Raytheon Technologies' (RTX) Q4 Earnings Beat, Sales Up Y/Y

Raytheon Technologies Corporation’s RTX fourth-quarter 2022 adjusted earnings per share (EPS) of $1.27 beat the Zacks Consensus Estimate of $1.24 per share by 2.4%. Moreover, the bottom line improved 18% from the year-ago quarter’s adjusted earnings of $1.08 per share, driven by tax benefits associated with legal entity and operational reorganizations.

Including one-time items, the company reported GAAP earnings of 96 cents per share compared with 46 cents recorded in the year-ago quarter.

For full-year 2022, the company reported adjusted earnings of $4.78 per share, which came in 12% higher than the year-ago figure of $4.27. The full-year bottom line also surpassed the Zacks Consensus Estimate of $4.76 per share by 0.4%.

Operational Performance

Raytheon Technologies’ fourth-quarter sales of $18,093 million missed the Zacks Consensus Estimate of $18,196 million by 0.6%. The sales figure, however, rose 6% from $17,044 million recorded in the year-ago quarter.

For full-year 2022, the company recorded revenues worth $67.07 billion, up 4% from 2021’s reported figure. The full-year revenues, however, missed the Zacks Consensus Estimate of $67.13 billion.

Total costs and expenses increased 5% year over year to $16,621 million. The company generated an operating profit of $1,501 million, compared with $1,320 million in the year-ago quarter.

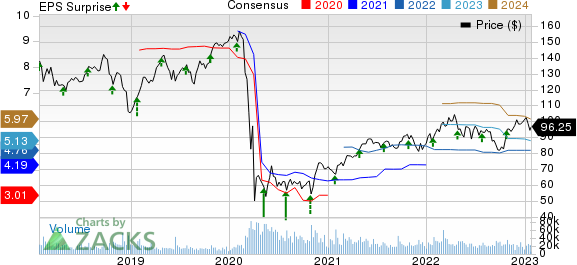

Raytheon Technologies Corporation Price, Consensus and EPS Surprise

Raytheon Technologies Corporation price-consensus-eps-surprise-chart | Raytheon Technologies Corporation Quote

Segmental Performance

Collins Aerospace: Sales at this segment improved 15% year over year to $5,662 million in fourth-quarter 2022, driven by higher commercial aftermarket as well as commercial OEM sales backed by recovering commercial air traffic and higher narrowbody deliveries. Also, an increase in military sales boosted this segment’s top line.

Its adjusted operating income came in at $743 million, compared with the year-ago quarter’s level of $469 million, driven by drop through on higher commercial aftermarket volume and lower R&D expense.

Pratt & Whitney: Sales at this segment rose 10% year over year to $5,652 million, driven by growth in the commercial aftermarket, military as well as commercial OEM businesses, backed by higher shop visits, related spare part sales, as well as favorable OEM engine mix and volume.

Its adjusted operating profit was $321 million, compared with the year-ago quarter’s level of $162 million, driven by drop through on higher commercial aftermarket sales.

Raytheon Intelligence & Space: This segment recorded fourth-quarter sales of $3,544 million, down 8% year over year, due to the divestiture of the Global Training and Services business.

Its operating profit was $278 million, reflecting a decline of 31%.

Raytheon Missiles & Defense: This unit recorded sales of $4,100 million, up 6% year over year, driven by higher net sales in Naval Power, including SPY-6, Strategic Missile Defense including NGI, and Advanced Technology programs.

The unit recorded an adjusted operating profit of $418 million in the fourth quarter, down 14% from the year-ago reported period.

Financial Update

Raytheon Technologies had cash and cash equivalents of $6,220 million as of Dec 31, 2022, compared with $7,832 million as of Dec 31, 2021.

Long-term debt was $30,694 million as of Dec 31, 2022, down from $31,327 million as of Dec 31, 2021.

Net cash inflow from operating activities amounted to $7,168 million as of Dec 31, 2022, compared with $7,142 million at the end of fourth-quarter 2021.

Its free cash flow was $3,773 million at the end of fourth-quarter 2022, compared with $2,207 million at the end of fourth-quarter 2021.

Guidance

Raytheon Technologies has provided its financial guidance for 2023.

The company currently projects adjusted EPS in the range of $4.90-$5.05. The Zacks Consensus Estimate for Raytheon’s 2022 EPS, pegged at $5.13, lies above the company’s guided range.

The company expects revenues in the range of $72.00-$73.00 million. The Zacks Consensus Estimate for revenues, pegged at $72.46 billion, lies below the mid-point of the company’s guidance.

The company also expects to generate free cash flow worth approximately $4.8 billion.

Zacks Rank

Raytheon Technologies currently carries a Zacks Rank #4 (Sell).

Upcoming Defense Releases

Spirit AeroSystems SPR: It is scheduled to release its fourth-quarter results on Feb 7. SPR has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SPR delivered a four-quarter average negative earnings surprise of 73.24%. The Zacks Consensus Estimate for Spirit AeroSystem’s fourth-quarter bottom line is pegged at a loss of 48 cents per share, which implies a solid improvement from a loss of 84 cents per share incurred in the fourth quarter of 2021.

Leidos Holdings LDOS: It is scheduled to release its fourth-quarter results on Feb 14. LDOS has a Zacks Rank #3.

LDOS delivered a four-quarter average earnings surprise of 2.01%. The Zacks Consensus Estimate for Leidos’ fourth-quarter earnings, pegged at $1.61 per share, implies an improvement of 3.2% from the fourth quarter of 2021.

Airbus Group EADSY is slated to report its fourth-quarter results soon. EADSY has a Zacks Rank #2 (Buy).

EADSY delivered a four-quarter average earnings surprise of 59.88%. The Zacks Consensus Estimate for EADSY’s fourth-quarter earnings, pegged at 48 cents per share, indicates a decline of 15.8% from the fourth quarter of 2021.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Spirit Aerosystems Holdings, Inc. (SPR) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance