Questor: enthusiasm for this American soft drink giant is showing no sign of going flat

As an investment, you could say it’s the “real thing”. Coca-Cola may not be your drink of choice, but for those on the lookout for quality and value over the longer term, the shares of the American consumer giant have a good deal to commend them.

In spite of regular predictions it would go out of fashion, Coca-Cola has for decades ranked high among the world’s most valuable brands. Last year, it was ranked in sixth place, for example, according to Forbes, behind Apple and Google but ahead of Disney, Louis Vuitton and McDonald’s.

Having successfully seen off the threat posed by arch-rival Pepsi during the 1970s – when the “real thing” slogan featured heavily in its campaigns – Coke has more recently survived the onslaught of flavoured waters and other healthier soft drink options.

Meanwhile, the group has substantially added to its portfolio, buying, among others, the maker of Innocent smoothies and juices, “smartwater” producer Glacéau and, probably most memorably for this column’s readers, it bought Costa Coffee from Whitbread almost six years ago for a cool £3.9bn.

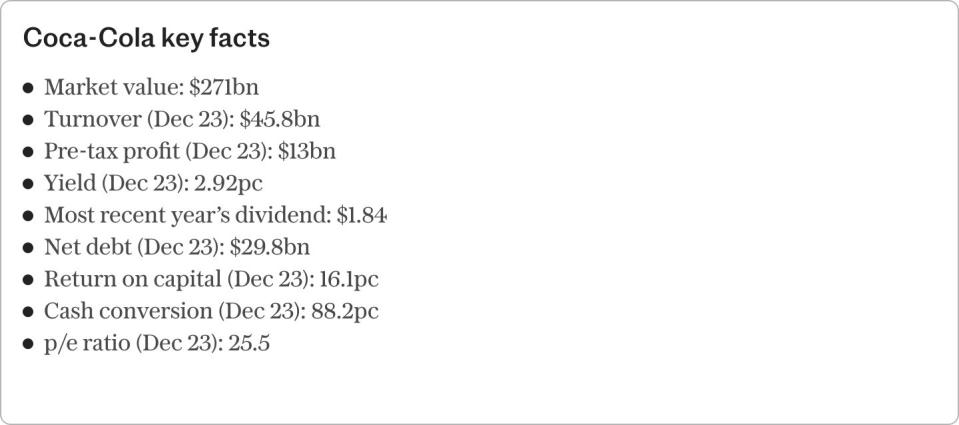

Financially, over the past five years, group wide sales have grown by 34pc to $45.8bn (£35.8bn) while underlying earnings before interest and taxes (Ebit) are up 36pc to $13.3bn last year. While rampant inflation has played its part in the growth, sales volumes have also been on the rise. This underscores not just Coke’s continued popularity, but also the group’s pricing power.

Analysts see little sign of the business losing momentum. They have pencilled in Ebit of more than $15.8bn in 2026 – equivalent to annualised growth of 6pc – on forecast sales of more than $51.0bn and a profit margin of 31pc.

It could be argued that Coca-Cola’s US-listed shares have lagged the group’s wider progress. Despite the upbeat growth forecast, the valuation of 22 times forecast next 12-month earnings is below the average valuation for the period of 24 times. A 3.1pc dividend yield is also expected.

British owners of the shares, which are listed on the New York Stock Exchange and available through most UK brokers, should be aware that they need to fill in appropriate documentation to minimise their liability for withholding tax on US dividend payments.

Coca-Cola’s strengths have not been lost on the world’s best-performing portfolio managers, some 15 of whom hold them. These investors are all among the top 3pc of more than 10,000 equity fund managers monitored by financial publisher Citywire.

It has led to Coca-Cola being awarded a top AAA Elite Companies rating by Citywire, which rates businesses based on “smart money” ownership.

Qualities including a long-and-strong track record, a robust balance sheet and attractive valuation have encouraged one of these top investors, Tom Hancock, all make the stock a top-10 position in his $9.5bn GMO Quality Investment Fund.

“It’s stood the test of time and, generally, our demeanour is to be respectful of companies that have a very long track record,” Hancock said. “People’s loyalty to Coke is so high that it’s become a classic beverage; we think it’s unlikely there’d be any massive switching to a competitor.”

There are always going to be challenger brands, but the group has taken intelligent steps to diversify into areas such as coffee, water and energy drinks. The group’s regular product variations, backed up by a fearsome marketing budget and presence on social media, ensure it remains in the public eye.

Although it is technically a defensive consumer staple, there is also plenty of growth potential in Coca-Cola’s business lines – it is forecasting, for example, compound annual growth of 5pc to 6pc in the coffee market between now and 2027.

And as well as the array of drinks it makes, it has several hundred partnership deals, including with the FTSE 100 bottling company Coca-Cola HBC, and has taken steps to target the premium end of the market.

Net debts are comfortable at below twice earnings before interest, tax, depreciation and amortisation (Ebitba), particularly given the company generates a huge amount of free cash flow. This column agrees with the top managers backing Coca-Cola’s shares. For long-term investors it is the “real thing” and the current price offers an attractive entry point.

Questor says: buy

Ticker: NYSE:KO

Share price: $62.55

Miles Costello is a contributing journalist for Citywire Elite Companies.

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm.

Read Questor’s rules of investment before you follow our tips.

Yahoo Finance

Yahoo Finance