Rachel Reeves: Sir Howard Davies house price remarks ‘out of touch with reality’

Rachel Reeves has slammed Natwest chair Sir Howard Davies’ comments on the property ladder, saying the City grandee is “out of touch” with the reality of millions of Brits.

Davies told the BBC this morning that it was not “that difficult” for people to get on the housing ladder.

The outgoing chairman of the embattled bank told the BBC’s Today programme that prospective buyers have to save, and that “is the way it always used to be”.

“I totally recognise that there are people who are finding it very difficult to start the process, they will have to save more, but that is, I think, inherent in the change in the financial system as a result of the mistakes that were made in the last global financial crisis,” he added.

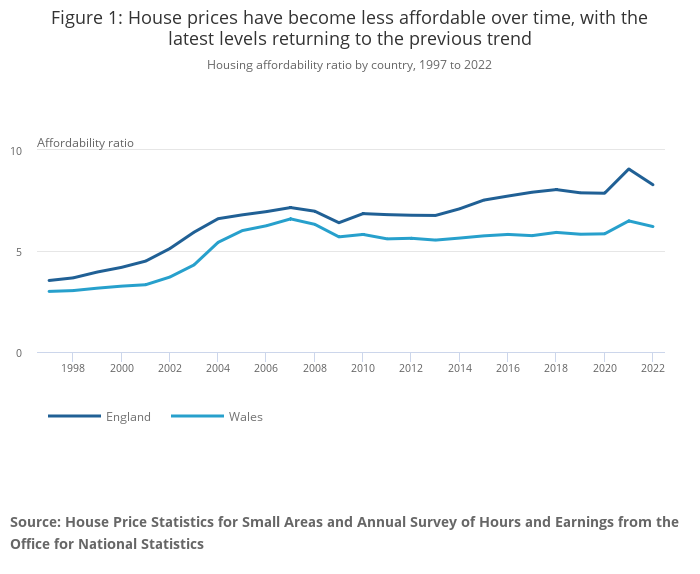

However a host of critics have pointed out that housing affordability has cratered over the past decade.

Over the last 25 years, housing affordability has worsened in every area of England, felt particularly acutely in London and surrounding areas.

Rachel Reeves said Davies’ comments were not “in tune with the reality faced by millions of people in Britain. There are many people who do own their own home but are struggling with the higher mortgage costs.”

Reeves told GB News that “I know that many, many people will find those remarks quite out of touch with the situation that they and their family face.”

Mortgage advisors have also criticised the City grandee.

“Making such bold statements with absolutely nothing to back it up is ludicrous,” said Katy Eatenton, a mortgage specialist at Lifetime Wealth Management. “The cost of living is the highest it has been, rents are increasing year on year and house prices, interest rates and the lack of first-time buyer schemes are all adding to the difficulty in getting on the property ladder.”

Stephen Perkins, managing director at Yellow Brick Mortgages added it was “tiring” hearing such comments from “people who bought their first house for around £10,000 with a minimal deposit and a mortgage at 2-3 times their income”.

Yahoo Finance

Yahoo Finance