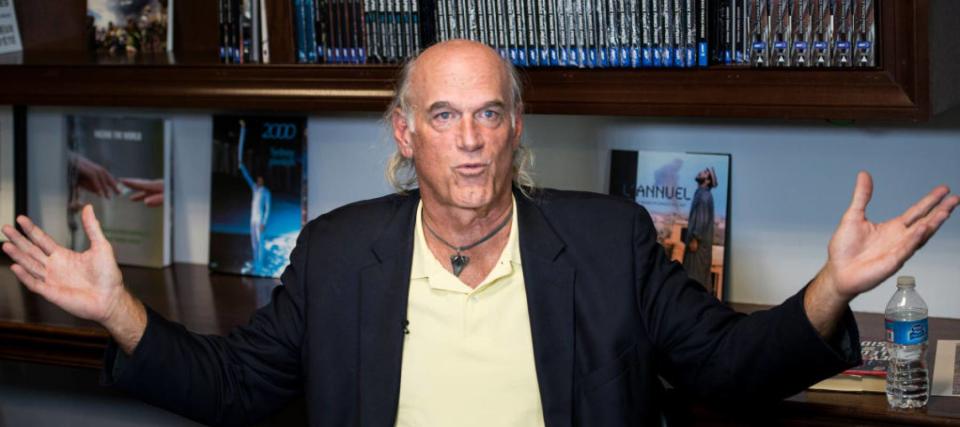

'I ran the 80-pound jackhammer': Former governor Jesse Ventura blasts billionaires, says no one works hard enough to make $1B — here are 3 ways make your money do the heavy lifting instead

Former WWF star and Minnesota governor Jesse Ventura may be known as a pro wrestler, but when it comes to billionaires, he’s not pulling any punches.

Don't miss

Here's how much money the average middle-class American household makes — how do you stack up?

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

This janitor in Vermont built an $8M fortune without anyone around him knowing. Here are the 2 simple techniques that made Ronald Read rich — and can do the same for you

Earlier this spring, Ventura was at Steel City Comic Con, where he launched a verbal takedown of the country’s wealthiest individuals, stating “there should not be one billionaire in America.”

Ventura then went on to add “there is nobody that works hard enough to earn $1 billion.”

It might sound rich coming from a man who may be a millionaire himself, but his argument was simple.

“The two jobs I did in my life that were physically the most demanding and mentally the most difficult … paid me the least amount of money,” he said.

Whether you agree with Ventura or not, his rant raises an age-old question: Is it better to work harder or smarter? (And which will make you more money?)

Jesse Ventura’s colorful career

Ventura, 72, first found fame as a professional wrestler with the AWA and WWF under the ring name “The Body.”

After a successful career in the ring and providing color commentary while also landing some Hollywood movies roles, Ventura turned his attention to politics in the 1990s. He served a four-year stint as the mayor of Brooklyn Park, Minnesota, from 1991-1995, before becoming the state's 38th governor in 1999, a position he held until 2003.

But it was neither Ventura’s wrestling, acting nor political careers that took the most — physically or mentally — out of him.

Instead, that dubious honor goes to his first two jobs after high school. First, Ventura worked for the Minnesota Department of Transportation, where he “ran the 80-pound jackhammer” for just a “couple [of] bucks above minimum wage.”

“I challenge any billionaire to run the jackhammer for 40 hours in one week and tell me he works harder than that,” Ventura said.

He offered billionaires a similar challenge to endure the grueling training schedule of his next job as a member of Underwater Demolition (SEAL) Team 12 for the U.S. Navy during the Vietnam War.

Ventura’s comments were shared in a TikTok, which then amassed 3.6 million views and triggered more than 17,100 comments — with many backing the ex-wrestler’s sentiments.

If you’re not keen on the idea of running a jackhammer for 40 hours a week, here are three smart ways to make your money do the heavy lifting for you.

Get a grip on your finances

Before you can put your money to work, you’ll need to put in a little effort yourself.

First, consider creating and sticking to a budget that breaks down your monthly income between necessities, wants and savings.

Once you’ve set your roadmap, you’ll want to clear any obstacles that might stand in the way of reaching your goals — like debt. Higher-interest debts on your credit cards or your car loan can weigh you down and often outpace the money you’d make saving and investing any excess income.

With your debt under control, you can look for ways to supercharge your savings. If you’ve got money left in your budget, it's worth making the most of tax-friendly retirement accounts — like 401(k)s and IRAs — where your savings are invested in the market for long-term growth.

Read more: 'Hold onto your money': Jeff Bezos says you might want to rethink buying a 'new automobile, refrigerator, or whatever' — here are 3 better recession-proof buys

Invest your spare change

Once you have a good grip on money management, you should consider investing to put any extra cash you have to work.

The four basic types of investment options are bonds, stocks, mutual funds and exchange-traded funds (ETFs). They all have the potential to earn higher returns than a high-yield savings account — but they also come with more risk.

Buying and selling individual stocks takes a lot of know-how to pick winners and losers — and even wise decisions can end poorly.

Those who are new to investing often get their feet wet with mutual funds or ETFs, which bundle together a diverse portfolio of investments. These are generally considered less risky than trading individual stocks.

You don’t have to commit a lot of money at first, either. You can start small and invest your spare change to generate passive income through dividends without having to lift a finger.

There are also lots of different kinds of apps out there these days that can help you dip your toe into the investing waters.

Get into real estate

As a tangible asset that typically appreciates over time, real estate is one of the more popular investment classes for building wealth.

There are a few ways to make money off of it. You can generate cash flow by renting out your property. You can also build equity as you pay off your mortgage, which comes with many benefits.

But for either of those options, you’ll need cash on hand for major upfront expenses like a down payment and closing fees, and to handle maintenance and repairs.

If the challenge of buying and maintaining physical property doesn’t appeal to you, there are other ways you can invest in real estate without all the hassle, like simple online platforms that allow you to invest in real estate investment trusts (REITs) and crowdfunding deals.

What to read next

The US dollar has lost 98% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Boomer's remorse: Here are the top 5 ‘big money’ purchases you’ll (probably) regret in retirement and how to prepare for them

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance