RBS draws fire with plans to close complaints process for controversial GRG unit

RBS is closing the redress scheme for small firms to make claims relating to the lender’s controversial turnaround unit Global Restructuring Group (GRG), despite accusations that it has “moved at a snail’s pace”.

The complaints process, which was opened to UK customers in November 2016 alongside an automatic refund of complex fees, will close to new complaints in the UK on October 22.

RBS completed the refund scheme a year ago, making offers worth £115m to 3,500 customers.

RBS said it had consulted retired High Court judge Sir William Blackburne, who has been overseeing the process as an independent third party, and the City watchdog, the Financial Conduct Authority, regarding the closure of the complaints process.

The bank will consult with the Central Bank of Ireland about a deadline for customers in the Republic of Ireland, who were informed about the complaints process two months after those in the UK.

Mike Cherry, national chairman of the Federation of Small Businesses said: “From the outset, the GRG redress process has moved at a snail’s pace. A decade on from many of these cases arising, we still have a situation where a third of claims are unresolved.”

He added that the independent consideration of consequential loss claims “only started a few weeks ago”.

“Now we’re being told it’s ending in the very near future.”

RBS said it had received 1,230 complaints from the 16,000 customers that were eligible to use the scheme, and a further 165 complaints from those outside its scope. It has issued a conclusion in 803 cases and had upheld 370 in full or part, making offers of just over £10m for direct losses.

The taxpayer-owned bank is currently receiving about six complaints a week, compared with a peak of 35 a week in December 2016.

Mr Cherry suggested that if claims continued at that rate until October, the bank might need to extend the deadline.

The RBS GRG division was created to handle loans classed as risky and is understood to have had the power to scrap loan deals, impose inflated interest rates and charge hefty penalties.

In January, the Treasury Select Committee published an internal RBS memo urging managers to let struggling business customers “hang themselves” when in financial difficulty.

Among the tips circulated to staff within GRG were to sell clients services that they “normally cannot afford” and “missed opportunities mean missed bonuses”.

The guide also recommended pursuing “basket cases” for work, alongside the advice: “if they sign, they can’t complain.”

The training document, written in 2009 and entitled ‘Just Hit Budget’, had previously been reported on but was not in the public domain.

Mr Cherry said: “The tactics deployed by GRG destroyed lives and livelihoods. Ten years on, justice for our small firms is long overdue.”

RBS chairman Howard Davies said: “Throughout the GRG complaints process… our focus has been on putting things right for those customers who did not receive the level of service and understanding they should have done whilst in GRG.

“We have worked hard to ensure high quality and fair decisions have been reached in response to the issues raised. These have been subject to rigorous independent assurance.

"We have concluded that this is the appropriate time to give our UK customers notice of its closure to new complaints.”

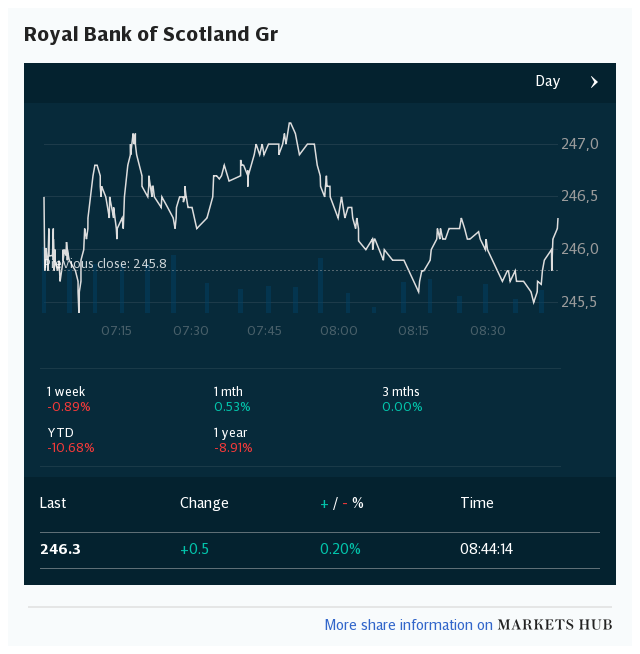

Yahoo Finance

Yahoo Finance