Will Recovering Air Travel Aid Raytheon (RTX) in Q4 Earnings?

Raytheon Technologies Corp. RTX is set to release its fourth-quarter and full-year 2022 results on Jan 24, before market open.

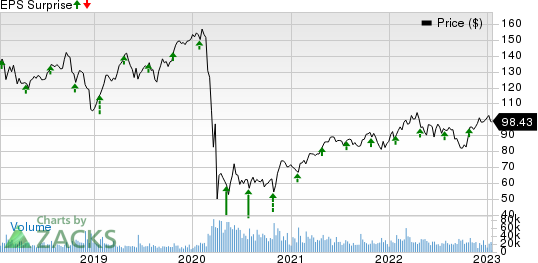

Raytheon delivered an earnings surprise of 8.34% in the last four quarters, on average. Steady recovery in international travel is likely to benefit Q4 results amid Russia-Ukraine conflict’s impacts.

Pratt & Whitney and Collins: Key Growth Catalysts

The merger between the legacy missile-maker Raytheon Company and multinational conglomerate United Technologies to form Raytheon Technologies was completed in April 2021. Raytheon Technologies’ fourth-quarter 2022 results are likely to benefit from the incremental merger synergies.

Also, cost synergies from the acquisition of Rockwell Collins are anticipated to bolster the company’s soon-to-be-reported quarter’s results.

Strong domestic and short-haul international travel, along with steady recovery in long-haul international travel, is likely to have boosted the company’s overall commercial OEM as well as aftermarket sales in the fourth quarter. This, along with solid growth from Pratt’s commercial engine business, must have driven the sales growth expectation for both its Pratt & Whitney and Collins business units.

The Zacks Consensus Estimate for Pratt & Whitney segment Q4 adjusted revenues is pegged at $5,681 million, suggesting an improvement of 11.1% from the 2021 third-quarter figure. The estimate for Collins Aerospace, pegged at $5,478 million, indicates an increase of 10.8%.

Raytheon Technologies Corporation Price and EPS Surprise

Raytheon Technologies Corporation price-eps-surprise | Raytheon Technologies Corporation Quote

Solid Outlook for Missile and Defense

Growing global budgets have led Raytheon to witness solid order growth in the recent past, which in turn, must have benefited the Q4 performance of the Raytheon Missiles & Defense segment. Higher volume on strategic missile defense programs is expected to have also boosted this segment’s top line in the soon-to-be-reported quarter.

The Zacks Consensus Estimate for Missiles & Defense segment Q4 adjusted revenues is pegged at $4,272 million, suggesting growth of 10.7% from the 2021 third-quarter figure.

Other Factors to Note

Amid the ongoing conflict between Russia and Ukraine, RTX ceased its business activities with Russia, which in turn might have hurt its Q4 sales. Nevertheless, strong sales performance from the majority of its business must have boosted its Q4 top- and bottom-line performances.

Further, the company is working on cost-reduction projects, which, in turn, must have benefitted its bottom line performance.

Q4 Expectations

The Zacks Consensus Estimate for Raytheon Technologies’ fourth-quarter earnings is pegged at $1.24 on revenues of $18.20 billion. The earnings and revenue estimates indicate improvement of 14.8% and 6.8%, respectively, from the year-ago quarter’s reported numbers.

What Our Model Predicts

Our proven model does not conclusively predict an earnings beat for Raytheon Technologies this time around. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for an earnings beat. This is not the case here.

Currently, Raytheon Technologies has an Earnings ESP of -4.65% and a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Below are three defense stocks that have the right combination for an earnings beat:

Spirit AeroSystems SPR: It is scheduled to release its fourth-quarter results soon. SPR has an Earnings ESP of +93.75% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

SPR delivered a four-quarter average negative earnings surprise of 73.24%. The Zacks Consensus Estimate for Spirit AeroSystem’s fourth-quarter bottom line is pegged at a loss of 48 cents, which implies a solid improvement from a loss of 84 cents incurred in the fourth quarter of 2021.

Leidos Holdings LDOS: It is scheduled to release its fourth-quarter results on Feb 14. LDOS has an Earnings ESP of +1.19% and a Zacks Rank #3.

LDOS delivered a four-quarter average earnings surprise of 2.01%. The Zacks Consensus Estimate for Leidos’ fourth-quarter earnings, pegged at $1.61, suggests an improvement of 3.2% from the fourth quarter of 2021.

Airbus Group EADSY is slated to report its fourth-quarter results soon. EADSY has an Earnings ESP of +6.25% and a Zacks Rank #2.

EADSY delivered a four-quarter average earnings surprise of 59.88%. The Zacks Consensus Estimate for EADSY’s fourth-quarter earnings, pegged at 48 cents, implies a decline of 15.8% from the fourth quarter of 2021.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Spirit Aerosystems Holdings, Inc. (SPR) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance