Questor: This trust will make good after worst slump in 36 years

Questor has reversed its “sell” recommendation on RIT Capital Partners following full-year results showing the Rothschild-backed investment trust pulling through the worst slump in its 36-year history.

RIT’s 2023 annual report last month showed the £3.6bn global portfolio disappointed last year. A 3.2pc rise in assets trailed the 18.4pc return from the MSCI All Country World index, and the 7pc rise in the inflation benchmark it also uses.

The report made for a sobering read for long-term shareholders. While the company’s underlying investment return of 3,343pc since listing in 1988 has smashed both benchmarks, which have gained 1,607pc and 637pc respectively, performance has dropped off alarmingly in the past decade.

The value of RIT’s diverse investments has lagged behind the MSCI index over three, five and 10 years, and over three years has fallen well behind its annual target of delivering at least three percentage points more than the consumer price index.

Shareholder returns have been far worse. From the top of the market in November 2021, the shares have slumped 36pc, largely over concern about the 45pc exposure to riskier unquoted assets held by 2022.

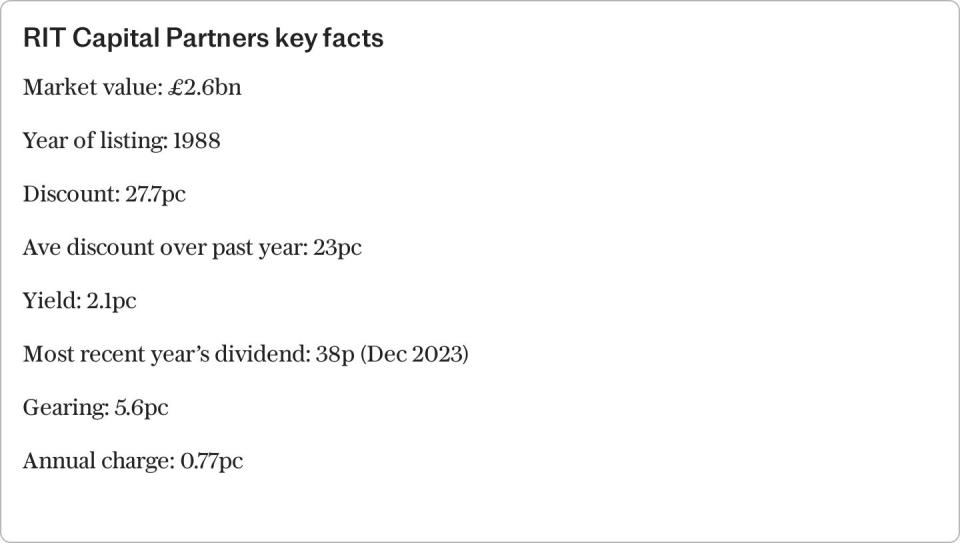

At £17.86, the shares have fallen 19pc since we dropped our “buy” rating on January 5 last year. That puts them 28pc below the net asset value of its holdings in publicly listed shares, private assets and other “uncorrelated” investments.

The discount, or gap, between the share price and asset value, has nearly trebled from 11pc since this column turned bearish, and is a big factor in upgrading our recommendation.

While uncertainties remain, such as whether RIT’s fund manager J Rothschild Capital Management can turn performance around under new chief executive Maggie Fanari and chief investment officer Nick Khuu, we believe these are reflected in the low share price.

Despite last year’s modest return, the results provided reassurance. In quoted equities, where RIT had 38.4pc invested in December, the trust reaped an 18.1pc return. That was in line with the MSCI benchmark, a good result given it held virtually none of the ‘Magnificent Seven’ US tech giants that dominated global markets.

More importantly, the investments in private equity funds and unlisted companies that had so alarmed us fell 6pc, less than feared. While stagflation and a consumer spending squeeze hurt some holdings, there were not widespread write-downs in this part of the portfolio, with losses mostly offset by strong growth elsewhere and higher valuations to tech firms enjoying the boom in artificial intelligence.

Following “candid” talks with shareholders, chairman James Leigh-Pemberton said the amount held in the more illiquid and opaque private investments would lower to between 25pc and 33pc in the next two years.

There will be no fire-sale, he said, but a gradual reduction as capital markets re-open and more companies float on stock exchanges, enabling RIT to make an exit. Several of its investments, such as US stock trading platform Webull, a 1.4pc position, are “actively exploring” initial public offers (IPOs).

Leigh-Pemberton said a two-year hiatus in IPOs, combined with impressive earlier private equity performance, were the reasons why these investments had become so dominant. RIT’s private assets had generated average annual returns of 20pc in the past 10 years, more than double the MSCI All Country World index.

Best of all, RIT has been actively buying back shares, spending £184m on its cheap stock in the past 15 months. That boosts shareholder returns a little, but more importantly shows the board’s conviction in the valuation of RIT’s assets and a belief that the shares are undervalued.

The trust’s recovery impressed Investec analyst Alan Brierley who has lifted RIT to “hold” from the “sell” rating he put on the trust in March 2023. While still wary about private equity, he believes Fanari, a former senior fund manager at the renowned Ontario Teachers’ Pension Plan, will bring “more institutional discipline and vigour”.

Mick Gilligan of wealth manager Killik & Co applauded the buybacks for “putting a floor under the discount” that he said implied RIT’s private equities were undervalued by up to 50pc. “This is much wider than most private equity trusts and offers an excellent margin of safety,” he said.

Both said RIT needs to do a lot more on cutting costs which, with fees of external funds included, amounted to 1.71pc last year, nearly double the 0.9pc average of listed global equity funds.

This column agrees that cutting expenses is essential for RIT’s rehabilitation. Nevertheless, the shares are currently extremely good value and with the company focused on improving shareholder returns we are happy to reinstate our previous recommendation.

Questor says: buy

Ticker: RCP

Share price at close: £17.86

Gavin Lumsden is editor of Citywire’s Investment Trust Insider website

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 5am.

Read Questor’s rules of investment before you follow our tips.

Yahoo Finance

Yahoo Finance