Reasons to Add DTE Energy (DTE) Stock to Your Portfolio Now

DTE Energy Corp.’s DTE disciplined capital spending program to maintain and upgrade the reliability of its utility systems boosts its performance. Given its growth prospects and robust ROE, DTE makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

Solid Growth Projections

The Zacks Consensus Estimate for DTE Energy’s second-quarter 2024 earnings per share (EPS) has increased 8.6% to $1.14 per share in the past 60 days. The estimate also suggests a 15.2% improvement from the year-ago quarter’s reported number. The Zacks Consensus Estimate for the second-quarter 2024 revenues is pegged at $2.98 billion, indicating an increase of 11.1% from second-quarter 2023 reported figure.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing funds to generate higher returns. DTE’s ROE is 11.53%, which came in higher than the industry’s average of 10.17%. This indicates that the company has been utilizing funds more constructively than its peers in the electricity utility industry.

Debt Position

DTE’s times interest earned ratio (TIE) at the end of first-quarter 2024 was 2.7. The TIE ratio of more than 1 indicates that the company will be able to meet its interest payment obligations in the near term without any problems.

DTE’s current total debt to capital is pegged at 27.66%, much better than the industry’s average of 62.21%.

Dividend History

DTE Energy has been consistently increasing shareholders’ value by steadily paying dividends. In May 2024, DTE announced a quarterly dividend of $1.02 per share, resulting in an annualized dividend of $4.08. The company’s current dividend yield is 3.49%, better than the Zacks S&P 500 Composite's average of 1.27%.

Systematic Investments

The company aims to invest a total of $25 billion over the next five years, suggesting an 8.7% improvement over its prior five-year investment plan. These investments will be aimed at upgrading the company’s transmission, distribution and generation infrastructure as well as gas main and pipeline integrity programs.

The company plans to invest $50 billion over the next 10 years to support its reliability, the addition of renewable resources and the increased pace of electric vehicle adoption. Profitable returns from such investments should enable DTE Energy to duly achieve its long-term operating earnings growth rate of 6-8%.

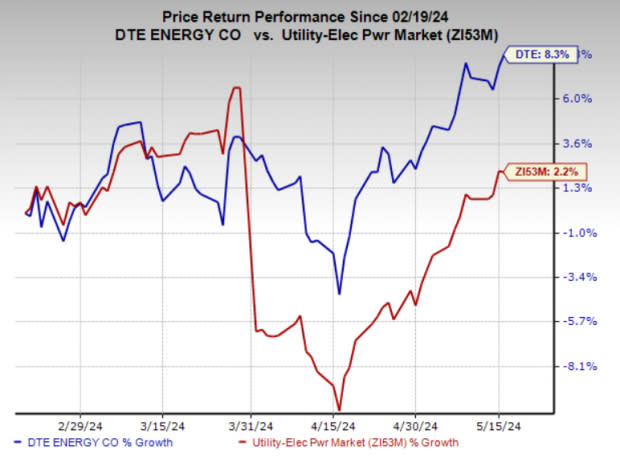

Price Performance

In the past three months, the stock has risen 8.3% compared with the industry’s average growth of 2.2%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Pampa Energia PAM, sporting a Zacks Rank #1 (Strong Buy), and PNM Resources PNM and Pinnacle West Capital PNW, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

PAM’s long-term earnings growth rate is 14.6%. The Zacks Consensus Estimate for Pampa Energia’s 2024 sales is pegged at $1.82 billion, indicating a year-over-year improvement of 5.1%.

PNM’s long-term earnings growth rate is 4.6%. The Zacks Consensus Estimate for PNM Resources’ 2024 sales is pegged at $2.35 billion, suggesting a year-over-year rise of 21.3%.

PNW’s long-term earnings growth rate is 7.6%. The Zacks Consensus Estimate for Pinnacle West Capital’s 2024 sales is pegged at $4.88 billion, calling for a year-over-year rise of 4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DTE Energy Company (DTE) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Pampa Energia S.A. (PAM) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance