Questor: This Hargreaves Lansdown bidder’s loan fund is a ‘buy’ for income seekers

Fund manager CVC Capital Partners has hit the headlines as the head of a consortium looking to buy broker Hargreaves Lansdown for £5.8bn, and for the firm’s stock market flotation in April that raised over €2bn (£1.7bn).

Away from the media spotlight, however, the Luxembourg-based investment group is already known to income seekers for running the best-performing London-listed loan and bonds fund.

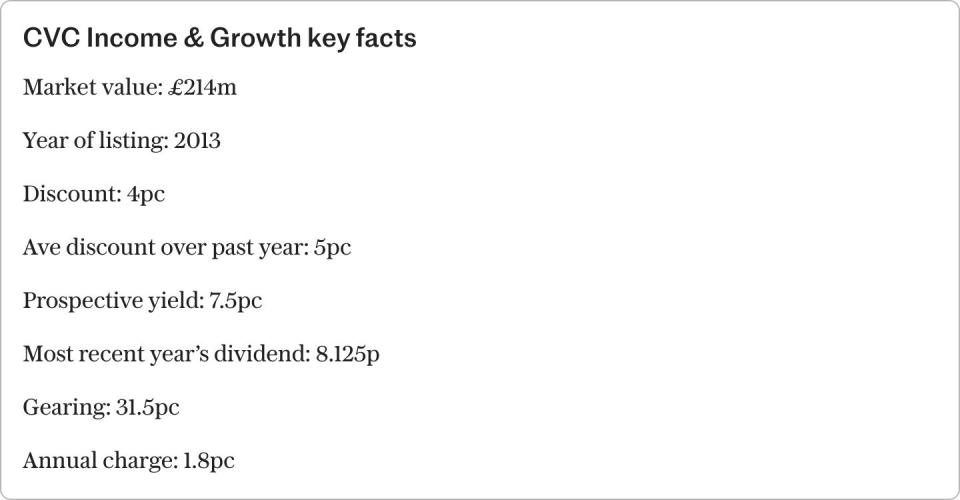

Launched in 2013, CVC Income and Growth has in the past five years generated a 43.4pc total return to holders of its sterling shares. This puts it ahead of six other rivals that, including CVC, have returned an average of just 19.7pc.

Similarly, over 10 years, the £214m Jersey-based investment company has produced a sector-leading 84.9pc total return. Most of this has come through quarterly dividends that, covered by income and gains from loans to credit-impaired companies, support a 7.5pc yield.

The company is a “feeder” fund investing in the CVC European Credit Opportunities fund in Luxembourg that in turn buys the high-yielding, floating rate debt of large non-investment grade corporate borrowers in the UK, US and Europe.

The portfolio is evenly split between “performing credit” where companies are meeting their loan repayments as they repair their ratings, and “credit opportunities” where fund managers Pieter Staelens and Mitchell Glynn see the ability to buy undervalued debt ahead of a refinancing, rating upgrade or acquisition.

All this could sound risky as more companies struggle with a surge in borrowing costs in the past two years. But fund managers explain that businesses with poor credit ratings are not necessarily bad ones but may be correcting a misstep or suffering a downturn in their markets.

If chosen wisely, the managers say debts like these can offer greater returns for not much more risk to capital than conventional bonds from companies on better credit ratings.

Although more companies are falling behind on loan repayments, default levels are well below the 2-3pc average of the past 18 years with the fund restricting its problem loans to just 0.9pc a year since launch.

About three-quarters of its 128 loans are senior, meaning the fund is at the front of the queue of creditors in the event of a collapse. They are also secured on a company’s assets in the way a mortgage is backed by the equity in a person’s home. Even when things do go wrong, the fund can protect its position and rarely loses money.

The floating rate nature of 83pc of the loans is important too. CVC’s borrowers pay a margin, or “spread” on their loans over base rate, the size of which varies depending on their credit rating and the risk they might skip repayments. Annual results in March showed average spreads of 5pc in Europe below a 6.6pc peak a year earlier but in line with their 10-year average.

Rates on floating loans are reset every three months which means if there is a change in the cost of borrowing, it is quickly reflected in the amount of interest they charge.

In the past three years money gushed into the fund as European interest rates jumped from 0.5pc to a 4.5pc peak last September and as spreads remained high. In response the company hiked the dividends it pays each year from 4.5p to 8.25p per share, or 2.06p a quarter, with top-up dividends of 1p and 2.25p in the past two years.

Last year bond markets stabilised after a rocky 2022 when the fund did very well to lose nearly 6pc. In 2023 CVC had its best-ever year making a total underlying return of 22.8pc. Trading below net asset value, the sterling shares didn’t deliver all this gain, however, returning 18pc. The euro shares, which the fund also has for European investors, rose 22pc.

This year the shares have rallied 16pc but have taken a breather after the European Central Bank cut rates by 0.25pc this month, and after the company issued its first new shares for four years in April and May. At 110p the shares have slipped to a 4pc discount to their estimated net asset value of 114.7p on June 14.

While cautious, Staelens said the ECB move was “hawkish” as the central bank raised expectations for eurozone inflation. “So, nothing really changed to my views that rate cuts will be small and gradual, rather than large and fast,” he said.

With the fund currently generating 14pc from its loans and unlikely to face a rapid series of rate cuts that would slash this high level of income, the shares continue to offer good value for income investors. The shares trade on a small discount with the risk of this widening much more reduced by the company offering two opportunities a year to sell the stock at 1pc below asset value.

Questor says: buy CVC Income & Growth

Ticker: CVCG

Share price at close: 110p

Gavin Lumsden is editor of Citywire’s Investment Trust Insider website https://citywire.com/investment-trust-insider

Yahoo Finance

Yahoo Finance