnings estimates.

Casella Waste Systems achieved the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 5.4% since the results and currently trades at $99.22.

Read our full, actionable report on Casella Waste Systems here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance