Reasons to Retain Genpact (G) Stock in Your Portfolio Now

Genpact G is currently benefiting from being an expert across multiple domains and the growth opportunity presented by artificial intelligence (AI).

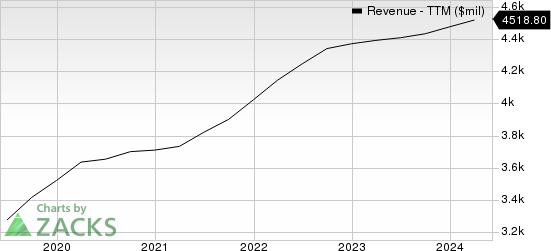

The company’s revenues for 2024 and 2025 are expected to improve 2.7% and 6.4%, respectively, on a year-over-year basis. Earnings are expected to increase 1.3% in 2024 and 9.8% in 2025. The company has an expected long-term (three to five years) earnings per share growth rate of 7.9%.

Genpact Limited Revenue (TTM)

Genpact Limited revenue-ttm | Genpact Limited Quote

Factors That Auger Well

Genpact is a prominent name in the BPO services market based on domain expertise in consulting services and digital and business analytics. The company is a leading provider of industry-specific solutions for the user experience, Industrial Internet of Things (IIoT), aftermarket services support, order and supply chain management, data engineering, direct procurement and logistics services, digital content management and risk management, industrial asset optimization and engineering services.

AI presents a substantial growth opportunity for Genpact. Gen AI serves as a driver for foundation work as the company assists businesses to develop a broad data and system architecture. The company’s Digital Smart Enterprise Processes (Digital SEPs) is a patented approach to improve the clients’ business processes’ performance. Digital SEPs reduce inefficiency and enhance the quality of processes using AI, advanced domain-specific digital technologies, Lean Six Sigma methodologies and experience-centric principles.

During 2023, 2022 and 2021, Genpact repurchased shares worth $225.4 million, $214.1 million and $298.2 million, respectively. The company paid $100 million, $91.8 million, and $80.5 million in dividends to its shareholders in 2023, 2022 and 2021, respectively. Such a shareholder-friendly strategy indicates the company’s commitment to create value for shareholders, thereby improving its bottom line.

Headwinds

Genpact also faces significant client concentration in terms of industries. In 2023, more than 25% of Genpact’s revenues were derived from clients in the financial services and insurance industries. Reliance on a particular industry does not bode well.

The outsourcing industry relies on foreign talent heavily and is labor intensive. Increasing costs of talent due to competition could curb the industry’s growth. However, Genpact is likely to be affected due to these headwinds.

Zacks Rank & Stocks to Consider

Genpact currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are Deluxe DLX and Marvell Technology MRVL.

Deluxe currently carries a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 12%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DLX delivered a trailing four-quarter earnings surprise of 23.3%, on average.

Marvell Technology presently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 27.2%.

MRVL delivered a trailing four-quarter earnings surprise of 2.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

Deluxe Corporation (DLX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance