Quectel Wireless Solutions Leads Three Growth Stocks With High Insider Ownership On The Chinese Exchange

Amidst a backdrop of deflationary pressures and cautious consumer sentiment in China, investors may find unique opportunities in growth companies with high insider ownership. These firms often demonstrate a commitment to long-term value creation, which can be particularly appealing in the current economic environment.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's dive into some prime choices out of from the screener.

Quectel Wireless Solutions

Simply Wall St Growth Rating: ★★★★★☆

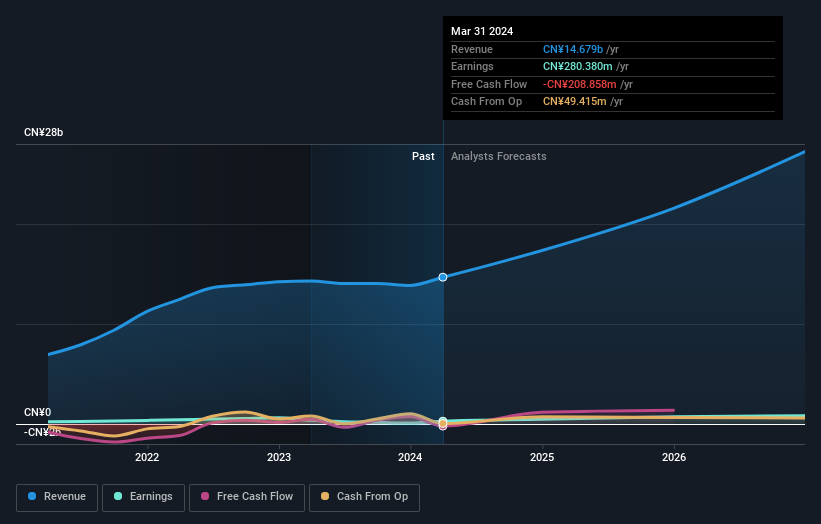

Overview: Quectel Wireless Solutions Co., Ltd. is a global company specializing in the design, development, and sale of wireless communication modules and solutions, with a market capitalization of approximately CN¥12.85 billion.

Operations: The company generates its revenue from the design, development, and sale of wireless communication modules and solutions globally.

Insider Ownership: 24.4%

Quectel Wireless Solutions, a Chinese growth company with high insider ownership, is trading at 45.7% below its estimated fair value while demonstrating robust financial performance. Its revenue and earnings are forecasted to grow faster than the market, with a significant annual earnings increase of 39.1% expected over the next three years compared to the market's 22.7%. However, it faces challenges such as low forecasted return on equity and large one-off items impacting results. Recent activities include substantial product announcements and participation in global IT shows, highlighting its active role in expanding IoT solutions internationally.

COL GroupLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: COL Group Co., Ltd. operates in the digital publishing sector in China, with a market capitalization of approximately CN¥15.10 billion.

Operations: The company generates its revenue primarily from the digital publishing sector in China.

Insider Ownership: 13.2%

COL Group Ltd., a growth company in China with high insider ownership, recently reported a significant decline in quarterly revenue and an increased net loss, contrasting with a profitable previous year. Despite this downturn, the company's annual earnings are expected to grow by 39.8% per year, outpacing the Chinese market forecast of 22.7%. However, its return on equity is projected to remain low at 14%, and revenue growth is anticipated to be slower than the industry average.

Eoptolink Technology

Simply Wall St Growth Rating: ★★★★★★

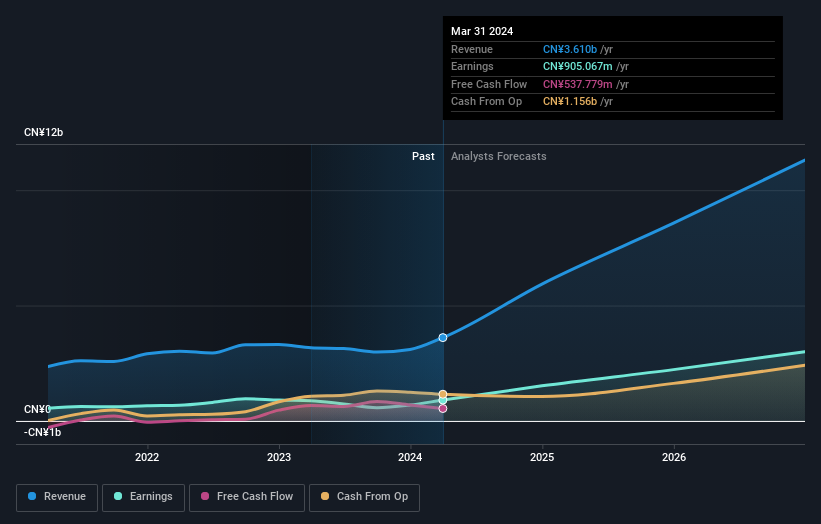

Overview: Eoptolink Technology Inc., Ltd. specializes in the research, development, manufacturing, and sale of optical transceivers both domestically and internationally, with a market capitalization of approximately CN¥77.03 billion.

Operations: The company generates CN¥3.61 billion primarily through the sale of optical communication equipment.

Insider Ownership: 26.7%

Eoptolink Technology, a Chinese firm with substantial insider ownership, has demonstrated robust growth potential. Recently, the company reported a significant increase in quarterly revenue and net income, highlighting strong financial performance. Analysts project Eoptolink's earnings to grow by 39.42% annually and its revenue by 37.7% per year, both metrics outpacing broader market expectations. Despite a volatile share price recently, these growth indicators suggest solid future prospects underpinned by recent product launches in advanced optical technologies.

Key Takeaways

Navigate through the entire inventory of 377 Fast Growing Chinese Companies With High Insider Ownership here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603236 SZSE:300502 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance