The Realia Business (BME:RLIA) Share Price Is Down 26% So Some Shareholders Are Getting Worried

It can certainly be frustrating when a stock does not perform as hoped. But it can difficult to make money in a declining market. The Realia Business, S.A. (BME:RLIA) is down 26% over three years, but the total shareholder return is -25% once you include the dividend. That's better than the market which declined 28% over the last three years. The more recent news is of little comfort, with the share price down 23% in a year. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days. But this could be related to the weak market, which is down 24% in the same period.

See our latest analysis for Realia Business

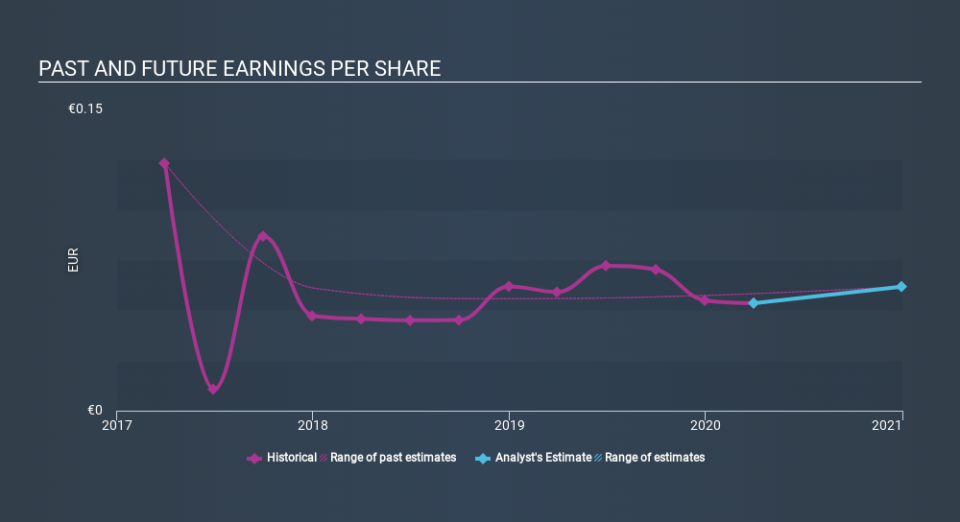

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Realia Business saw its EPS decline at a compound rate of 24% per year, over the last three years. In comparison the 9.4% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Realia Business's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Realia Business shareholders, and that cash payout explains why its total shareholder loss of 25%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

The total return of 23% received by Realia Business shareholders over the last year isn't far from the market return of -22%. Longer term investors wouldn't be so upset, since they would have made 2.2%, each year, over five years. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Realia Business (1 is potentially serious!) that you should be aware of before investing here.

But note: Realia Business may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance