Questor: This defence company could keep leading the charge beyond its 100pc return so far

It is always tempting to sell a holding that has risen sharply in value.

For instance, shares in defence contractor QinetiQ have soared by 100pc since Questor first advised readers to purchase them in September 2017.

In doing so, it has outperformed the FTSE 100 index by 89 percentage points and beaten the FTSE 250 index by 93 percentage points.

This year alone, the company’s share price has surged 45pc higher.

However, it continues to offer a potent mixture of long-term growth potential, solid fundamentals and a wide “margin of safety”.

Therefore, selling now would be a rather illogical move that is likely to mean missing out on further capital gains.

Indeed, the company’s recently released full-year results showed that it is making encouraging progress in implementing its growth strategy.

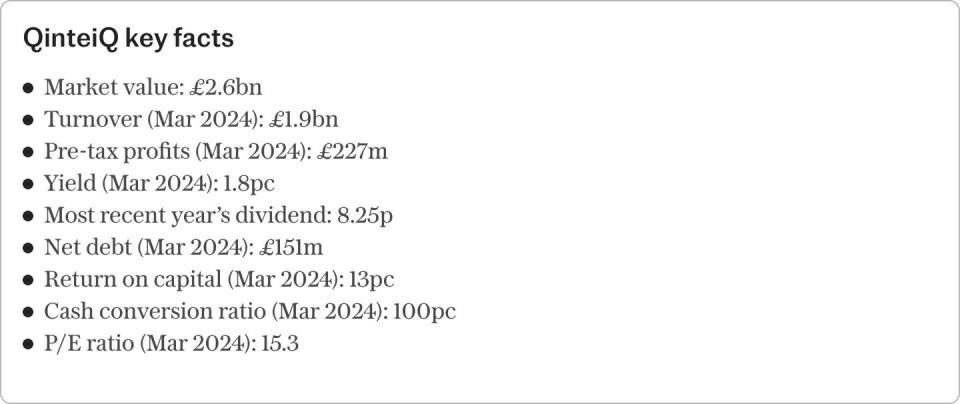

Revenue rose by 21pc, with it increasing by 14pc on an organic basis. And with a stable operating profit margin of 11.3pc, the company’s operating profits were up 20pc versus the prior year. Its order intake of £1.74bn, meanwhile, was a new record.

Alongside improved financial performance, the firm upgraded its financial guidance.

It expects to generate high single-digit organic revenue growth and to maintain operating profit margins at their present level in the current financial year to March 2025.

It also expects to post organic revenue of £2.4bn in the 2027 financial year, which would represent a 26pc increase on its latest year and amount to an annualised growth rate of around 7.9pc.

In addition, it forecasts that operating profit margins will rise by 0.7 percentage points to 12pc over the next three years.

The company’s solid financial position means it has the capacity to bolster its organic growth prospects via acquisitions.

The integration of cyber security specialist Avantus is now complete, with QinetiQ’s net gearing ratio of just 16pc and net interest cover in excess of 15 highlighting its ability to increase leverage to make further purchases.

And with return on equity amounting to 18pc last year despite the presence of very modest debt levels, the company has a clear competitive advantage that bodes well for its future performance.

Of course, the prospects for the wider defence industry have dramatically improved over recent years. Geopolitical risks have risen to a level not seen for many years, or even decades, which suggests that demand for the firm’s products and services is likely to increase.

Indeed, defence spending among Nato members is rising.

Among its European members, military spending is expected to reach 2pc of their collective GDP this year. This is up from a figure of less than 1.5pc a decade ago.

And with the prospect of a new US administration that adopts a tougher stance on spending levels among Nato members, as well as an improving global economic outlook amid falling inflation and interest rate cuts, the outlook for the wider sector is increasingly upbeat.

Separately, QinetiQ’s share price continues to offer a margin of safety. Despite its vast outperformance of the FTSE 100 and FTSE 250 indices, the company trades on a rather modest price-to-earnings ratio of 15.3.

This suggests there is scope for an upward rerating to complement a likely rise in profits over the coming years.

In Questor’s view, investors are only gradually realising that the fundamentals of the defence sector have materially changed and that it now offers substantial growth potential over the long run.

A modest market valuation means that the company’s £100m share buyback programme is highly logical.

And while a dividend yield of 1.8pc is likely to be too low to pique the interest of income investors, dividend cover of 3.6 last year and an improving outlook for profitability suggest it could become a worthwhile dividend stock.

QinetiQ’s central appeal, though, is its capital growth potential. The firm benefits from solid fundamentals and a buoyant industry outlook, while its market valuation indicates that investors have not yet fully priced in its long-term prospects.

So, while some investors may naturally be tempted to sell after such large gains, it is far more logical to keep buying the company’s shares.

This column expects further capital gains, as well as index outperformance, as rising defence spending leads to improved financial performance and greater growth opportunities over the coming years.

Questor says: buy

Ticker: QQ

Share price at close: 451.2

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm.

Read Questor’s rules of investment before you follow our tips.

Yahoo Finance

Yahoo Finance