Reflecting On Agricultural Machinery Stocks’ Q1 Earnings: AGCO Corporation (NYSE:AGCO)

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how agricultural machinery stocks fared in Q1, starting with AGCO Corporation (NYSE:AGCO).

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

The 6 agricultural machinery stocks we track reported a mixed Q1; on average, revenues missed analyst consensus estimates by 1.8%. while next quarter's revenue guidance was 11.6% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and agricultural machinery stocks have had a rough stretch, with share prices down 12.4% on average since the previous earnings results.

AGCO Corporation (NYSE:AGCO)

With a history that features both organic growth and acquisitions, AGCO (NYSE:AGCO) designs, manufactures, and sells agricultural machinery and related technology.

AGCO Corporation reported revenues of $2.93 billion, down 12.1% year on year, falling short of analysts' expectations by 3%. It was a weak quarter for the company with a miss of analysts' organic revenue and earnings estimates.

"AGCO demonstrated strong execution of its Farmer First-strategy in the first quarter," said Eric Hansotia, AGCO's Chairman, President and Chief Executive Officer.

The stock is down 15.5% since reporting and currently trades at $94.73.

Is now the time to buy AGCO Corporation? Access our full analysis of the earnings results here, it's free.

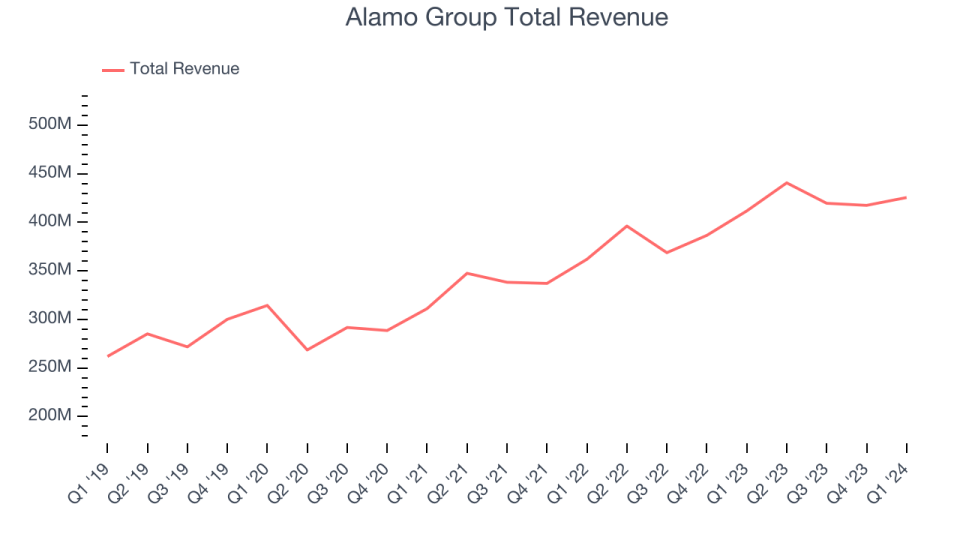

Best Q1: Alamo Group (NYSE:ALG)

Expanding its markets through acquisitions since its founding, Alamo (NSYE:ALG) designs, manufactures, and services high-quality vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural use.

Alamo Group reported revenues of $425.6 million, up 3.4% year on year, outperforming analysts' expectations by 3.6%. It was an impressive quarter for the company with a decent beat of analysts' earnings estimates.

Alamo Group achieved the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 15.6% since reporting. It currently trades at $164.89.

Is now the time to buy Alamo Group? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Titan International (NYSE:TWI)

Acquiring Goodyear’s farm tire business in 2005, Titan (NSYE:TWI) is a manufacturer and supplier of wheels, tires, and undercarriages used in off-highway vehicles such as construction vehicles.

Titan International reported revenues of $482.2 million, down 12.1% year on year, falling short of analysts' expectations by 10.3%. It was a weak quarter for the company with revenue guidance for next quarter missing analysts' expectations and a miss of analysts' earnings estimates.

Titan International had the weakest performance against analyst estimates in the group. As expected, the stock is down 37.4% since the results and currently trades at $6.99.

Read our full analysis of Titan International's results here.

Deere (NYSE:DE)

Revolutionizing agriculture with the first self-polishing cast-steel plow in the 1800s, Deere (NYSE:DE) manufactures and distributes advanced agricultural, construction, forestry, and turf care equipment.

Deere reported revenues of $13.61 billion, down 15.4% year on year, surpassing analysts' expectations by 2.2%. Looking more broadly, it was a very strong quarter for the company with a decent beat of analysts' Production & Precision Agriculture revenue estimates and a decent beat of analysts' earnings estimates.

The stock is down 15.1% since reporting and currently trades at $351.55.

Read our full, actionable report on Deere here, it's free.

The Toro Company (NYSE:TTC)

Originally manufacturing tractor engines in the early 1900s, Toro (NYSE:TTC) is a provider of outdoor maintenance and beautification solutions.

The Toro Company reported revenues of $1.35 billion, flat year on year, in line with analysts' expectations. Looking more broadly, it was a strong quarter for the company with a solid beat of analysts' Residential revenue estimates and a decent beat of analysts' earnings estimates.

The stock is up 10.2% since reporting and currently trades at $87.79.

Read our full, actionable report on The Toro Company here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance