Rate rise will hit UK's most vulnerable families hardest, charity warns

The Bank of England’s decision to increase interest rates on Thursday would hit UK’s most vulnerable families hardest, debt charity StepChange has warned.

The charity is concerned that the already-struggling families would find it even harder to make ends meet following the rise in rates to 0.75% from 0.5%.

“What is probably not being considered is the implication on those who are financially struggling. We’re seeing people in the UK, many of them are just hanging on by their finger tips,” said Phil Andrew, chief executive of StepChange on BBC Radio 5’s Wake up to Money on Friday.

Mark Carney, governor of the Bank of England, had been asked about the implications of the rate rise on families in debt when the rate rise was announced on Thursday.

He argued that the rise was needed for the benefit of the economy as a whole. “The households that are most affected by high and volatile inflation and most likely to be out of work, unfortunately, are the poorest households,” Carney said.

This is why, he said, it is important to take steps to keep the economy growing and inflation under control.

What has StepChange been saying?

Andrew, chief executive of the charity, said that even small changes in rates can push those in precarious financial positions into difficulty. Its research shows that of its clients with mortgages, one in 10 would be spending more of their income if their mortgage payments increased by £23 a month. [StepChange’s calculation is that this is, broadly, the impact of Thursday’s rise on a mortgage holder with a £150,000 loan.] That is about 60,000 people.

“Whilst a rise in interest rates might be for right the wider economy, form a consumer debt perspective many households are walking a precarious budget tightrope, as their incomes don’t cover the basics each month,” said Andrew.

Does the Bank of England think households can cope?

Its surveys show that “households are now more likely to be resilient to shocks”. This is because the proportion of households with high debt servicing ratios – income compared to debt repayments – is below its pre-crisis peak and households in this category have been saving more.

Carney said that it would take a full percentage point rise in rates to get those debt serving ratios back to historic levels. And when it came to those with the heaviest debt burden – those with a debt-service ratio of around 40% – rates could rise by a two percentage points before the historic norms were reached.

The governor also argued that those struggling with debt are not so much troubled by remortgage payments but by credit card bills and overdrafts on which rate rises have less of an impact.

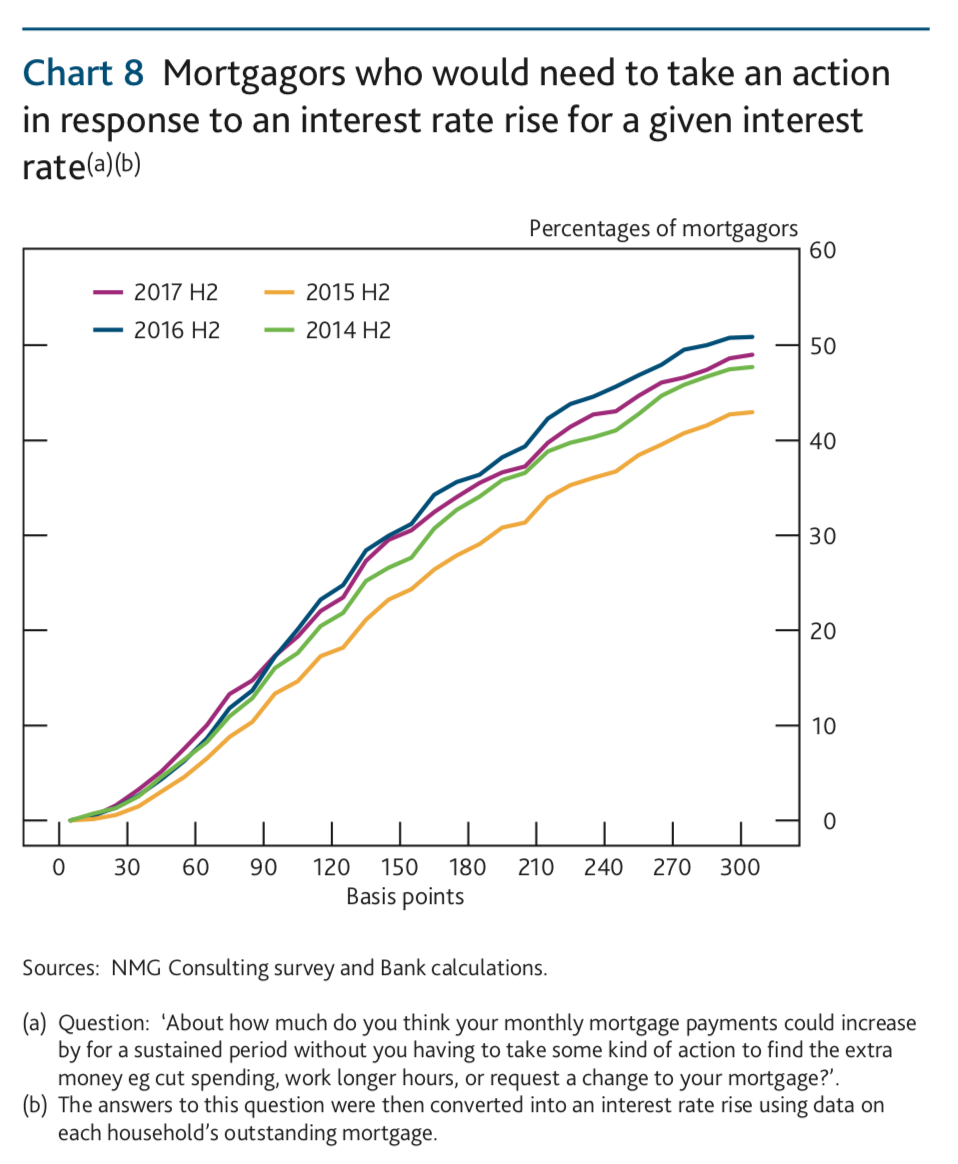

Carney cited a survey from last year which showed that 2.5% of households with mortgages would need to spend less or work more hours after a rate rise. The research was showed to the Bank of England’s Monetary Policy Committee – which sets interest rates – before last November’s rise (when rates rose by a quarter point, the same amount on as Thursday).

That survey said: “Following a 25 basis point increase in their mortgage rate, only 2.5% of mortgagors would need to take action to find the extra money, rising to 7.5% for a 50 basis point rise. These proportions are similar to the levels reported in 2014 and 2016, and are low as a percentage of all households.”

Yahoo Finance

Yahoo Finance