Rakuten Group Leads Three High Insider Ownership Growth Stocks On The Japanese Exchange

Amid a backdrop of heightened uncertainty surrounding Japan's monetary policy and its impact on market performance, investors are closely watching shifts in the Japanese stock markets. In such a climate, growth companies with high insider ownership, like Rakuten Group, can offer potential resilience as insiders typically have a vested interest in the company’s long-term success.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 81% |

Let's review some notable picks from our screened stocks.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

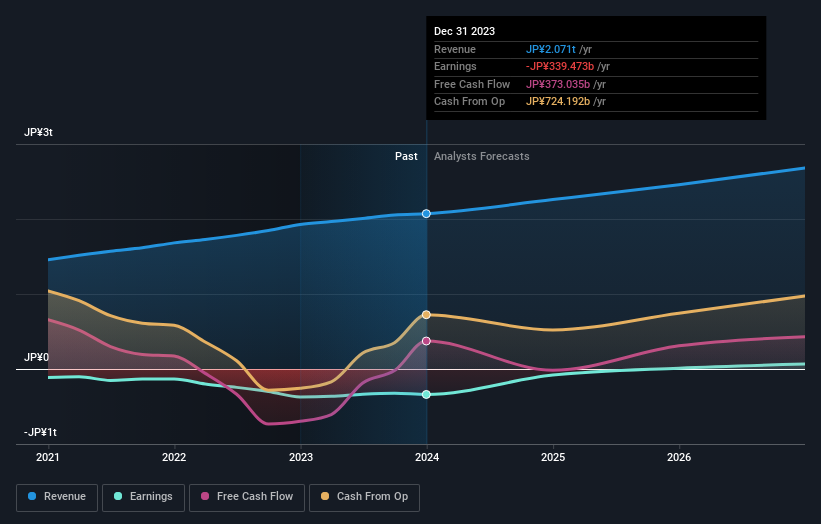

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users globally with a market capitalization of approximately ¥1.75 trillion.

Operations: The company generates revenue through its operations in online retail, financial services, digital media, and telecommunications.

Insider Ownership: 17.3%

Earnings Growth Forecast: 83.9% p.a.

Rakuten Group, with significant insider ownership, is poised for notable growth. The company recently completed a substantial fixed-income offering of US$1.99 billion to bolster its financial position. Despite a forecasted low return on equity of 9.1% in three years, Rakuten is expected to become profitable within this period, with earnings projected to increase by 83.88% annually. However, its revenue growth at 7.4% per year may lag behind more aggressive market averages but still outpaces the Japanese market forecast of 4.2%.

Micronics Japan

Simply Wall St Growth Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. operates globally, specializing in the development, manufacture, and sale of testing and measurement equipment for semiconductors and LCD systems, with a market capitalization of approximately ¥245.76 billion.

Operations: The company generates revenue primarily from the sale of semiconductor and LCD testing and measurement equipment.

Insider Ownership: 15.3%

Earnings Growth Forecast: 39.8% p.a.

Micronics Japan, with high insider ownership, is set to outpace the Japanese market with a forecasted annual revenue growth of 23.2% and earnings growth of 39.8%. Analysts predict a significant stock price increase of 42.1%, currently trading at 38% below its estimated fair value. Despite these strong growth indicators, the company's profit margins have declined from last year's 16.7% to 10.6%. The share price has been highly volatile over the past three months, adding a layer of risk for potential investors.

Lasertec

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and globally, with a market capitalization of approximately ¥3.21 trillion.

Operations: The company operates primarily in the design, production, and sale of inspection and measurement systems worldwide.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.2% p.a.

Lasertec, a Japanese company with high insider ownership, is experiencing robust growth. Its earnings surged by 105.6% last year and are expected to grow by 20.17% annually over the next three years, outpacing the Japanese market's 8.9%. Revenue growth forecasts also remain strong at 16.4% annually. However, despite these positives, Lasertec faces challenges with a highly volatile share price and recent executive changes that could impact stability and direction.

Turning Ideas Into Actions

Click this link to deep-dive into the 98 companies within our Fast Growing Japanese Companies With High Insider Ownership screener.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4755 TSE:6871 and TSE:6920.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance