Reasons to Add Portland General Electric (POR) to Your Portfolio

Portland General Electric’s POR long-term capital expenditure plans, strong dividend history and rising earnings estimates make it a great investment opportunity in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a robust investment option at the moment.

Growth Projections

The Zacks Consensus Estimate for the company’s 2024 EPS has increased 0.32% to $3.07 per share in the past 60 days.

The Zacks Consensus Estimate for POR’s 2024 revenues is pegged at $3.17 billion, which implies a year-over-year increase of 8.52%.

Solvency & Debt Position

Portland General Electric’s times interest earned ratio (TIE) at the end of the fourth quarter of 2023 was 2.6. The TIE ratio of more than 1 indicates that the company will be able to meet its interest payment obligations in the near term without any problems.

Currently, POR’s total debt to capital is 57.52%, better than the industry’s average of 62.48%.

Dividend History

Portland General Electric consistently increased its shareholder value by paying dividends. In February 2024, the company announced a quarterly dividend of 47.5 cents per share, resulting in an annual dividend of $1.9 per share. Currently, its dividend yield is 4.56%, better than the Zacks S&P 500 composite’s 1.3%.

Systematic Capital Expenditure

Strategic capital investments are making POR’s infrastructure stronger and more resilient. It invested $1.36 billion in 2023.

The company expects its capital expenditures to be worth $1.3 billion for 2024, which includes the upgrade and replacement of generation, transmission and distribution infrastructure as well as costs related to BESS projects. Portland General Electric now expects a total of $6.2 billion capital expenditure plan for the 2024-2028 period.

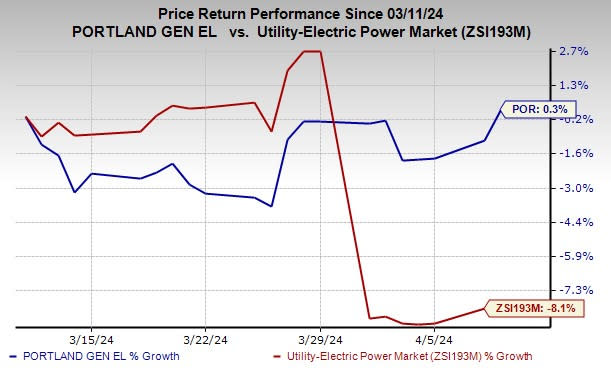

Price Performance

In the past month, Portland General Electric’s shares have risen 0.3% against the industry’s 8.1% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are NiSource NI, Pinnacle West Capital PNW and National Grid plc NGG, each holding a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NI’s long-term earnings growth rate is 6%. The company delivered an average earnings surprise of 5.56% in the last four quarters.

PNW’s long-term earnings growth rate is 7.6%. The Zacks Consensus Estimate Pinnacle West Capital’s 2024 EPS is pegged at $4.76, which implies a year-over-year improvement of 7.94%.

NGG’s long-term earnings growth rate is 2.7%. The Zacks Consensus Estimate National Grid plc’s fiscal 2025 EPS is pegged at $4.63, which suggests a year-over-year improvement of 19.95%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Portland General Electric Company (POR) : Free Stock Analysis Report

National Grid Transco, PLC (NGG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance