Rakuten Group And Two More Japanese Exchange Growth Stocks With Significant Insider Ownership

Amidst a backdrop of fluctuating market conditions, Japan's stock markets experienced a downturn last week, influenced by uncertainties around the Bank of Japan's monetary policy decisions. In such an environment, examining growth companies with high insider ownership can offer insights into firms that potentially have aligned interests between shareholders and management, fostering stability and confidence.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 81% |

Let's explore several standout options from the results in the screener.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

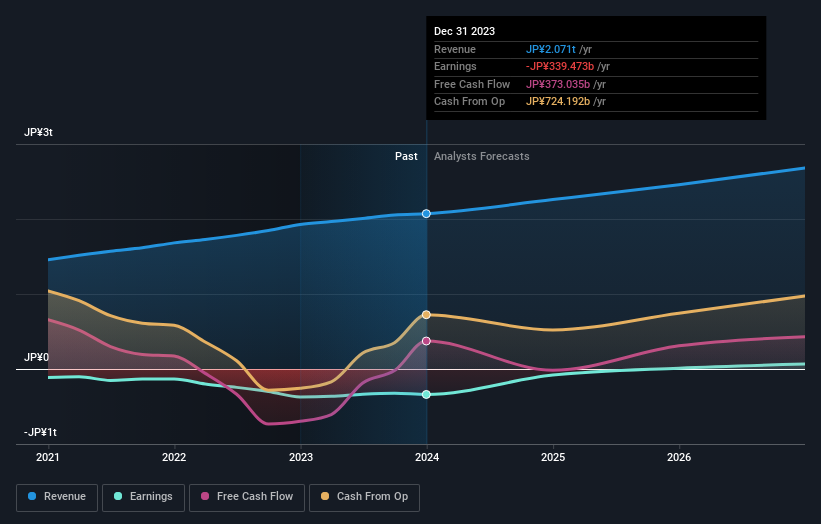

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors globally with a market capitalization of approximately ¥1.75 trillion.

Operations: The company generates revenue through its operations in online retail, financial services, digital media, and telecommunications.

Insider Ownership: 17.3%

Earnings Growth Forecast: 83.9% p.a.

Rakuten Group, currently trading at US$78.1% below its estimated fair value, shows potential for growth with earnings expected to increase by 83.88% annually. Although its revenue growth of 7.4% per year is below the high-growth benchmark of 20%, it still surpasses the Japanese market forecast of 4.2%. Despite a forecasted low return on equity at 9.1%, Rakuten is anticipated to become profitable within three years, outpacing average market growth. Recent activities include a substantial fixed-income offering raising nearly US$2 billion and strategic adjustments in corporate planning as indicated by aborting a plan to list its securities unit.

Dive into the specifics of Rakuten Group here with our thorough growth forecast report.

Our valuation report unveils the possibility Rakuten Group's shares may be trading at a discount.

Micronics Japan

Simply Wall St Growth Rating: ★★★★★★

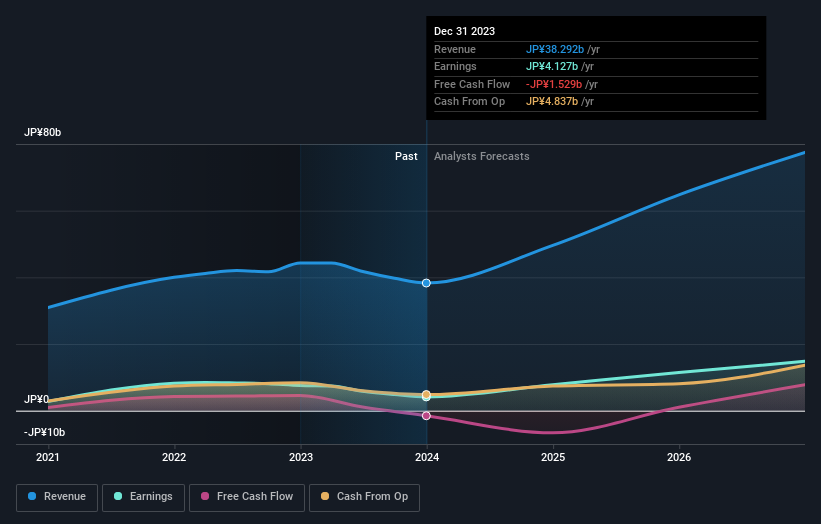

Overview: Micronics Japan Co., Ltd. specializes in developing, manufacturing, and selling testing and measurement equipment for semiconductors and LCD systems globally, with a market capitalization of approximately ¥245.76 billion.

Operations: The company generates its revenue primarily from the sale of semiconductor and LCD testing and measurement equipment globally.

Insider Ownership: 15.3%

Earnings Growth Forecast: 39.8% p.a.

Micronics Japan, with a forecasted annual earnings growth of 39.8% and revenue increase at 23.2% per year, is poised to outperform the Japanese market significantly. Despite trading at 38% below its estimated fair value, concerns linger as its profit margins have dipped from 16.7% to 10.6%. Analysts predict a potential price rise of 42.1%, backed by an expected high return on equity of 26.8%. The company will report Q1 results on May 13, reflecting these dynamics.

Lasertec

Simply Wall St Growth Rating: ★★★★★☆

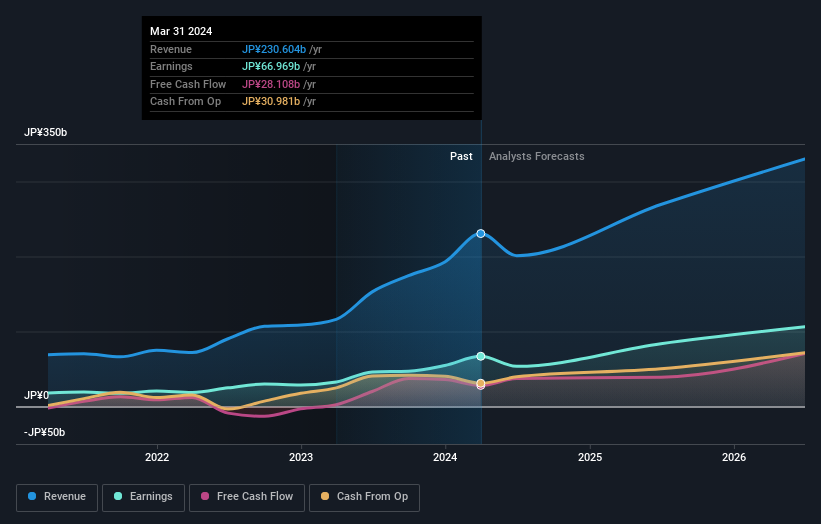

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment, operating both in Japan and internationally, with a market capitalization of approximately ¥3.21 trillion.

Operations: The company operates globally, specializing in the production and distribution of inspection and measurement systems.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.2% p.a.

Lasertec Corporation, a key growth company in Japan, is experiencing robust earnings and revenue acceleration, with forecasts suggesting substantial growth over the next three years. Despite high insider ownership fostering strong alignment with shareholder interests, the firm faces challenges from a highly volatile share price. Recent executive changes aim to bolster leadership as it continues to outpace its previous year's sales figures significantly, indicating sustained operational momentum.

Click here and access our complete growth analysis report to understand the dynamics of Lasertec.

Our valuation report unveils the possibility Lasertec's shares may be trading at a premium.

Next Steps

Navigate through the entire inventory of 98 Fast Growing Japanese Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4755 TSE:6871 and TSE:6920.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance