Q2 Rundown: Owens Corning (NYSE:OC) Vs Other Home Construction Materials Stocks

As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the home construction materials industry, including Owens Corning (NYSE:OC) and its peers.

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 12 home construction materials stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was 22.9% below.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Thankfully, home construction materials stocks have been resilient with share prices up 7.1% on average since the latest earnings results.

Owens Corning (NYSE:OC)

Credited with the discovery of fiberglass, Owens Corning (NYSE:OC) supplies building and construction materials to the United States and international markets.

Owens Corning reported revenues of $2.79 billion, up 8.8% year on year. This print fell short of analysts’ expectations by 4.6%. Overall, it was a slower quarter for the company with a miss of analysts’ organic revenue estimates.

“Owens Corning delivered another outstanding quarter, generating strong margins and cash flow while completing the acquisition of Masonite and continuing our review of glass reinforcements,” said Chair and Chief Executive Officer Brian Chambers.

Owens Corning achieved the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 6% since reporting and currently trades at $174.35.

Is now the time to buy Owens Corning? Access our full analysis of the earnings results here, it’s free.

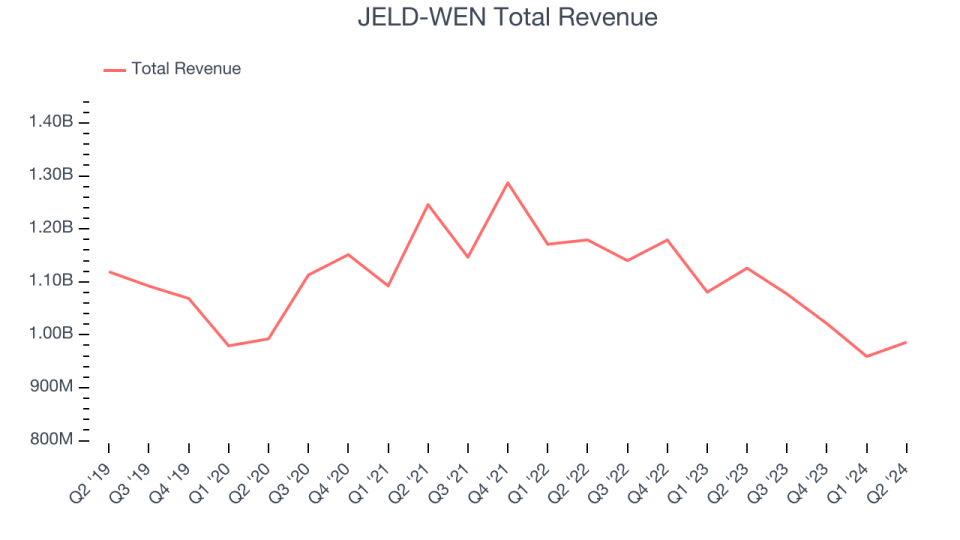

Best Q2: JELD-WEN (NYSE:JELD)

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE:JELD) manufactures doors, windows, and other related building products.

JELD-WEN reported revenues of $986 million, down 12.4% year on year, falling short of analysts’ expectations by 1.4%. However, the business still had a very strong quarter with an impressive beat of analysts’ organic revenue and earnings estimates.

The market seems happy with the results as the stock is up 8.8% since reporting. It currently trades at $15.97.

Is now the time to buy JELD-WEN? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Gibraltar (NASDAQ:ROCK)

Gibraltar (NASDAQ:ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Gibraltar reported revenues of $353 million, down 3.3% year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates and full-year revenue guidance missing analysts’ expectations.

As expected, the stock is down 11.6% since the results and currently trades at $70.89.

Read our full analysis of Gibraltar’s results here.

Simpson (NYSE:SSD)

Aiming to build safer and stronger buildings, Simpson (NYSE:SSD) designs and manufactures structural connectors, anchors, and other construction products.

Simpson reported revenues of $597 million, flat year on year. This result missed analysts’ expectations by 1.3%. Overall, it was a disappointing quarter as it also recorded a miss of analysts’ earnings estimates.

The stock is up 6.2% since reporting and currently trades at $192.09.

Read our full, actionable report on Simpson here, it’s free.

Quanex (NYSE:NX)

Starting in the seamless tube industry, Quanex (NYSE:NX) manufactures building products like window, door, kitchen, and bath cabinet components.

Quanex reported revenues of $280.3 million, down 6.4% year on year. This number met analysts’ expectations. Overall, it was a strong quarter as it also produced a solid beat of analysts’ Cabinet Components revenue estimates and a decent beat of analysts’ operating margin estimates.

Quanex delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 13% since reporting and currently trades at $28.09.

Read our full, actionable report on Quanex here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.