New RBS scam to avoid as bank boss blames victims

Scammers are attempting to steal personal details from Royal Bank of Scotland (RBS) customers with a new text message scam.

It’s the latest ‘smshing’ con criminals are using to trick bank customers into revealing personal details designed to gain access to and drain bank accounts.

The new scam is doing the rounds as the boss of RBS has said fraud victims should take more blame for falling for these tricks and losing money.

What to watch out for

The new RBS text message con appears to be from the bank, and claims that there has been some unusual activity on the recipient’s online banking account.

In order to secure the account victims are encouraged to click on a link and login.

However, this is likely to lead to a bogus RBS site that harvests your personal banking details and allows fraudsters to empty your account.

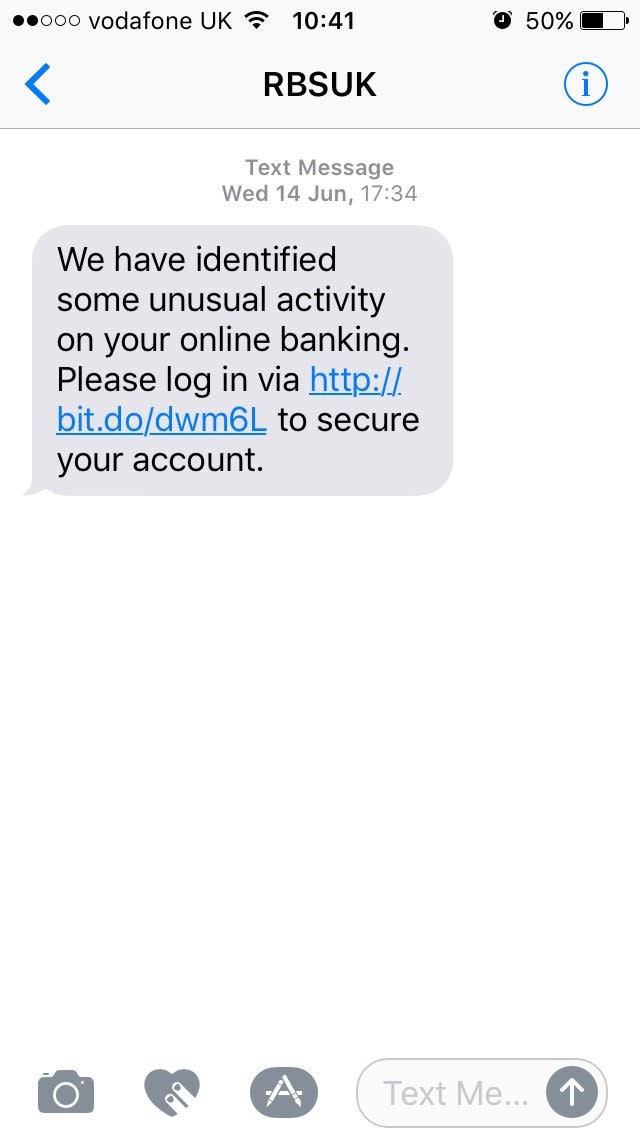

Below is an example of the RBS text message scam, sent in by a worried loveMONEY reader.

It’s not the most sophisticated con we’ve seen. Though the 'RBSUK' sender looks genuine, the shortened Bitly link should raise your suspicions as you have no idea where clicking it will lead.

Be in with a chance of winning £500 every week with loveMONEY! Click here to find out more

‘Careless’ fraud victims shouldn’t get refunds

RBS customers should be extra vigilant of this new text message scam as the bank’s boss Ross McEwan recently expressed little sympathy for those who fall victim to these types of cons.

He said it was not the responsibility of banks when customers revealed their account details or sent money to online scammers. When quizzed over whether RBS had a duty of care to victims, he reportedly said ‘no’.

He told the Daily Mail: “We are working very hard to help customers detect when there are difficulties but I think this has to be in partnership with the customer and with the bank.

“You can’t keep blaming this on an organisation where customers don’t take their own duty of care as well.

"When people are passing their iPads or laptops over with their passwords and the likes, there’s got to be a care here otherwise this will just become a major issue for all and the cost will pass through."

According to the paper, between January and September 2015 nearly 5,000 RBS customers were conned out of £25 million, or £5,000 each on average. Sadly, over the whole of 2015, 70% of RBS fraud victims got nothing back.

Critics say the bank should take some responsibility as it closes branches and pushes more and more customers to use online services. RBS has axed at least 853 branches since 2008, and in March announced plans to scrap 150 more.

Currently the rules state that banks must refund victims of fraud unless they can prove a customer has been negligent with their details – this includes situations where customers have revealed their details to a criminal via fake bank websites.

An RBS spokesman said: "Where a customer has suffered loss we review their situation, establish the facts and make a decision on a case by case basis."

But campaigners want banks to do more to help victims tricked into transferring money as scams get more and more sophisticated.

Gareth Shaw from consumer group Which? said: ‘Banks are still placing too much responsibility on consumers to spot and protect themselves from sophisticated online scams. We’ve heard from many people who have lost life-changing amounts of money through bank transfer fraud, through no fault of their own, who are unlikely to get their money back from the banks involved.’

How to stay safe

While it’s easy to spot this particular scam if you aren’t a RBS customer, it could look convincing if you did bank with the brand as you may well have received texts from them in the past.

It’s worth noting that this scam can easily be tweaked to reference a different financial institution, so it’s not just RBS customers who need to be vigilant.

As always when it comes to suspicious texts and emails, the key is to never respond directly.

If you want to verify the information contained in the message, contact your bank or building society via a number or website that you have looked up separately.

Don’t bank with RBS? Watch out for these HSBC, Nationwide, NatWest and Santander text message scams.

Yahoo Finance

Yahoo Finance