There Is A Reason Sirius Real Estate Limited's (LON:SRE) Price Is Undemanding

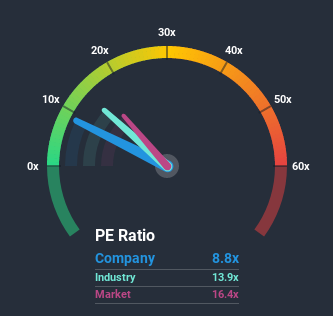

Sirius Real Estate Limited's (LON:SRE) price-to-earnings (or "P/E") ratio of 8.8x might make it look like a buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 17x and even P/E's above 35x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Sirius Real Estate has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Sirius Real Estate

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sirius Real Estate.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Sirius Real Estate would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company are not good at all, suggesting earnings should decline by 27% over the next year. Meanwhile, the broader market is forecast to moderate by 0.2%, which indicates the company should perform poorly indeed.

With this information, it's not too hard to see why Sirius Real Estate is trading at a lower P/E in comparison. Nonetheless, with earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Even just maintaining these prices could be difficult achieve as the weak outlook is already weighing down the shares heavily.

What We Can Learn From Sirius Real Estate's P/E?

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Sirius Real Estate maintains its low P/E on the weakness of its earnings forecast being even worse than the struggling market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Although, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Sirius Real Estate (1 is significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Sirius Real Estate, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance