Questor: This stock tip has been a shocker – but there’s hope yet

As stock ideas go, Smith & Nephew has been a shocker. The thesis that a recovery in surgical interventions in a post-pandemic world would benefit the specialist provider of orthopaedic implants, sports medicine and advanced wound management products has not played out.

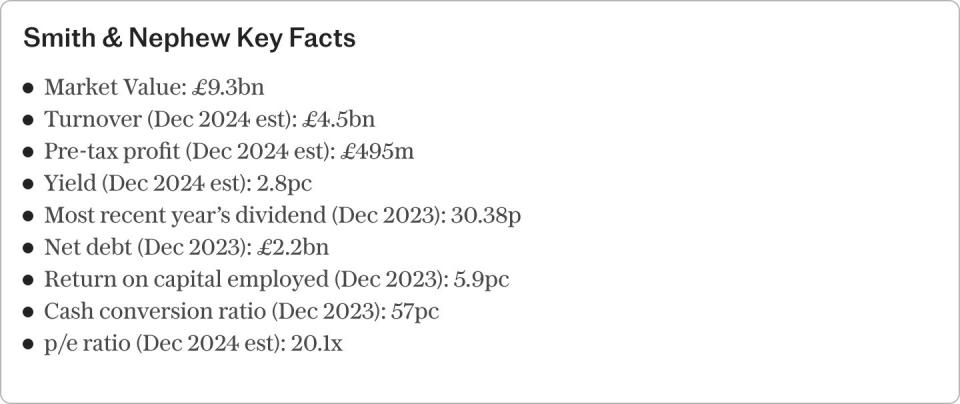

Nor have profit margins and return on capital improved, despite efficiency programmes and an easing of the supply chain pressures that resulted from lockdowns. As result, we are sat on a 25pc book loss, only partly mitigated by just over 100p a share in dividends but if there is any good news here it is: we are not the only ones whose patience is wearing thin.

The Swedish activist investor Cevian is now on the shareholder register and the share price is responding, in anticipation of some form of action or other, so this may be the final roll of the dice so far as the FTSE 100 member and the Questor portfolio are concerned.

Chief executive officer Deepak Nath outlined a 12-point plan in autumn 2022, with the ultimate goal that the cost and efficiency benefits would drive the underlying profit margin to 20pc by 2025. This year’s first-quarter results (1 May) at least featured no nasty surprises as Mr Nath reasserted guidance for 2024 of underlying sales growth of between 5pc and 6pc and an underlying margin of 18pc, an improvement on 2023’s 17.5pc (which itself represented a modest advance from 2022’s 17.3pc).

However, even that 18pc figure means there is still work to be done. Ongoing weakness in the US hip and knee implant business, plus a year-on-year drop in sales at the advanced wound management business, meant the update did not inspire much market confidence, judging by how the share price continued to ebb to a mark nearly 40pc below that of five years ago.

Enter Cevian. Activists have a fairly classic – indeed even predictable – playbook, and any chief executive who has not sat and thought about how their business looks relative to a typical activist approach really needs to do so.

In sum, the activist investor tends to come with one (or more) of four possible thrusts: strategic change, including asset sales, a break up for preparing a firm for a bid; a change in capital allocation policy, designed to boost cash returns to investors via enhanced dividend or share buybacks; or operational improvements, through the closure or restructuring or underperforming divisions. The activist investor may also try boardroom change such as improvements in governance, whereby the activist looks to improve the skillset of the board relative to the company’s target industry, or reining in executive pay (if it is seen to be excessive) or even appoint its own people to the management team.

In this case, it would be logical to assume that Cevian is looking for faster improvement in operational and financial performance, and perhaps more ambitious margin targets, whether this is achieved through a wider ranging cost-cutting plan or even changes to Smith & Nephew’s three-division structure, so that resources can be allocated to the best effect.

One option that does not seem likely, for the moment at least, is hectoring the FTSE 100 index constituent to shift its listing to New York from London. Granted, Smith & Nephew trades at a big valuation discount to American rival Stryker, at 20 times forward earnings compared to more than 30 times, and at a discount to another transatlantic peer, Zimmer Biomet, which trades on a multiple in the low 20s.

But Smith & Nephew’s margins lag those of the comparable American firms and thus is it quite legitimate to argue the discount is merited.

If the margin gap closes, so could the valuation gap and that is still the job at hand for Mr Nath and management, albeit perhaps now in the face of greater scrutiny now that Cevian is a shareholder.

Shifting the listing to a different stock exchange would not make Smith & Nephew a better company and to think otherwise would be a mistake. As fund management legend John Bogle, the founder of Vanguard, once noted: “The stock market is a giant distraction from the business of investing. In the long run investing is about returns earned by businesses – not the stock market.”

If Smith & Nephew can improve its margins, cash flow and returns on capital, then shareholders are in business. If not, the stock is dead money at best, but the prospect of a Cevian-inspired shake-up at least improves our chances or erasing the paper loss we currently hold on the stock.

Questor says: hold

Ticker: SN

Share price at close: £10.62

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance