Reasons to Add MGE Energy (MGEE) Stock to Your Portfolio

MGE Energy Inc.’s MGEE strong fundamentals and a solid financial position with favorable growth estimates make it a good investment choice.

MGE Energy currently carries a Zacks Rank #2 (Buy).

Growth Projections

The Zacks Consensus Estimate for 2024 and 2025 earnings per share has moved 0.3% and 0.8% north in the past 60 days to $3.69 and $4.03, respectively.

The Zacks Consensus Estimate for 2024 and 2025 sales implies growth of 2.4% and 3.2%, respectively, from the year-ago levels.

Return on Equity

The company’s return on equity for the trailing 12 months is 10.6%, comparing favorably with the industry’s 9.91%. This uptrend reflects MGEE’s higher efficiency in utilizing its shareholders’ funds than its peers.

Dividend

MGE Energy continues to reward its shareholders with dividend payments. It has paid cash dividends for more than 110 years. Management has approved an annual increase in dividends for the past 48 years.

On May, 2024, its board of directors approved a dividend of 42.75 cents per quarter. Its current dividend yield is 2.26%, which is better than the Zacks S&P 500 composite’s average yield of 1.59%.

Debt to Capital

MGE Energy’s debt to capital at the end of the first quarter of 2024 was 38.24%, comparing favorably with the industry’s 54.69%. This indicates that the company is utilizing much less debt to run its operations compared with peers. This definitely lowers the capital servicing expenses amid the still-high interest-rate scenario.

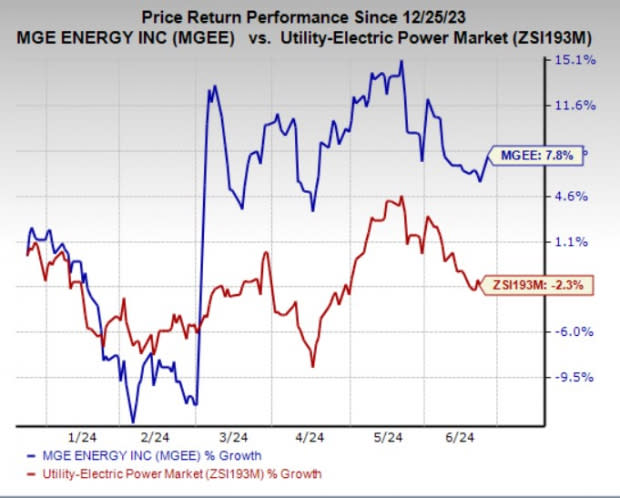

Price Performance

In the past six months, the stock has gained 7.8% against the industry’s 2.3% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Consolidated Edison ED, FirstEnergy FE and Public Service Enterprise Group PEG, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term (three-to-five years) earnings growth of Consolidated Edison, FirstEnergy and Public Service Enterprise Group is projected at 7.4%, 5.9% and 6.6%, respectively.

In the past 60 days, the Zacks Consensus Estimate for Consolidated Edison, FirstEnergy and Public Service Enterprise Group’s 2024 earnings has risen 0.4%, 0.7% and 0.5%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

MGE Energy Inc. (MGEE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance