Funds Circling India Debt Risk Being Tripped Up by Red Tape

(Bloomberg) -- India’s $1.3 trillion sovereign debt market has become a magnet for global investors. This newfound interest just serves to highlight how difficult doing business in the world’s most populous country can be for outsiders.

Most Read from Bloomberg

SpaceX Tender Offer Said to Value Company at Record $210 Billion

Bolivia’s President Arce Swears in New Army Chief After Coup Bid

China’s Finance Elite Face $400,000 Pay Cap, Bonus Clawbacks

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

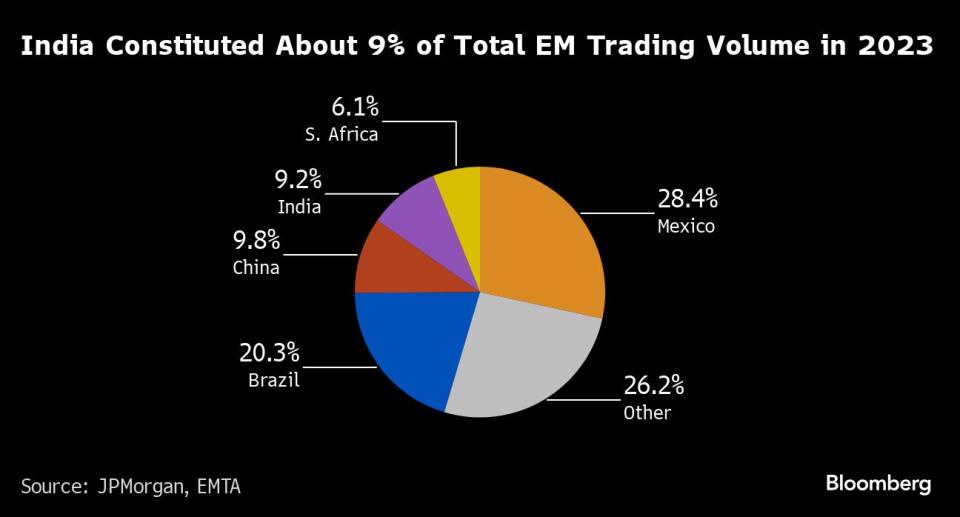

Foreigners are eagerly buying bonds before they’re added to JPMorgan Chase & Co.’s main emerging market debt index from Friday. When doing so, they face challenges ranging from lengthy documentation to the intricacies of settling a trade and the complexities of paying taxes on any profits.

That’s because Indian authorities, cautious of hot money flows that led to the Asian financial crisis, chose not to follow in the footsteps of China. Unlike Beijing, which provided concessions such as exempting investors from taxes ahead of joining major debt indexes, New Delhi has been reticent to make any changes.

“It’s still a very difficult market to access, requiring a lot of documentation,” said Jae Lee, a portfolio manager for Los Angeles-based investment management firm The TCW Group. “The other thing is there are variances in tax treaties. So where you’re domiciled has an impact on what your net return is in India bonds.”

India began working to gain access to bond indexes in 2019 to lower funding costs by generating additional demand for its bonds. With record borrowing during the pandemic, officials opened a segment of the sovereign bond market to overseas investors.

However, to trade directly in the Fully-Accessible Route (FAR) bonds, which are eligible to added to JPMorgan’s index, foreign funds must complete a registration process for each account via a custodian.

Registration in India can be burdensome with paperwork, according to several people familiar with the process. They declined to be named due to the sensitivity of the matter.

Investors have found it frustrating that the documentation required is more complex than in other countries, according to one of the people. For example, electronic signatures aren’t available for non-residents. While on-boarding typically takes eight weeks, there have been cases of it taking as little as seven days or as long as two years, that person said.

But the process has improved, thanks in part to a streamlined application form, some of the people said. In any case, the fact global funds have bought roughly $10 billion of FAR bonds since index inclusion was announced in September suggests any logistical headaches are not deterring investors.

The stability of the rupee versus the dollar only adds to the appeal of the market, according to Eugenia Victorino, head of Asia Strategy at Skandinaviska Enskilda Banken AB.

Lengthy Process

The Securities and Exchange Board of India, the nation’s markets regulator, declined to comment when contacted by Bloomberg about the process.

India’s sovereign bonds are traded and settled on the central bank’s trading platform. Foreign funds not registered onshore typically place orders through custodian banks, making the process cumbersome.

“There are many people who probably never invested in India and they’re just figuring this out now that this takes time,” said Shiva Iyer, who heads trading for the EM debt team in Asia at Morgan Stanley Investment Management.

JPMorgan said that there had been “teething issues” with the operational readiness in an interview with Bloomberg in May. But Gloria Kim, global head of index research, noted that the market feedback has been positive, with most clients ready to trade.

The Wall Street bank sees the share of foreign ownership nearly doubling in the next year, to more than 4.4% from 2.5% currently, it said in a recent note.

Regarding taxation, India has agreements with dozens of countries, allowing some investors to benefit from lower rates than the standard 30% for short-term capital gains and 10% for long-term gains. Interest income is taxed at 20%, but tax treaties can reduce this rate.

India’s withholding tax rate will be higher than those of emerging market bond index members Indonesia, Malaysia, Mexico, Turkey and South Africa, according to JPMorgan’s June report.

China’s Finance Ministry exempted foreign institutions from corporate income tax and value-added tax on interest income from investments in domestic bond markets in November 2018, prior to joining major indexes. The exemption has been extended to the end of 2025

For non-residents in a “jurisdiction which has a tax treaty with India, the beneficial tax regime under such tax treaty should be applicable,” said Rahul Jain, partner at the law firm Khaitan & Co.

Bloomberg Index Services Ltd. will also include some Indian bonds in its emerging market local currency index starting next year. Bloomberg LP is the parent company of Bloomberg Index Services Ltd., which administers indexes that compete with those from other service providers.

--With assistance from Saikat Das, Preeti Singh, Subhadip Sircar, Jing Zhao, Wenjin Lv and Stephan Kahl.

(Updates to add comment on currency in 10th paragraph)

Most Read from Bloomberg Businessweek

The FBI’s Star Cooperator May Have Been Running New Scams All Along

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance